Stock tip of the week, a recognized global brand!

This week’s Stock Tips from Vikingen and Aktieutbildning.nu!

The tips published in this blog and in our social media are primarily written for educational purposes (and less as a concrete buying advice). Evaluate first what you think and remember that the stock market gives and takes. Welcome to follow us on FB, Linkedin and X so that you can take part in what we publish. Please tell your friends and colleagues to do the same!

Do you want to read this blog in Swedish? Click here.

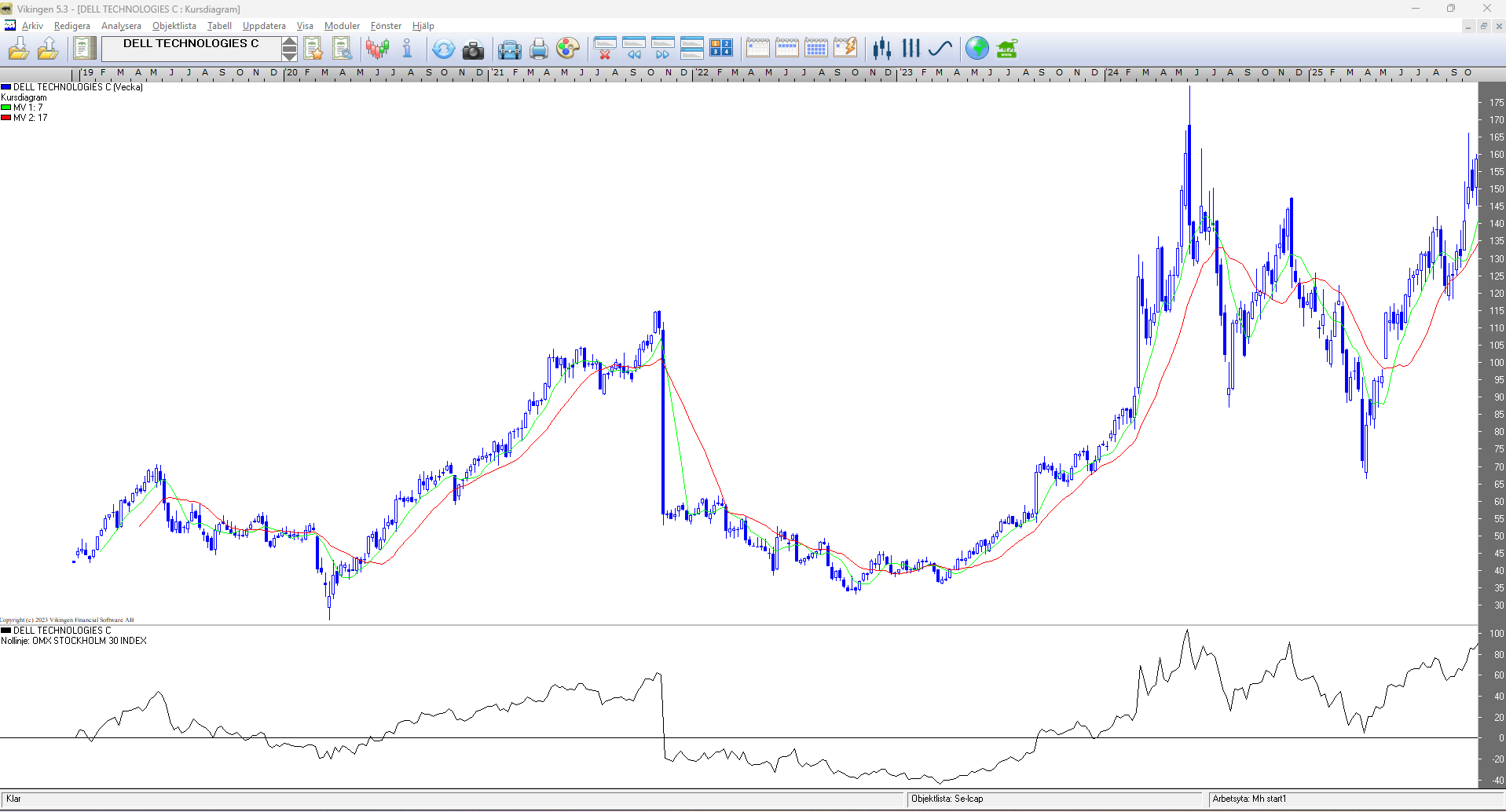

Recommended buy week 44: Dell Technologies

The stock is now trading at around USD 158.50.

