Forget about AMC, there’s another movie theater stock that could rally soon

Cinemark, a movie theater chain, has attracted large short selling similar to AMC Entertainment. Shares in Cinemark have had an outstanding run this year, leaving many short sellers with significant losses.

Cinemark is considered a less risky venture than AMC, with lower volatility, more robust business fundamentals and a sounder liquidity position. Thanks to its significant short interest, there is a potential for further upward movement and a short squeeze in Cinemark, making it a comparatively safer option than AMC.

Cinemark, another target for short sellers

AMC Entertainment (AMC) – is not the only movie theater stock that has been the target of heavy short selling in recent years. Although rival Cinemark (CNK) doesn’t have the amount of “Ape” supporters, it has short-term interests that are quite similar to AMC’s.

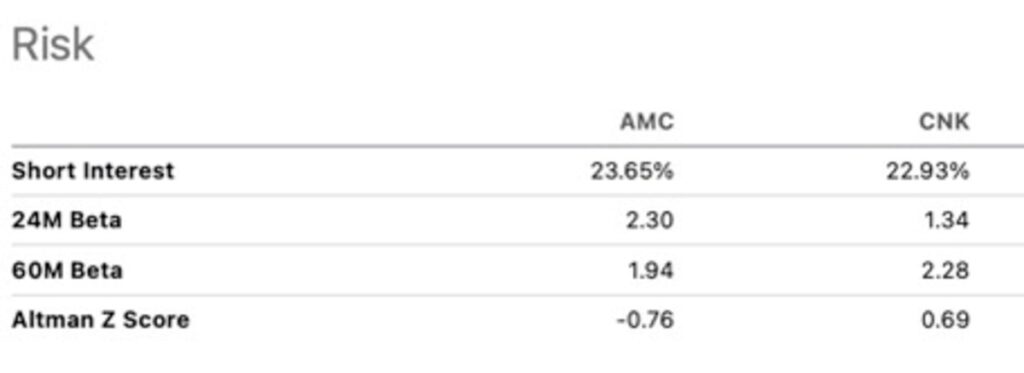

Approximately 22.9% of Cinemark’s available shares are currently on loan, while approximately 23.6% of AMC’s float has been sold short.

But based on CNK’s cumulative performance this year, Cinemark’s blanks have suffered far more than AMC’s. Cinemark stock is up more than 93 percent compared to AMC’s 14 percent.

This solid performance has caused Cinemark’s short sellers to suffer significant mark-to-market losses during this period. This has pushed them to close their positions on further upward movements, potentially creating a snowball effect.

The major difference between Cinemark and AMC in terms of a higher probability of a short squeeze lies in the shares’ borrowing fees.

Currently, Cinemark’s short sellers have to pay fees below 1 percent to borrow shares. Meanwhile, the AMC’s loan fees are almost 1,000% on an annual basis – which is quite extreme.

But while relevant, loan fees are not the only determining factor for a short squeeze. Other factors, such as the availability of shares to borrow, market sentiment and overall demand for the stock, also play crucial roles.

Whether loan fees are below 1% or above 1,000%, if a stock experiences a significant upward price movement and increased buying pressure, it can still lead to a short squeeze as short sellers rush to cover their positions – especially if they have already accumulated significant losses.

Why Cinemark is a less risky venture

Cinemark shares are much less volatile than AMC’s, given that CNK’s beta over the past 24 months has been 1.34, versus AMC’s 2.30. This means that AMC shares tend to be twice as volatile as the broader market.

In addition, Cinemark’s business fundamentals are currently better than AMC’s.

In addition, Cinemark’s business fundamentals are currently better than AMC’s.

.

As box office numbers continue to recover from the pandemic, Cinemark is expected to increase its revenue by 27 percent this year. This is in addition to a 136% improvement in the company’s earnings before interest, taxes, depreciation and amortization (EBITDA) compared to the same period last year.

