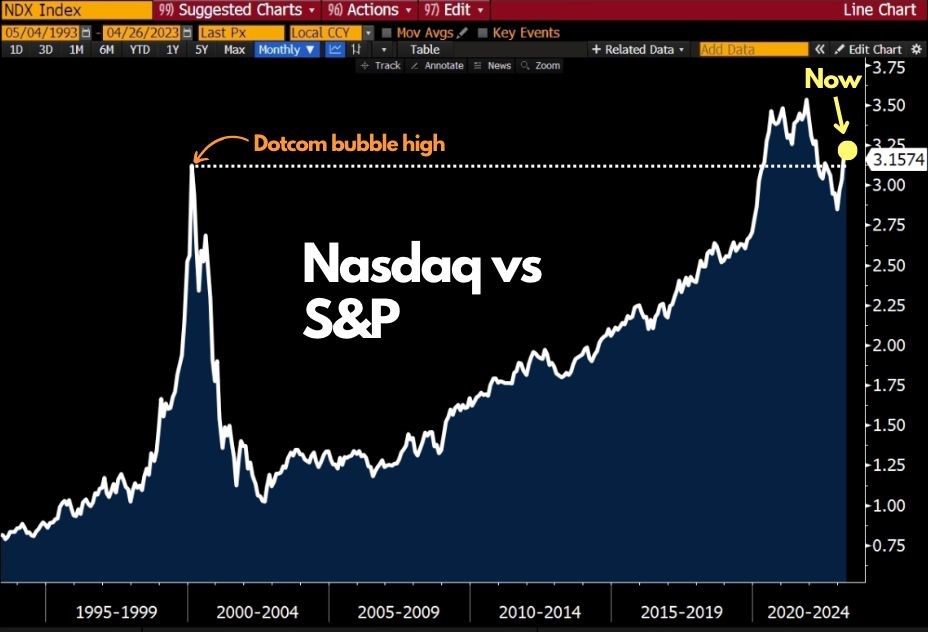

Tech stocks are more expensive now than during the dotcom bubble

Check out the ratio of the Nasdaq-100 relative to the broader market (S&P 500). Five companies – Microsoft, Apple, Amazon, NVIDIA and Alphabet – account for 45% of the Nasdaq 100. It is close to all-time highs. According to BofA, Banc of America, long big tech is currently the most crowded trade. The banking crisis has scared investors away from bank stocks and as a result, investors are turning to technology for defensive positioning. Tech stocks are more expensive now than during the Dotcom bubble.

It sounds like an oxymoron, but this is not the era of technology stocks. They have strong balance sheets and high free cash flow. They also report better than most people expected during this winning season.

However, there is a catch

This chart is fundamentally misleading. What we have here are ‘weighting charts’. It shows the weighting of the NASDAQ to the S&P500. Keep in mind that the major stocks on NASDAQ are also in the S&P 500. So all this chart says is that the NASDAQ has a greater weight than the S&P500. One should not draw too many conclusions from this.

If we were to add many large companies to NASDAQ vs. S&P500, we would get the same effect. That said, the valuations of the major technology stocks have been pushed too high. The current economic climate does not justify it.

Metrics to look at would be pricing sales, price to book value, free cash flow %, etc. The final result will be a shift away from high technology and back to value which now has very attractive valuation metrics. Rotation seems to be the market mantra of the last year. It is unlikely that the overall averages will break out on the upside or downside. This is what is known as a market for stockpickers.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, price data, tables and stock prices, you can sort out the most interesting ETFs, shares, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)