Vikingen Investment School, our performance the first week!

The first week of the Vikingen Investment School!

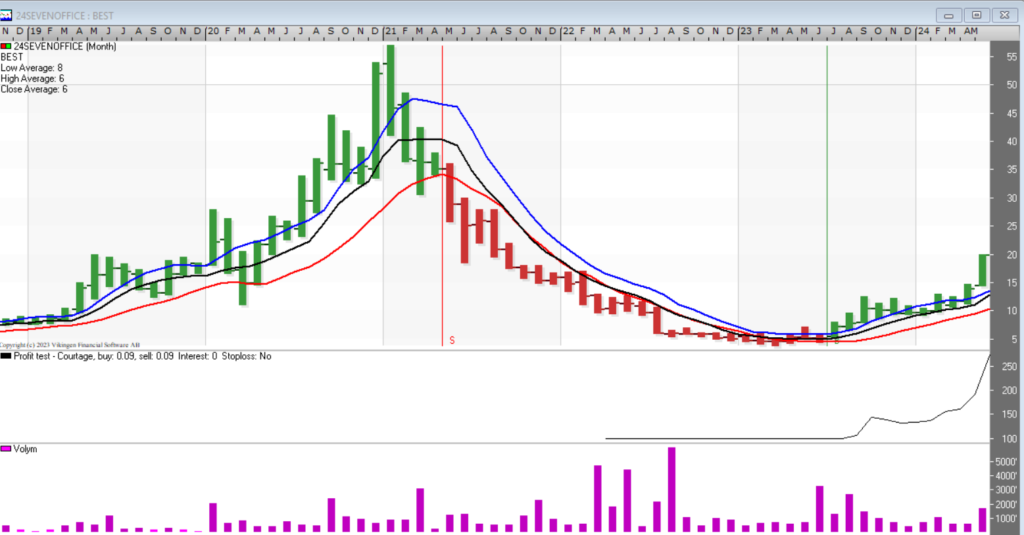

On Friday, May 17th, the Vikingen Investment School chose to sell Premium Snacks Nordic, which proved to be completely correct as the stock had reached its peak. Instead, we bought 24SevenOffice Group AB, which is on an upward trend, just as Vikingen predicted. Looking at the Vikingen Investment School as a whole, we have increased 4.89% in one week. Read more below.

Analysis of the world economy through the Viking

This morning Vikingen and Peter Östevik helped us to review the current status on the world’s stock markets. Most stock markets tend to follow each other (usually not the Nikkei), and most stock markets are trending up now. Nasdaq and S&P are moving up as is the Stockholm Stock Exchange Market . So now is the time to start to purchase equities. We also looked at commodities, interest rates and currencies through Vikingen.

North Sea oil is standing still, the price is leveling off, and we look at oil to understand the movements of interest rates, which are now trending downwards, both long and short-term rates.

The USD has fallen a bit lately, but it is better for the economy that the USD stabilizes at a lower level and stays there, than that it is volatile and jumps up and down.

Through Vikingen, we also look at commodities, which are a good economic indicator. Copper (used for wiring in houses, among other things) is going up and has reached a peak, but is still going up. Stainless steel (including nickel) and zinc also go up. Like the price of silver, which has risen.

At the same time, there is of course great unrest in the world. And that makes the price of gold go up, which contradicts the idea that the economy is turning around. But at the Vikingen Investment School, we believe in a turnaround.

The stocks we are betting on in week two are the ones below.

Gränges AB we are keeping Gränges even though it is standing still right now, as the monthly chart in Vikingen shows a rise.

OEM Automatic we bought this stock because it broke through its resistance and had a good price for us. The OEM now shows an eruption out of a pennant formation, so we keep it!

Hoist Finance (acquiring consumer dephts), shows a somewhat sensitive position. Vikingen’s weekly chart for this stock shows a nice trend. But we are watching this stock, and when it reaches about SEK 52, we might sell!

Premium Snack Nordic we sold this share on 17/5.

24SevenOffice Group AB, which we bought 17/5, is moving nicely upwards, the chart above shows that it is far to the top and that the stock has left a resistance area and is now trending upwards. We get a nice buy signal in the Vikingen monthly chart with the BEST model.

Hexatronic (HTRO), the monthly chart in the Viking shows that this stock has only just started its rise (SEK 120 has been the top price). However, the stock may level off at SEK 58-59 and then we will probably sell! More in the next episode of the Vikingen Investment School!

Frontline Plc which is on the NYSE and chugging along. A favorite.

LL Lucky Games AB we bought today 21/5. The available capital we could trade for (SEK 14:-), we chose to invest in LL Lucky Games, which is one of the stocks that trends most upwards when Vikingen analyzes stocks 5 days back in time, based on several models. And this share costs us SEK 0.650 each. Clearly within the limits of our budget!

What is the Vikingen Investment School?

The Viking Investment School started on May 13th, 2024. We are two woman without huge savings who have invested 10 000 SEK and hope that you out there with us want to learn how you can get rich (-er) on the stock exchange. Our ambition is that you will recognize yourself in us and want to join us from being beginners to knowledgeable investors. Whether you’re younger and hungrier with a longer investment horizon (like Freya) or more mature with less time to your retirement (like Catrin), we hope this journey will inspire you to learn more about investing through Vikingen Financial Software. If you have more than SEK10,000 to invest, it is of course even more interesting, but the principles are the same.

Vikingen shows the way!

Through Vikingen Financial Software and our mentor Peter Östevik, we select the stocks / other investment objects that are most worth buying here and now. Follow us on FB and/or Linkedin.

We hope that our journey and increased knowledge in technical analysis and stock market trading will inspire more people like you. Investing in the stock market does not have to take lots of time or be complicated. We learn step by step together. With Peter Östevik as our mentor! Peter has been using Vikingen for 37 years and has developed several of its unique models, including the BEST Model!

To be continued! Join us on FB and/or Linkedin.

We will probably return with a shorter update on May 24th!

But otherwise, see you on May 27th again.

Vikingen Financial Software would like to remind you that past positive results do not always indicate future profits, and that all stock market trading is at your own risk.

Yours sincerely

Catrin Abrahamsson-Beynon