Luxury stocks are not as expensive as they seem

Despite their recent share price rise, luxury stock valuations are in line with their historical range. In this article, we dive deeper into luxury valuations and what has driven luxury stock prices recently.

Luxury valuations are trading below their historical averages

2022 was a mixed year for the luxury sector, with strong underlying revenue growth (22%) only partly reflected in share prices with the sector down -26% over the year. This year has started strongly with share prices rising +22% to their peak in 2023, prompting investors to question the sector’s valuations.

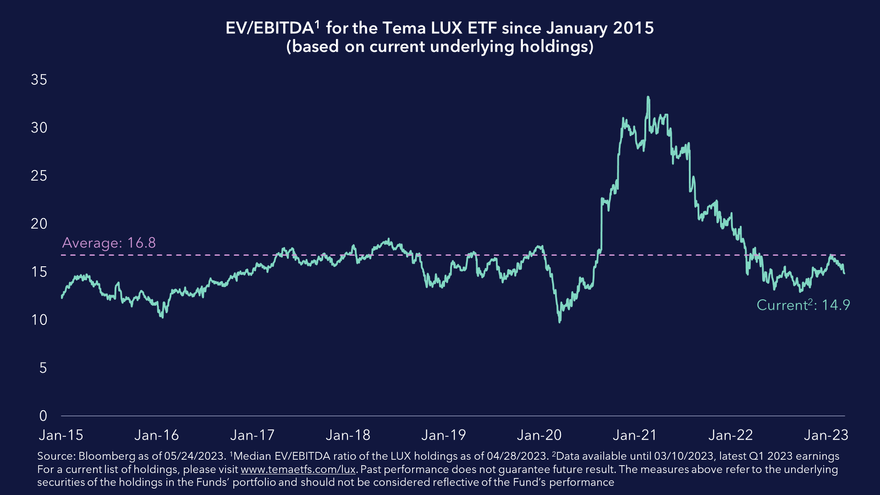

Although industry analysts usually prefer to point to P/E valuation multiples, it is considered that EV/EBITDA is a more relevant measure given the net cash position of many luxury companies. The chart below shows the average EV/EBITDA ratio for a portfolio of luxury stocks over time, currently trading at 14.9x EV/EBITDA, below the 8-year average.

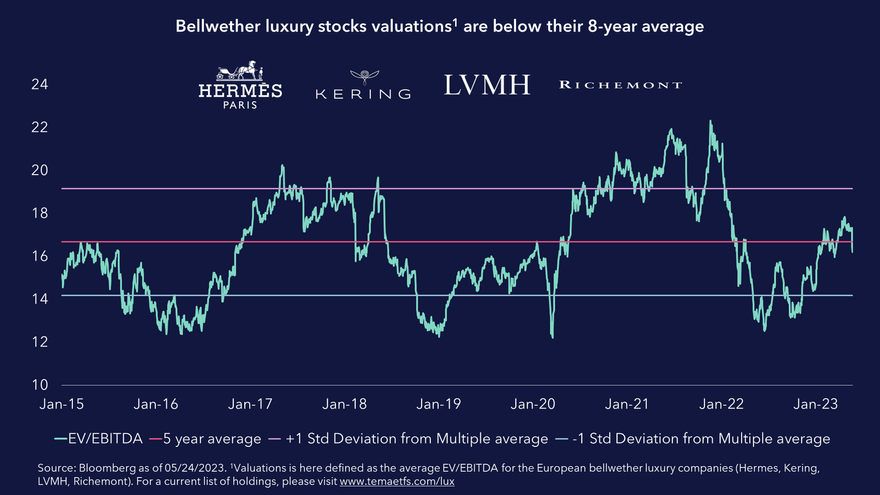

Similarly, if we zoom in further on the four largest luxury companies globally (LVMH, Hermes, Richemont, Kering), we see that these companies are currently trading at an average 15.1x EV/EBITDA multiple, below their historical 8-year average. This is captured in the chart below which combines the straight average multiple of these four companies plotted over time. This underlines the view that absolute EV/EBITDA valuations in luxury today are not demanding, especially given the business quality and growth profile.

Similarly, if we zoom in further on the four largest luxury companies globally (LVMH, Hermes, Richemont, Kering), we see that these companies are currently trading at an average 15.1x EV/EBITDA multiple, below their historical 8-year average. This is captured in the chart below which combines the straight average multiple of these four companies plotted over time. This underlines the view that absolute EV/EBITDA valuations in luxury today are not demanding, especially given the business quality and growth profile.

What has actually driven stock prices?

What has actually driven stock prices?

