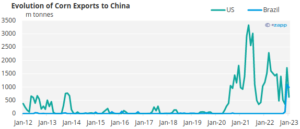

Brazil could export five million tons of corn to China by 2023

Sandro Steinbach, director of the Center for Agricultural Policy and Trade Studies at North Dakota State University in the US, recently completed a study on global shipping disruptions during the pandemic and the impact on US agricultural exports. Brazil could export five million tons of corn to China by 2023.

Steinbach, considered one of the leading voices in global food chains, also analyzes the possible impact of less competitive US grain production in the global food trade and how it could affect countries like Brazil. The conclusion is that unless the US reduces its corn prices or Brazilian production becomes uncompetitive. He considers both of these things unlikely, Brazil will continue to increase its corn exports to China – the largest consumer in the world.

At the end of 2022, Beijing approved several Brazilian companies that can export corn to China. The list now includes 400 companies. According to market estimates, Brazil could export around 5 million tons of corn to China this year – this is 10 percent of total global corn exports and 194 percent more than Brazilian corn exports to China in 2022.

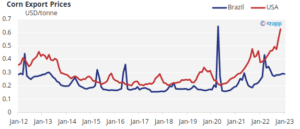

In December alone, just after China and Brazil signed a trade agreement on corn, Brazil exported 1.1 million tons of corn to China. In January, almost 1 million tons were exported. Since May 2022, the Brazilian corn prices have become cheaper than US corn by USD 0.05 per kg on average.

A trend of increasing price differences between the two countries can be observed since May 2022, with Brazil’s average May export price being lower.

In addition, it is noted that since 2019, an additional 10% tariff has been imposed on corn imported from the US by China as a measure of trade retaliation.

It is possible that the combination of higher corn export price and the additional retaliatory duties has made it difficult for corn importing companies in China to continue buying from the US. As a result, these companies may have turned to alternative suppliers with lower prices.

Source: USDA, Comex.

Unless the US reduces its corn export prices, China removes retaliatory tariffs or Brazil’s corn export prices become uncompetitive with other suppliers, it is likely that China will continue to increase its corn imports from Brazil.

How much cheaper was Brazilian corn last year compared to US corn?

Since May 2022, the Brazilian corn price has become cheaper than US corn by USD 0.05 per kg on average. USDA’s January 2023 feed outlook predicts a decline in U.S. corn production due to reduced domestic consumption and exports.

Sales have been sluggish compared to the previous year, mainly because of increased export prices due to limited exportable supplies and high transportation costs from rural areas to export terminals, especially by barge from key locations along the Mississippi River to the Gulf of Mexico.

Source: USDA, Comex

If the trend of declining production and increasing prices for US corn continues, China is likely to turn to Brazilian corn and other sources to meet its medium- and long-term needs.

China is diversifying its supply chains to be less dependent on US supplies. It is a lesson learned from Covid, the maritime challenges and the trade war. Brazil’s corn export prices had also been lower than from the US over the past 12 months, giving Chinese state-owned importers further incentive to increase purchases from Brazil.

It is common for US corn exports to China to fall during the winter. However, the increase in exports from Brazil represents a major change which, depending on the price gap, will continue to exist in the medium to long term. An additional variable to take into account is Chinese demand. Depending on the size of the economic downturn, there may be less demand in the short term.

Source: World Bank

US has lost $10 billion in agricultural exports during the pandemic

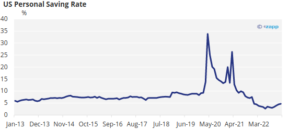

The US lost around $10 billion in agricultural exports between May 2021 and January 2022. The cause of the losses cannot be attributed solely to the pandemic or logistics issues. The pandemic initially triggered losses in US agricultural exports, but there is more to it.

The government’s response, the unbalanced trade market, the sea freight and the lack of containers are all responsible for the logistical issues that caused the loss of US agricultural exports.

The drivers of the losses can be summarized in four main points.

Source: Federal Reserve of Saint Louis

First, the personal savings rate skyrocketed. Since the outbreak of the pandemic in early 2020, increased unemployment benefits, stimulus checks and deferred consumer spending have caused US personal savings to skyrocket by around 14 percentage points by September 2021.

The additional savings allowed the US population to have more purchasing power to buy more durable goods, which were usually imported from Asian countries like China. However, West Coast ports were increasingly overwhelmed by the incoming products, creating congestion in the ports and slowing down the turnaround time for ships traveling around the continents.

Second, the growing demand for durable goods from Asia resulted in a significant increase in maritime freight rates. In January 2022, container freight rates from Asia to the US increased more than six times compared to the pre-pandemic period, while freight rates from the US to Asia remained stable.

This shipping difference made it more profitable for containers to be sent back to Asia empty instead of waiting several days to be filled with US agricultural products.

Thirdly, slow processing times compounded the problem. The time it took to ship agricultural products from the US West Coast to China reached more than 110 days in January 2022. In 2019, it took only 50 days.

This slow processing time makes shippers less willing to wait more days in the western ports for agricultural products. Instead, they chased higher freight rates by shipping goods from China to the US.

Fourth, agricultural exporters faced a shortage of containers. Agricultural exporters faced rising container rental fees, demurrage charges and storage fees.

Some agricultural exporters had to reroute containers through Texas, Vancouver or the East Coast at great cost. Many shippers also decided to cancel contracts and refused to deliver empty containers to US exporters, sending them back unfilled to Asia instead.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)