NOVEMBER 2023 STOCK TIPS

With these stock market tips for November 2023, you have a good chance of succeeding in the stock market. These are the best securities according to the Viking and have a good chance of continuing to rise. The recent accuracy of the tips has been around 90%, i.e. 9 out of 10 of the tips have increased in value. Let’s hope this continues with the below.

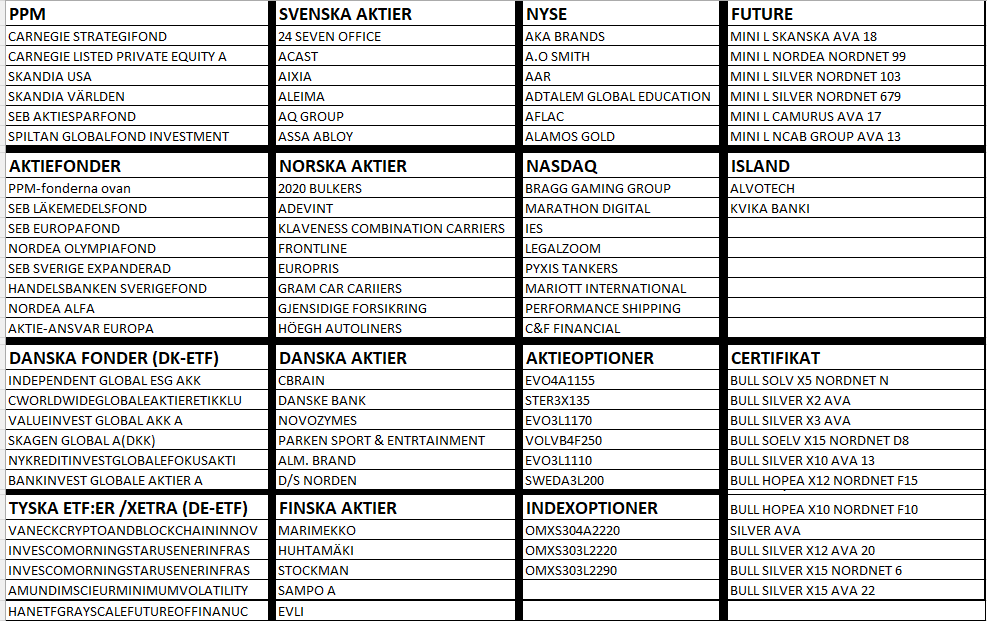

The list of stock market tips

Above is a selection of the best, excluding Swedish and US stocks. There are many Swedish and American stocks that have buy signals, so I only included a few. You can see that global equity funds have a buy signal, i.e. it seems that stock markets all over the world have a buy signal at the same time. According to the certificates, silver seems to be on the rise.

The stock tips were developed with Vikingen Maxi

Fund tips

The tips with, PPM, equity funds and ETFs were developed using Regression Change, with only 5 days of hindsight to bring out those that have turned up recently.

Preparation

I started by removing old funds. Activated the Stock Fund item list, clicked on the “Time” column header, selected all old funds, clicked at the top of the menu on “Edit” and then on “Delete”. They will only disappear from the screen in the table, not from the list of objects. Right clicked, selected Select All, right clicked, selected Create Object List, selected the name 0. (I usually have it as a slush, because then the number 0 is at the top of the object list).

Then I selected the Regression Change model in the analyst. Activated and model, right clicked, selected model settings and entered 5 periods instead of the normal 20 periods. Pressed Save. Now the autopilot will run with the new setting.

Autopilot for generating fund tips for funds and more.

First activated the newly saved object list, in my case with the designation 0. then I chose the Autopilot 17 slope (regression) day.

The ones with the best slope were saved in an object list (select, right click in the table, select “Create object list”) and then I also looked at them with a workspace “Kursband-multi-RSI” and slide loop, autopilot 13_slide show. I also have a workspace with BEST week and BEST month. If I want, I can save the best of the best by selecting “Stock list” in the “Table” menu and right-clicking on the ones I want to save in a new item list. Or enter them in a spreadsheet as above.

Stock tips for November 2023

Recently, stock tips have been very good, often with an accuracy rate of 90%, i.e. nine out of ten correct.

Presumably because the stock market is trending and has turned upwards.

Activated the object lists SE-Stock, DK-Stock, NO-Stock, FI-Stock, IC-Stock, Nysestck and Nasdaq one at a time and ran both Autopilots 02 and 07. Autopilot 02 has more persistent signals, autopilot 03 shows fresh signals with multi-model. Autopilot automatically creates a “Prospects” item list that I scrolled through with the “Price Band Multi-RSI” workspace and one with BEST week and BEST month. The list displayed by autopilot 07 Multimodel purchase does not automatically create an item list, but I select the ones I find interesting and create a new item list (right click in the table). The stocks that I have reviewed with the workspaces and find exciting, I take an extra look at the fundamentals and the latest report.

Stock market tips with options, certificates, futures

There is one model in the Viking Maxi that is absolutely fantastic, the Delhioptioner01. I start by activating the SE-akopt object list. Run the autopilot 20_filterlist. Then activates the object list 0filterlist which is the result of autopilot 20.

Run the autopilot Max01_Buy and sell tables delphi options01. Unfortunately, options with old dates also need to be removed. Click on ‘Time’ in the column header and select all those with old dates (select one, pierce the mustang and drag downwards). Select Edit at the top of the menu and ‘Delete’. Now you have the latest options with turnover, those with 0 days. The options that have had a signal in the past are usually at least 8 out of 10 correct. That is, those with a sell signal should have a minus sign (-) in the “% from signal” column. This is the percentage earned by the issuer of the option. Vice versa for the buy signal table, those options should of course have increased in value.

Disclaimer

Keep in mind that saving in securities always involves a risk. The value of your investment can go down as well as up and you may not get back the full amount you invested. Nor is the historical performance of a security a guarantee of future performance.

Investing in securities always involves the risk of losing your money.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, models, price data, tables and stock prices, you can sort out the most interesting ETFs, stocks, options, warrants, funds, certificates, mutual funds, indices, etc. Read more here: Home – Stock market program for those who want to become even richer (vikingen.se).

To access Certificates in Vikingen, first subscribe to Vikingen Mini/Exchange/Trading and add Certificates. For example, Viking Exchange with autopilot and Certificates, 390 + 79 kr per month (or 3900+790 kr/year). Or add shares from other exchanges, €790 per exchange per year (Denmark, Norway, Finland, Nasdaq, NYSE).

The Viking Maxi subscription includes all databases, including, for example, options. The Viking Maxi costs 990 kr/month or 9900 for a full year. A small cost compared to what many people invest in options.

Write to

support@vikingen.se

if you are interested in the Viking stock exchange program.

Peter Östevik, Vikingen Financial Software AB