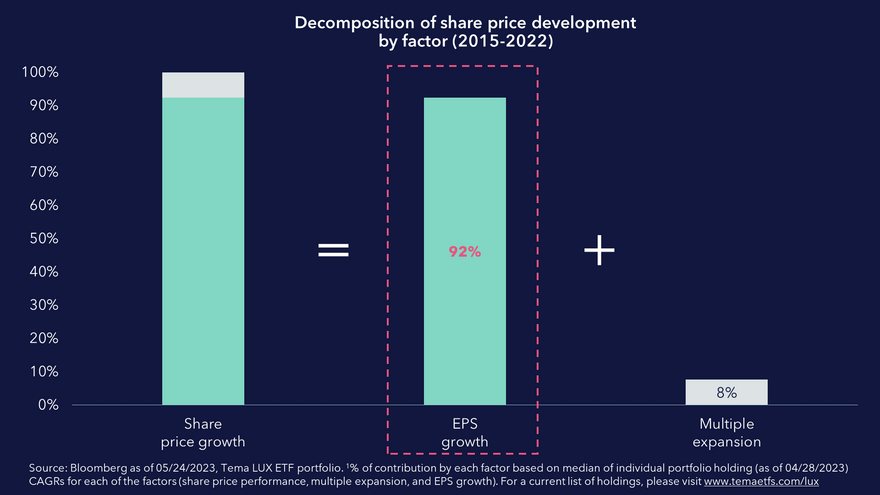

When we decompose the share price performance of underlying companies since 2015, we note that share price growth has been mainly driven by underlying earnings growth with minimal contribution from multiple revaluations, as illustrated in the chart below.

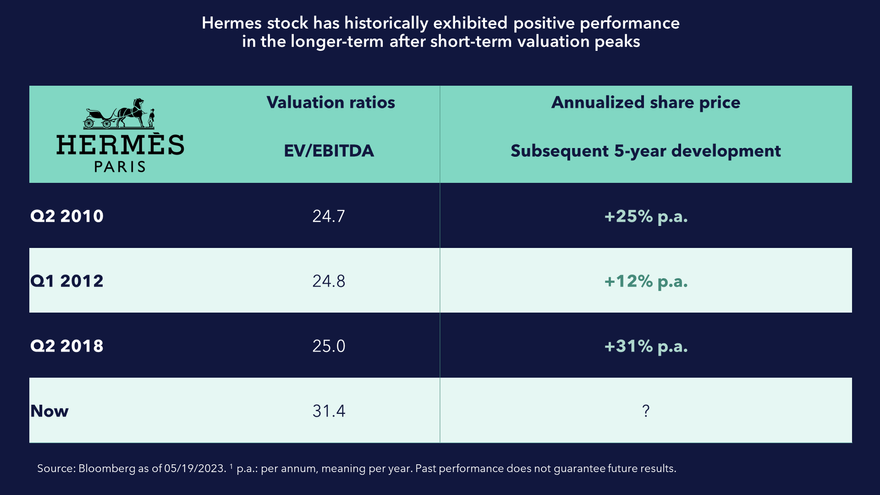

One example is Hermes. The company has become known not only for the prices of its most sought-after handbags, but also for the premium valuation that the share price demands. At various times over the past 15 years, shares peaked at valuation multiples that can only be considered high. Despite this, share price performance remained strong over the subsequent 5 years in all these cases. We believe this can be attributed to its desirable brands, enviable market position and market-leading earnings growth.

One example is Hermes. The company has become known not only for the prices of its most sought-after handbags, but also for the premium valuation that the share price demands. At various times over the past 15 years, shares peaked at valuation multiples that can only be considered high. Despite this, share price performance remained strong over the subsequent 5 years in all these cases. We believe this can be attributed to its desirable brands, enviable market position and market-leading earnings growth.

Despite the sector’s positive secular growth background, there are growing concerns about the impact of a potential slowdown in US luxury spending. Many analysts share this concern as confirmed by recent credit card data and earnings results. However, analysts believe that this risk will be largely managed by the reopening of much of Asia led by China, which is becoming apparent in Asia leading the growth in recent earnings results.

Despite the sector’s positive secular growth background, there are growing concerns about the impact of a potential slowdown in US luxury spending. Many analysts share this concern as confirmed by recent credit card data and earnings results. However, analysts believe that this risk will be largely managed by the reopening of much of Asia led by China, which is becoming apparent in Asia leading the growth in recent earnings results.

Analysts believe that this balance of growth means that the luxury goods sector has increasingly become more resilient, as it has diversified both geographically and demographically, justifying a higher valuation multiple. Asia remains the fastest growing luxury market globally and is expected to account for over 50% of global luxury consumption by 2025.

Conclusion

The analysts believe recent valuation concerns in the luxury sector are overdone, with the sector and bellwether stocks trading at 15.1x EV/EBITDA, below their historical average. The historical share price performance has come predominantly from earnings growth. Concerns about a slowdown in the US are genuine, but we believe luxury’s more globally diversified customer base should make the revenue outlook for the sector more stable than in previous cycles, potentially justifying a higher run rate multiple.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, price data, tables and stock prices, you can sort out the most interesting ETFs, shares, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)