In this week’s Analysis – an exciting airline company!

Aksjeanalyser.com analyzes an Norwegian Airline Company!

Aksjeanalyser.com takes a closer look at Norse Atlantic ASA in our Analysis of the Week!

(ticker on Euronext Expand Oslo: NORSE)

Tuesday May 6th, the company released its traffic figures for April 2025, showing another month of strong growth.

Read more about the stock below in this week’s Analysis from Vikingen Financial Software and Aksjeanalyser.com.

Briefly about Norse Atlantic ASA

Briefly about Norse Atlantic ASA

(ticker on Euronext Expand Oslo: NORSE)

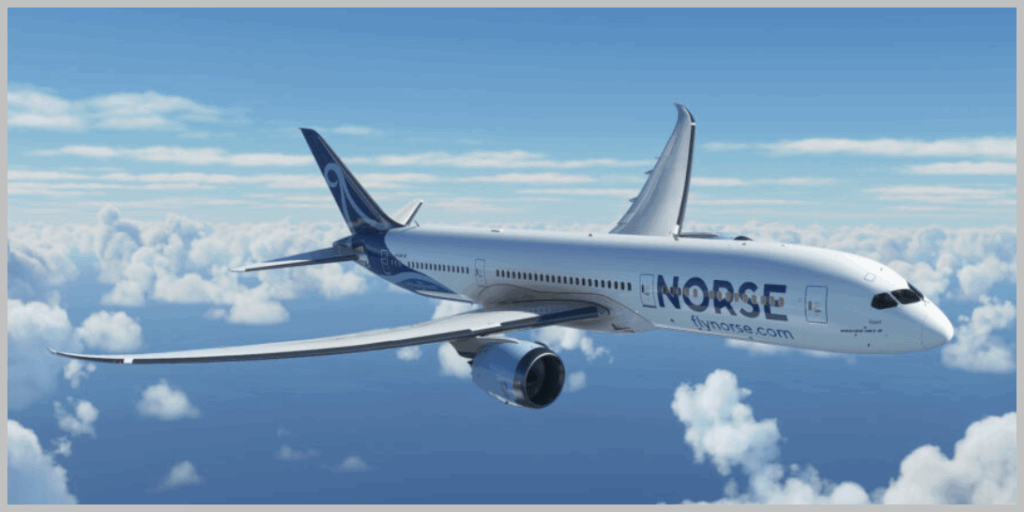

Norse Atlantic operates an aviation business. The company offers a wide range of destinations around the world’s continents. The largest operations are in North America and Europe. The vision is to be a long-term and sustainable player in the aviation market by offering a wide range of travel. The customers consist of both private operators and small and medium-sized corporate customers. Norse Altantic was founded in 2021 and is headquartered in Norway.

Norse Atlantic Airways (hereafter ‘Norse Atlantic’), founded by CEO and major shareholder Bjørn Tore Larsen in March 2021, is an airline specializing in low-cost, long-haul, non-stop flights to a variety of exciting destinations in the intercontinental market, offering passengers more options and flexibility to explore the world.

Headquartered in Arendal, Norway, Norse Atlantic ASA, a public company listed on Euronext Expand Exchange in Oslo, Norway, is the parent company of Norse Atlantic Airways AS and Norse Atlantic UK LTD. Norse Atlantic Airways AS holds two Air Operator’s Certificates (AOC), one in Norway and one in the UK.

Norse Atlantic’s fleet includes 15 modern, fuel-efficient and more environmentally friendly Boeing 787 Dreamliners serving destinations including New York, Los Angeles, Las Vegas, Miami, Orlando, Bangkok, Cape Town, Oslo, Athens, London, Berlin, Rome and Paris. The company’s first flight took off from Oslo to New York on June 14, 2022.

For more information about the company, visit their website here.

Technical Analysis of Norse Atlantic ASA

Technical Analysis of Norse Atlantic ASA

(ticker on Euronext Expand Oslo: NORSE)

The Norse Atlantic share has triggered several positive technical signals in recent months. The stock is now breaking upwards from its long term falling trend (see weekly chart). Furthermore, the stock has broken above both the 50-day and 200-day moving averages, and the 50-day moving average has broken above the 200-day moving average (the so-called ‘Golden Cross Signal’, which is a strong positive signal for future price development).

In the short term, the Norse Atlantic share is consolidating between a support level around NOK 4.50 and a resistance level around NOK 6.00. The share is rising today after the positive traffic figures for April 2025, which were presented this morning, and the share is now testing this technical resistance level around NOK 6.00.

The BEST model in Vikingen has also triggered a buy signal for the stock. This popular and effective technical analysis model was developed by Peter Östevik. He finalized the the BEST model around 2019, and after 30 years of experience in technical analysis and Vikingen Financial Software.

An established break above the NOK 6.00 level would trigger a strong technical buy signal for the Norse Atlantic share, which then has a short term (3-6 months) potential to around NOK 12.00), and a potential to around NOK 20.00 – 22.00 in the 6-12 month term.

What could possibly change the currently positive technical picture that the Norse Atlantic share shows would be if the share were to fall back and down below the 50-day moving average, and down below the important technical support level around NOK 4.50.

Based on the overall technical picture that the Norse Atlantic share is currently showing, we assess Aksjeanalyser.com the stock as an interesting buy candidate.

News from Norse Atlantic Airways

News from Norse Atlantic Airways

Norse Atlantic Airways AS: Norse Atlantic Remains Steady at Record-High Load Factor

Published Tuesday, May 06, 2025 at 07:00 ∙ Cision

Arendal, Norway, May 6, 2025 – In April, Norwegian Atlantic Airways remained at a record-high 95% load factor, an increase of 16%-points compared to April 2024. The load factor in own scheduled network also was the highest ever at 95%, a YoY increase of 19%-points.

Bjørn Tore Larsen, CEO, Founder and major shareholder of Norse Atlantic, comments: “I’m pleased that for the third consecutive month we reached a record-high 95% load factor across our own scheduled network and chartered flights. We have a good momentum into the upcoming busy summer months, where we will continue to deliver our affordable, value for money product to our customers worldwide.” Source.

Vikingen Top 10 buy signals!

Have you looked at Vikingen’s website and taken a look at this week’s Top 10 buy signals yet? If you haven’t, here are the signals for week 19.

Here is a direct link to Vikingens webshop where you can choose the programs and add-ons that suit you best.

And here you can watch free trainings (in Swedish) about Vikingen Mini, Börs, Trading and Vikingen Maxi programs.

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Sincerely yours