Is it time to buy US stocks with extra dividends?

Is it time to buy US stocks with extra dividends, you might ask. Which stocks have extra dividends and what about currency risk (or currency risk)? You can read more about these stocks in the article Five US stocks that pay extra dividends in 2024 (vikingen.se). Of course it is good to get extra dividends, but is it the right time to buy them, should they be kept or sold? What if shares fall more than dividends or the exchange rate gets worse? Here is an assessment of the timing of stocks and the dollar exchange rate. More on the dollar below, and a good stock tip.

Five US stocks with good dividends

Here are some thoughts on the timing of buying, holding or selling these dividend-paying stocks. It is of course up to you whether you agree or not.

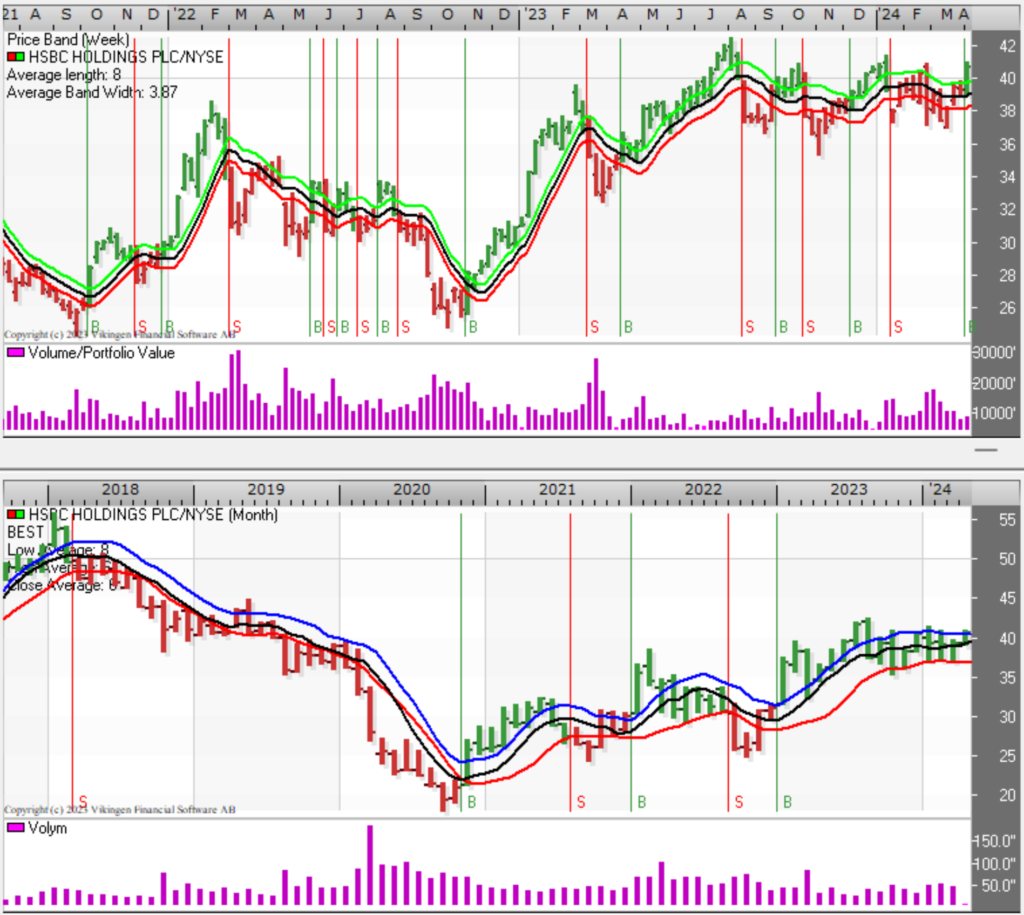

| HSBC HOLDINGS PLC/KEY |

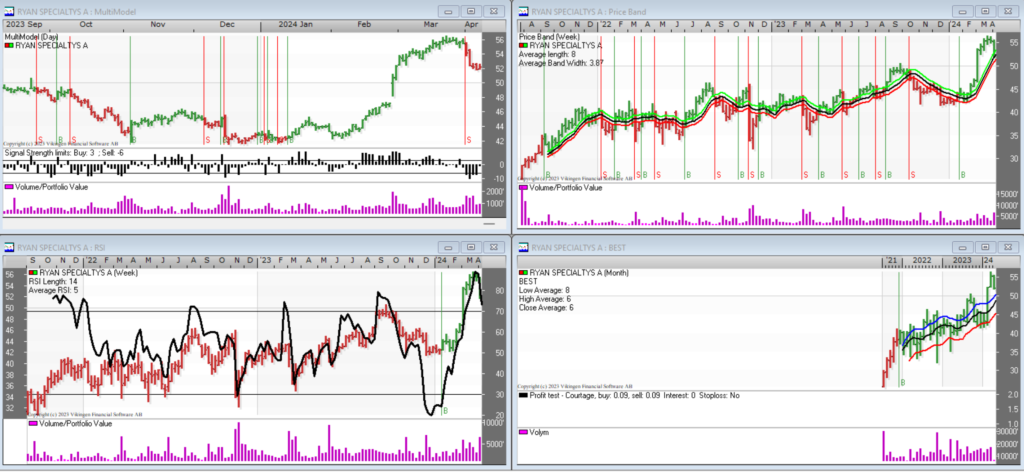

| RYAN SPECIALTYS A |

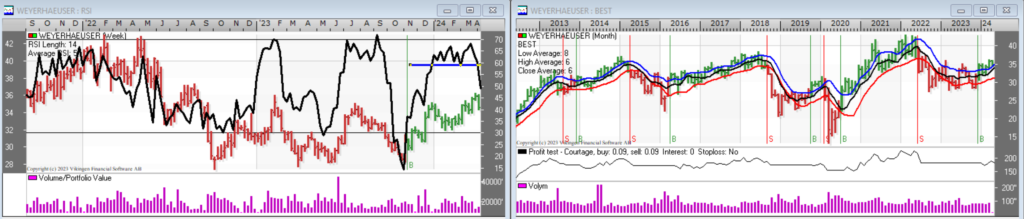

| WEYERHAEUSER |

| FORD MOTOR COMPANY |

