Stockanalysis.com looks at a biotech and pharmaceutical company!

In ‘Analysis of the Week’, Aksjeanalyser.com takes a closer look at an exciting biotech and pharmaceutical company on the Oslo Stock Exchange!

Thor Medical

(ticker on Oslo Stock Exchange: TRMED)

The stock almost doubled recently (Aug-Sept) in just one month’s time, and it could now double and maybe triple again in the next 3-6 months alone.

From September 22, 2025, Thor Medical was also included in the

the main index on the Oslo Stock Exchange (OSEBX)

and in the fund index (OSEFX).

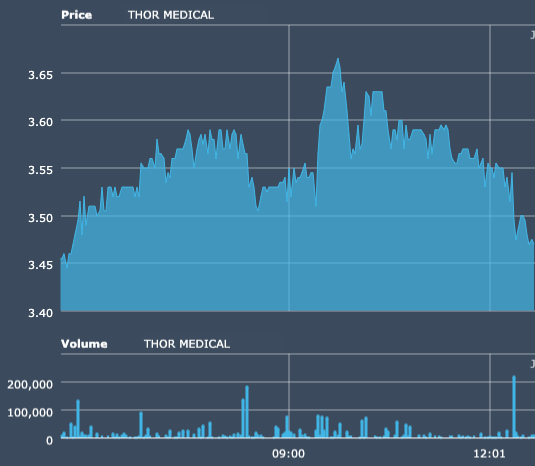

The stock almost doubled in just one month recently, and then the stock has had a downward correction in recent weeks. Now the stock is turning upwards again and may be at a very favorable level to buy it at.

During the recent correction, the stock has been well received at a significant technical support level around NOK 3.00 and at the

50-day moving average.

Read more below under the technical analysis of

the Thor Medical share

.

Brief about the company and press news

(ticker on Oslo Stock Exchange: TRMED)

Thor Medical

is a pharmaceutical company that specializes in the development of antibody drugs for the treatment of hematological cancer. The greatest specialization is in precision therapy used in the clinical phase. Other diseases treated are non-Hodgkin’s lymphoma (NHL). The company was founded in 2009 and is headquartered in Oslo.

For more information about the company, visit their

websites here.

Thor Medical (TREMD ) was included in the main index on the Oslo Stock Exchange (OSEBX) and in the fund index (OSEFX) from September 22, 2025:

11 Sep. 06:29 ∙ Source: TDN Finance

Oslo (Infront TDN Direkt): Euronext has revised the composition of several indices. The changes will be implemented after the market closes on Friday, September 19 and take effect on Monday, September 22, 2025.

This was stated in a press release on Wednesday.

In the main index (OSEBX) and the fund index (OSEFX), Link Mobility Group, Norbit, Public Property Invest (PPI) and Thor Medical are included, while Nel is excluded.

Bakkafrost, Dof Group and Tomra are included in the OBX index, while CMB.Tech Hafnia and TGS are removed.

Furthermore, Link Mobility Group, Norbit and Pexip are included in the OBX ESG index, while CMB.Tech and Vår Energi are removed. Source

Technical Analysis of Thor Medical

(ticker on Oslo Stock Exchange: TRMED)

Thor Medical (TRMED)