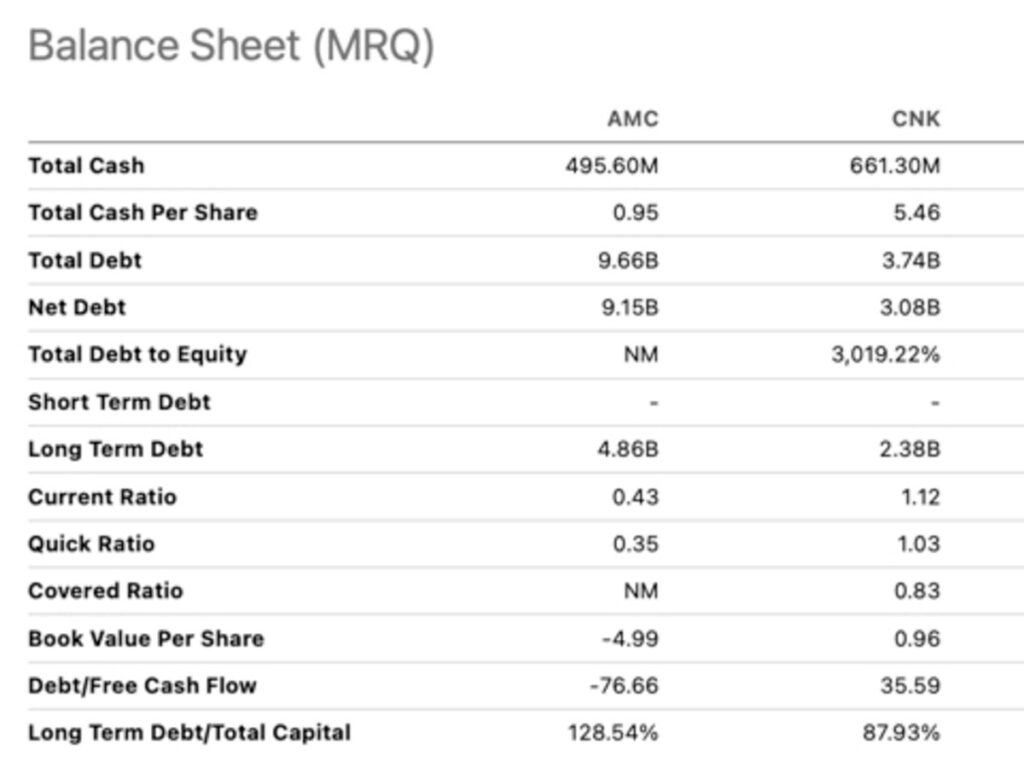

In addition, Cinemark is expected to see free cash flow (FCF) per share growth of 49 percent by the end of this year. A look at Cinemark’s balance sheet shows that the theater chain currently has about $661 million in cash and a net debt of about $3 billion. With a ratio of 1.12, Cinemark’s liquidity is relatively robust and its financial position should be strong enough to meet its short-term obligations.

On the other hand, AMC’s liquidity position is more complicated, with about $495 million in cash and net debt of $9.15 billion. AMC’s current ratio stands at 0.4, indicating that the company may not have enough cash to cover its short-term commitments.

On the other hand, AMC’s liquidity position is more complicated, with about $495 million in cash and net debt of $9.15 billion. AMC’s current ratio stands at 0.4, indicating that the company may not have enough cash to cover its short-term commitments.

Buzzer

As the drama of a class action lawsuit seeking to block the conversion of AMC Preferred Equity (APE) shares drags on, AMC continues to experience very high volatility.

The conversion of the APE would eliminate the spread between the company’s ordinary shares and preference shares. Card merchants have bet heavily against AMC and in favor of APE.

In addition, the APE conversion would in theory cause AMC shares to fall because of the dilution it would cause.

While AMC’s loan fees of nearly 1,000% suggest that the card trade could bounce back, it also indicates a significant risk of a stock drop.

On the other hand, Cinemark’s shares, free from stock dilution or arbitrage trading drama, have taken the industry’s struggles in stride and delivered a surprising performance this year – fueled by many short sellers closing their positions.

Given that, as with AMC, there is still huge short interest in Cinemark, there are potentially further upward movements to follow, putting pressure on short sellers. For now, a bet on Cinemark is less risky than one on AMC.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)