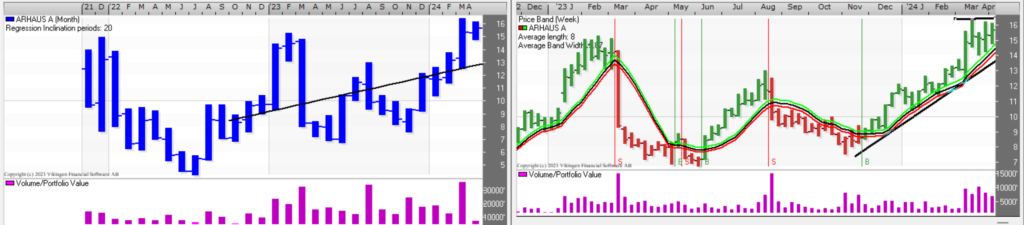

| ARHAUS A |

HSBC Holdings has high dividends

The company is part of the NYSE object group in Vikingen. A good model for slow-moving stocks or funds is the price band model with weekly data. We now have a fresh(=right now) buy signal in the price band model. The buy signal is indicated by a green line and the bar turning green.

However, we have three previous peaks at the same level, which then represents a strong resistance to moving up. If this resistance is broken, for example the price goes up to 42 USD, we get an additional buy signal.

It is also interesting to look at the price development in the long term and this can be seen in the monthly chart shown in the lower part of the image. Here we see that there is no trend at all right now, as the stock has been largely stagnant since mid-2023. Safe and boring. Retain. Or you could look even further back to 2020, in which case the stock is still in a rising trend. Overall, it looks good, buy.