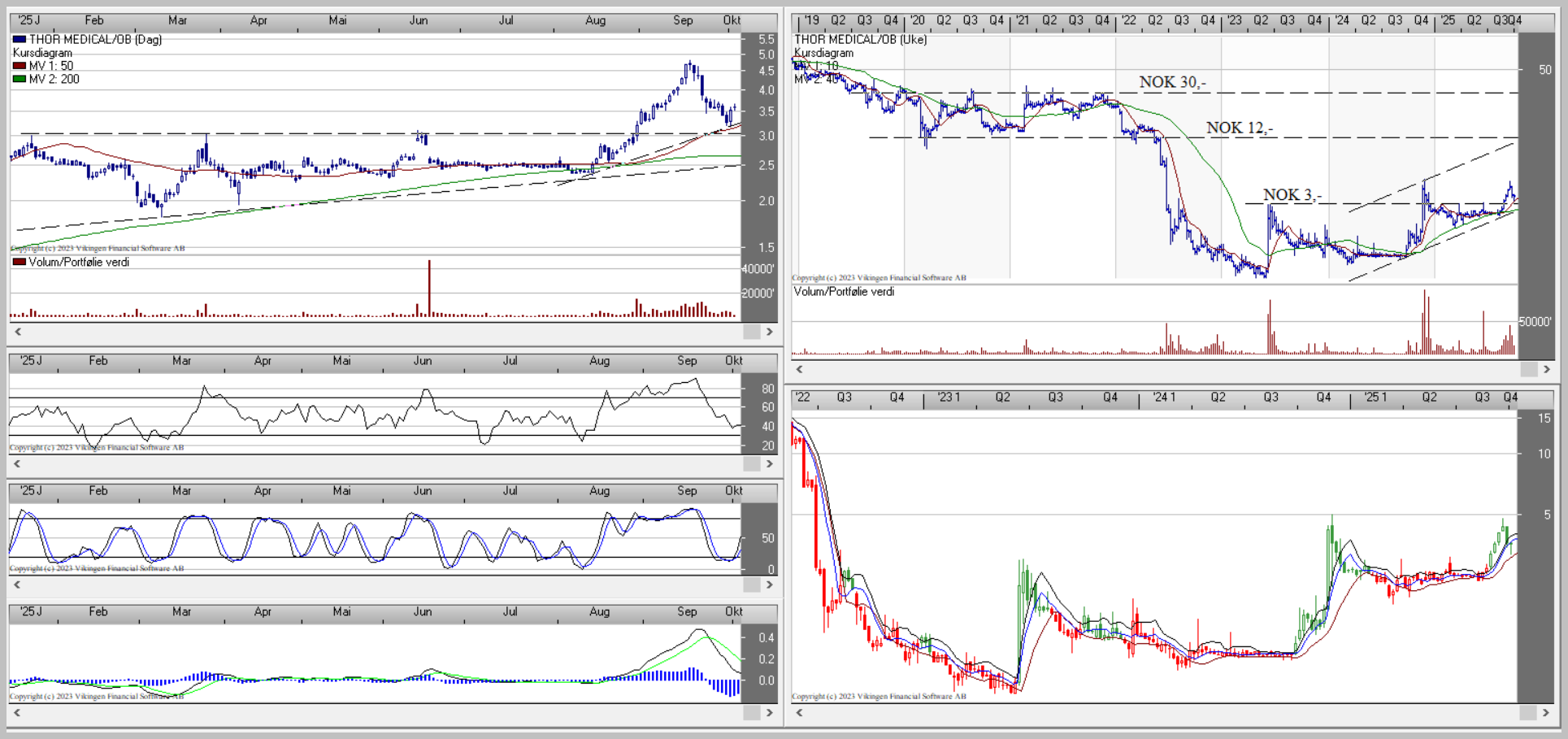

shows a strong development within a

steeply rising long-term trend

.

The stock almost doubled from mid-August to mid-September, and then had a downward correction.

Now the stock is finding significant technical support at

50-day moving average

and around the NOK 3.00 level.

Various momentum indicators such as RSI and Stochastics are now signaling that a new upturn for the stock may be imminent.

The BEST model in Vikingen

is also in buy signal for Thor Medical. This popular and effective technical analysis model was developed by

Peter Östevik

. He finalized the

the BEST model

around 2019, and after 30 years of experience in technical analysis and Vikingen Financial Software.

Based on the overall very positive technical picture for

the Thor Medical share

, then considers

Aksjeanalyser.com

the stock as a very interesting buy candidate here at the current price level.

The potential for the share, and according to the long-term rising trend within which the share is moving, indicates that the share has a potential to reach around NOK 12.00 in 3-6 months’ time.

In other words, we’re talking about a possible tripling of the share price in the next 3-6 months alone.

There is now little technical resistance for further upside for the stock, and

Aksjeanalyser.com

believes in a very strong development for the Thor Medical share in the short and medium term.

What could possibly change the currently very positive technical picture for the Thor Medical share would be if the share were to break down below the currently significant technical support level of around NOK 3.00, and below the 200-day moving average (which is currently around NOK 2.60).

Viking’s Top 10 buy signals

f

for week 40 can be found here!

We use the

Nordic Complete add-on

in the BEST model.

Don’t miss out on Viking’s offer: tn October 12 you get a 30% discount on

Nordic Complete, annual subscription!

Use the code OCT30

Here is a link to the Viking online store where you can choose other Viking

programs and add-ons that suit you best.

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Sincerely yours