Target is about 210 USD. Stoploss 144 USD.

Why is now a good time for Dell Technologies?

Technical analysis of Dell Technologies

(see also charts below)

-

- Strong upward trend seems to have started. Long-term upward trend break

- Large head-shoulder formation, since February 2024, now breaking upwards

- We go from consolidation and low volatility to hopefully rising price and higher volatility

- The Viking BEST model, Price band model (weekly and monthly) and other models, gives “green” light and buy signal

- The relative graph breaks upwards in a similar way, which is very positive, i.e. the company accelerates upwards relative to OMX in a similar formation as the absolute graph, which is probably due to large investors driving the price upwards

- We have known for a long time that USA Tech is going up and is relatively stronger than most, including Mag7 etc.

Fundamental analysis of Dell Technologies

What are Dell Technologies’ strengths, weaknesses and momentum?

Below is a SWOT analysis of Dell Technologies and an assessment of the company’s momentum. Dell is in a transition phase, where their traditional PC business is meeting the rapid growth in AI infrastructure.

Strengths

-

- Leading in AI servers: This is Dell’s biggest growth engine. They have established themselves as one of the leading providers of servers optimized for AI workloads (with NVIDIA GPUs), resulting in a 37% increase in Server and Network revenue in Q4 2025. They had an AI server order book of approximately $9 billion at the beginning of the year.

- Strong Brand Recognition: Dell is a recognized global brand and a market leader in personal computers (PCs) and servers.

- Diversified Product Portfolio: Dell has a broad product portfolio in both infrastructure (servers, storage, networking) and client solutions (PC), which provides some stability.

- Financial Stability and Dividend: The company has shown strong financial health, with increased earnings per share (EPS) and a recently announced 18% dividend increase.

Weaknesses

-

- The cyclical nature of the PC market: A large part of the revenue comes from sales of personal computers, which is a commodity-like market with low margins and slow growth. Consumer sales have been volatile.

- Margin pressure on AI servers: Although the demand for AI servers is huge, the cost of producing this advanced hardware is very high (especially for NVIDIA GPUs), which can put pressure on gross margins.

- Intense Competition: Dell faces stiff competition in all its segments from giants like HP, Lenovo, Cisco and cloud providers like AWS and Azure.

Opportunities

-

- Edge Computing and Decentralized AI: The evolution of Edge Computing and the need to move AI processing closer to the source of data is a big opportunity for Dell infrastructure products.

- AI PCs: The replacement of older PCs with new “AI PCs” (computers with dedicated NPU chips) could drive a new upgrade cycle in the client market.

- Cloud and Data Center Growth: The long-term trend toward cloud and data center investment continues to drive demand for Dell’s storage and server solutions.

Threats

-

- Macroeconomic Uncertainty: A possible recession could lead companies to postpone large IT investments, affecting sales of servers and other infrastructure.

- Rapid Technological Change: The rapid development of AI and chip technology requires continuous and massive investments in research and development (R&D).

- Competition from white-box servers: smaller players can offer servers at lower prices.

Momentum

Momentum

Momentum is strong and focused on AI infrastructure

-

- Positive Earnings Growth: Dell reported strong earnings growth and increased full-year outlook for FY2026.

- The AI catalyst: The biggest driver is the strong demand for AI servers. Analysts expect AI-related revenue to continue growing strongly.

- Share performance: The share has performed very strongly in 2025, reflecting the market’s optimism about the company’s ability to establish itself as a key player in the AI infrastructure revolution.

Vikingens’s offer all day long!

Vikingens’s top 10 buy signals for week 44 is here! We use the the Nordic Complete supplement in BEST model and the volume is increased to 1 000 000.

Don’t miss Vikingen’s offer: the whole day, October 31st, you get 30% off on the add-on Vikingen Nordic Complete, annual subscription. Use the code 2OCT30

Here is a direct link to the Vikingen web shop where you can choose from all Vikingen programs and add-ons and find what suits you best.

Don’t miss Börssnack!

Every week you have the opportunity to participate in Börssnack that Aktieutbildning.nu gives on Wednesdays, via an open webinar at 19-20 CET! Here you can find more info about Börssnack.

In Börssnack you’ll learn how to invest in interesting companies and get answers to questions like:

How do we do better in the stock market? Which global stock markets look best? How should you act in the stock market? Is now the time to buy/sell? Which stocks and funds are interesting? What does Börssnack’s portfolio look like? It is reviewed and analyzed every Wednesday. A warm welcome!

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Yours sincerely