Ryan Specialtys also pays dividends

Another stock that answers the question: “Is it time to buy extra dividend stocks in the US?”. The company distributed USD 0.34. On the last day for dividend entitlement, the price stood at 54.21, a dividend yield of 0.6% including an extra dividend, although they pay out once a quarter, which is still quite low.

When the payout came, the share price dropped in a couple of days from 54 to 52 USD, a drop of 3.7%. Apparently a short-term bad buy, despite the dividend.

In the short term, the stock is in sell according to multi-model day in the upper right corner, which is reinforced by the fact that RSI has been high and is falling. In the weekly chart above right, the stock appears to be falling back to the USD 50 support. Looking at the rising bottoms (=trend) in the monthly chart, you can see that the stock can fall back to USD 45-46 and still be in a steep rising trend, about 45 degrees of slope. I would wait or sell and see if the trend holds. For example, buy if the stock turns up from 45-46 USD.

WEYERHAEUSER pays a decent dividend

Sometimes a picture is worth a thousand words. In the monthly chart on the right, you can see that the stock is more or less static. The RSI chart breaks down out of formation, that is, sell in the medium term. According to BEST month, it is in purchase, but this is unlikely to happen. Safe, secure and boring, but since my own strategy is to buy stocks that go up, I don’t buy this stock.

Is it time to buy a Ford or several?

Ford is currently trending upwards. Could be time to buy.

Ford awards 4 times a year. In 2023, the dividend was USD 1.25 including extra dividends. The stock stands at about $13.28, in other words, 9.4% in dividends. Good! This year there has already been an extra dividend in February and yet the share price is rising.

Arhuas Inc pays extra dividends and trends upwards

The best for last. Is it time to buy US stocks with extra dividends? Well, if you look at Arhaus Inc, it looks particularly interesting. Trend strongly upwards. The first thing I look at is whether the middle line is upward sloping, i.e. the regression line is upward sloping. Below, 20 weeks are included in the regression and have a good upward slope.

On the left is a triangle and a rising trend. The forecast is then that the share will go above USD 16 with the distance in the triangle, USD 2.5, i.e. about 16% upwards. Although the stock has recently paid a dividend, it is still going up, which is a sign of strength.

Arhuas Inc can be found in the Nasdaq object list in Vikingen.

What about currency risk while buying shares with extra dividends?

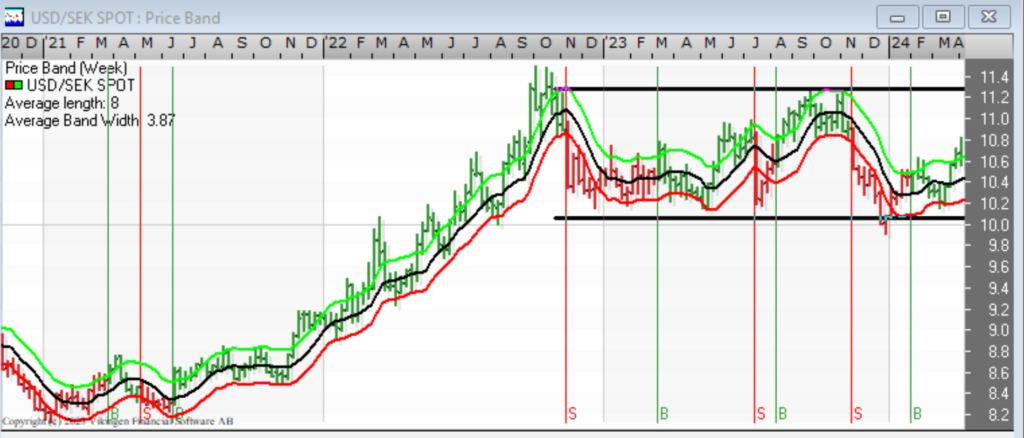

USD/SEK

The exchange rate is essentially stationary and moves in a range, in a rectangle. It is in the middle of the rectangle, as much up as down. A currently limited risk, nothing unusual like an outbreak in sight. The currency seems to have a minor impact on stock trading performance at the moment.

