Trade better with smart stop-loss

You can trade better with smart stop-losses than just a simple percentage. The question has occupied people’s minds for as long as share trading has existed. When to sell? There is no way of knowing when the best time to sell is, because the stock can continue to go up even though I have sold. But you can make an educated guess with the support of Viking.

A common mistake with stop-loss is that you sell too early because it is the gains that will pay for past and future losses. A very good rule is “Let the profits run and cut the losses short”, which means you keep the stocks that are trending upwards.

Day traders trade worse with stop-loss

Unfortunately, very few day traders make money from stock market trading. A common figure is that about 98% of day traders lose their money. However, you may be one of fifty people making money by following the rates minute by minute. I have been one of those who made money first, only to lose as much. What has always worked is to sell when the weekly trend breaks and buy when a good monthly model gives a buy signal. Take it easy and make more money with weekly trading, i.e. much more swing trading than day trading. (But what do I know… I’ve only been doing Vikingen for 37 years :->, so there’s more to learn. I could be wrong, of course. )

Shop better with smart stop-loss in Viking

Trade better with smart stop-loss in Viking. Stop-losses in Viking are called sell signals in Vikingen’s signaling models. A signaling model can be Kursband-BEST-Bolllingerband-Multimodel etc.

Is it best to always use 3% below the lowest rate, or 10% below the highest rate? Actually, it goes without saying, of course there are different values at different times. Sometimes the course moves a lot and sometimes calmly. Increase your profits by using the Vikingen signaling models.

Testing out the best stop-loss limits

A mathematical model that gives buy and sell signals can contain many millions of settings. Something that has happened many times before has a high probability of happening again, that is, you make an educated guess using values that worked in the past. Better than using values that are untested. In Vikingen Trading and Vikingen Maxi , you can test the settings and the model per share that worked best.

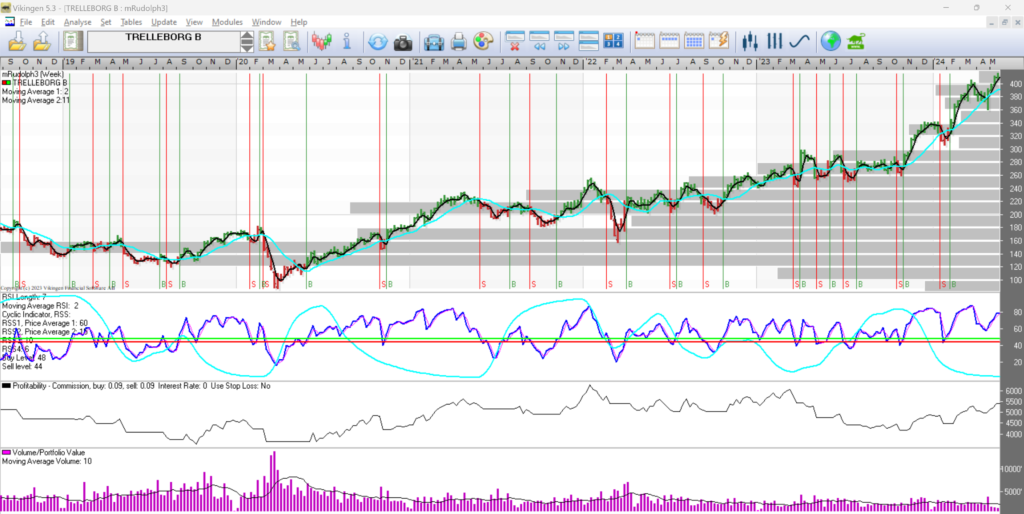

Here is an example with Trelleborg where the computer had to go through 700 000 variants, and that was a small part of all possible settings. I tested with weekly data for the BEST-Bollngerband-EMA-MACD-mRudolph3-Multimodel-Peters specialare-Volatility signal models.

| Instrument | Ranking | Annual Interest (%) | Profitable/ Deals | In Time (%) | Start time | Stop time | Long Position |

| TRELLEBORG B | 1 | 12,77 | 41 / 72 | 62,09 | 860105 | 240519 | 10,15 |

41 gains out of 72 sales, almost 6 out of 10 made a profit. This is a good thing. 50 times the money (5000%).

The mRudolph3 model came out best and it is mostly based on RSI and averages with a touch of a cyclical indicator. NB: weekly data.

| Moving Average 1: | Moving Average 2: | Moving Average Volume | RSI Length | Moving Average Length | Buy Level | Sell level | Cyclic Indicator. Price Average 1 (RSS1) | Cyclic Indicator: Price Average 2 (RSS2) | Cyclic Indicator RSS parameter 3 | Cyclic Indicator RSS parameter 4 |

| 2 | 11 | 10 | 7 | 2 | 48 | 44 | 60 | 15 | 10 | 6 |

On a day-to-day basis, the EMA is a better fit for Trelleborg.

Read further article on Stop-Loss here: Key Stop-Loss strategies for effective risk management in trading (vikingen.se)

Watch a video on developing good stop-loss values: Part 3 of the art of getting rich on the stock market. Best model. Automatic alarms. Optimize in Vikingen Trading. – YouTube

Disclaimer

Of course, we cannot promise that the stock market will behave as described above. We only interpret what the stock exchange program shows. You take all the risk yourself on the success of your investments. Vikingen Software Financial AB does not share in your loss or profit when trading securities.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)