In this week’s analysis a company within carbon capture and utilization!

This week Aksjeanalyser.com has taken a closer look at an interesting Norwegian company!

Bergen Carbon Solutions (ticker on Euronext Growth Oslo: BCS)

Several positive technical signals have been triggered for the stock recently, and the stock is considered to have great potential both in the short and longer term. Read more in the technical analysis below of Bergen Carbon Solutions (BCS).

About the company

About the company

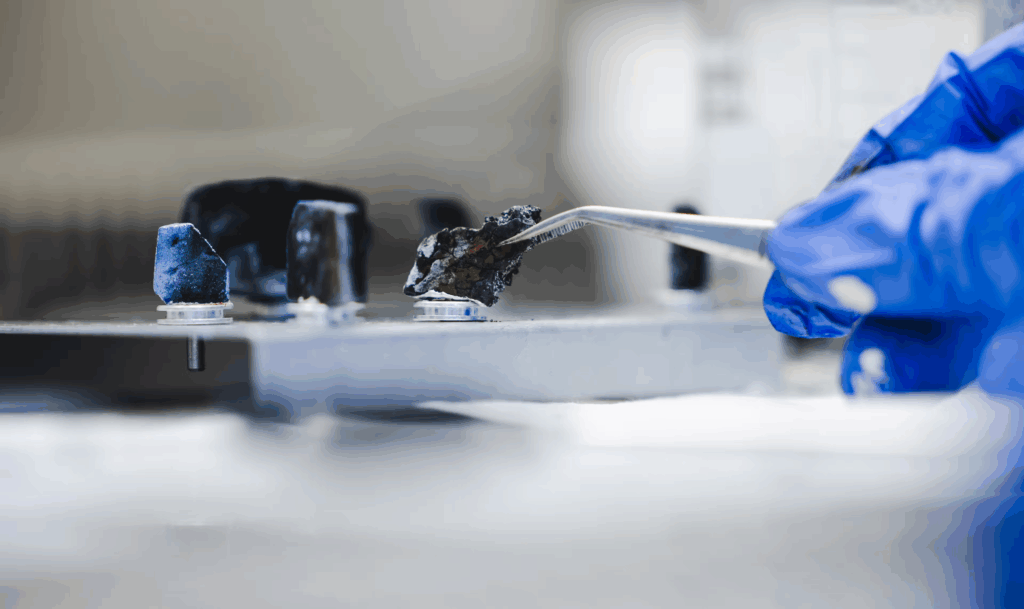

Bergen Carbon Solutions (ticker on Euronext Growth Oslo: BCS) is a carbon utilization technology company. The company works to turn CO2 into a valuable resource, using energy to convert excess greenhouse gas into fixed carbon. With its pioneering, proven carbon capture and utilization (CCU) process, Bergen Carbon Solutions enables clean carbon for the battery industry. The technology can provide a stable supply of carbon nanotubes and graphite, helping manufacturers become less exposed to the raw material risks of geopolitical rivalry.

Established in 2016, Bergen Carbon Solutions, based in Norway and listed on Euronext Growth, targets the fast-growing battery industry globally, and other carbon-intensive industries looking to replace conventional, fossil-based solutions to remain relevant in their markets. For more information about the company, Bergen Carbon Solutions, visit their websites.

Technical Analysis of Bergen Carbon Solutions

Technical Analysis of Bergen Carbon Solutions

(ticker on Euronext Growth Oslo: BCS)

Bergen Carbon Solutions (BCS) has given several positive technical signals recently. The share has broken out of the long-term falling trend, within which it has moved since peaking around NOK 80.00 in January 2022.

Furthermore, the stock has broken above both 50-day and 200-day moving average and has also broken up from a rectangle formation (cf. day chart above).

There is also a positive volume balance for the share, with rising volume on price rises and lower volume on downward corrections. This reinforces the positive technical picture for the share.

The BEST model in Vikingen is also in a buy signal for BCS. This popular and effective technical analysis model was developed by Peter Östevik. He finalized the BEST model around 2019, and after 30 years of experience in technical analysis and Vikingen Financial Software.

Based on the overall positive technical picture that Bergen Carbon Solutions (BCS) is now showing, Aksjeanalyser.com considers the stock an exciting and interesting buy candidate.

The potential for the share is estimated to be around NOK 8.00 in the short term (1-3 months) and around NOK 14.00 – 20.00 in the 6-12 month term.

What could potentially change the current positive technical picture for the share would be if it were to break below a now significant and important technical support level around NOK 4.00 and below the 200-day moving average.

Vikingen Top 10 buy signals!

Have you already visited Vikingen’s website and taken a look at this week’s Top 10 buy signals? If not, the signals for week 24 can be found here!

We are now using the Nordic Complete add-on in the BEST Model. You can find more information and purchase it here!

Here is a direct link to the Vikingen webshop where you can choose among all the other Vikingen programs and add-ons to find what suits you best.

And here you can watch free trainings (in Swedish) about Vikingen Mini, Börs, Trading and Vikingen Maxi programs.

Welcome to participate in Börssnack!

Every week you have the opportunity to participate in Börssnack as Aktieutbildning.nu organises on Wednesdays, via an open webinar at 7-8 pm CET!

In Börssnack, you’ll learn how to invest in interesting companies and get answers to questions like:

How do we do better business in the stock market? Which global stock markets look the best? How should you act in the stock market? Is it time to buy/sell now? Which stocks and funds are interesting? Are cryptos like Bitcoin and Ethereum interesting? What does Börssnack’s Portfolio look like? It is reviewed and analyzed every Wednesday.

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Sincerely yours