USD/DKK

Same appearance as above for USD/DKK.

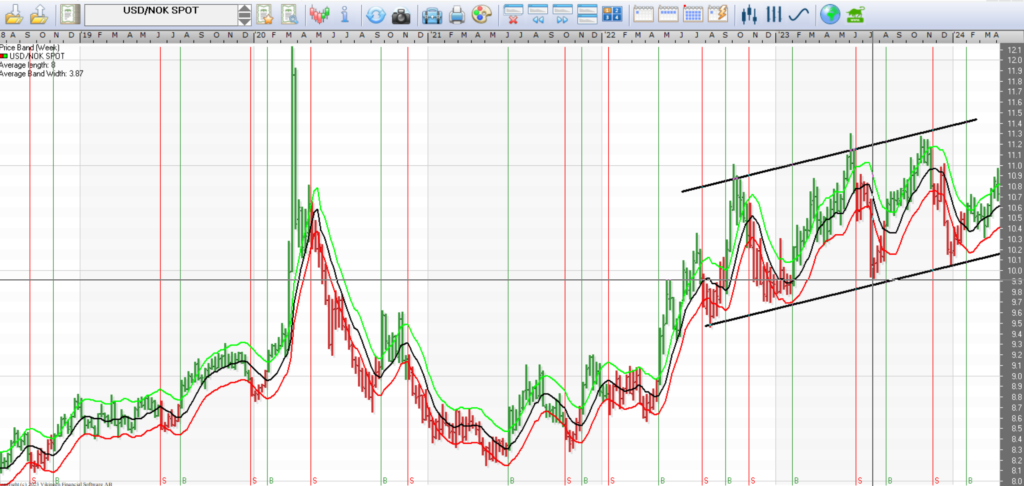

USD/NOK

The Norwegian krone depreciates by about USD 0.4 per year against the dollar. If you have Norwegian kroner and buy a share from the US, the value will increase with the help of the dollar exchange rate. (As it stands now).

You can find the currencies in the X-Curr item list for those who have Vikingen Börs/Trading/Maxi.

The Vikingen is a good stock market program to find the winners, perhaps the best program.

It is easy to use the automatic filters available in Vikingen Börs/Trading/Maxi, the so-called “autopilots”. I use the Viking Maxi, English variant because the monthly BEST and mRudolph3 models give excellent buy signals. Looking back, I realize “I should have done that”. They are practical models where you can keep up, though they are not always the best models, but they work in practice.

Our holdings 28 March 2024

Sold Japanfonden and replaced with Odin Norge C. Bought Lundin, Meta, McCormick and Scandinavien Astor Group. Sold Nuvei, Nvidia, Bruker and the call option in SBB.

My and my partner’s holdings:

| APPLOVIN A |

| AUTOLIV SDB (SEC) |

| BOLIDEN |

| DANSKE BANK |

| DELPHI GLOBAL |

| LUNDIN MINING CORPORATION |

| MCCORMICK & COMPANY |

| META PLATFORMS A/NASDAQ |

| MPC CONTAINER SHIPS |

| NORDEA BANK(SEC) |

| ODIN NORWAY C SEC |

| PICTET-DIGITAL-R USD |

| SAAB B |

| SCANDINAVIAN ASTOR GROUP |

| SKANDIA GLOBAL EXPOSURE |

| SKANDIA TIME GLOBAL |

| SPILTAN SMALL CAP FUND |

The next day, the content may be different.

Disclaimer

It is up to you whether you follow the recommendations above and you take all the risk yourself. The hope, of course, is that you’ll make money from the tips, but we can’t promise that.

It’s always the way it is; if it goes down, it goes down, that’s just the way it is. Then you act accordingly. Same in reverse, if it goes up, it goes up, even if the bad news on TV says otherwise. The Viking is objective, just showing how it is. It took me many years to accept.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of the oldest stock exchange programs in the Nordic region. Tell your friends and acquaintances about the Vikingen.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)

Good luck to Peter Östevik