Stock tip of the week and new share issue in 3 Prospect Invest!

This week’s Stock Tips from Vikingen and Aktieutbildning.nu!

Don’t miss out! Vikingen’s parent company 3 Prospect Invest invites the public to a share issue!

Welcome to find out all the details here!

The stock tips published in this blog and in our social media are primarily written for educational purposes. Evaluate first what you think and remember that the stock market gives as well as takes. Welcome to follow us on FB, Linkedin, Instagram and X so you do not miss out on anything. Please tell your friends and colleagues to do the same!

Do you want to read this blog in Swedish? Click here.

Recommended Buy Week 50: Munters Group AB (MTRS)

The share is now trading at around SEK 166.40.

Why is now a good time for Munters?

Technical Analysis of Munters

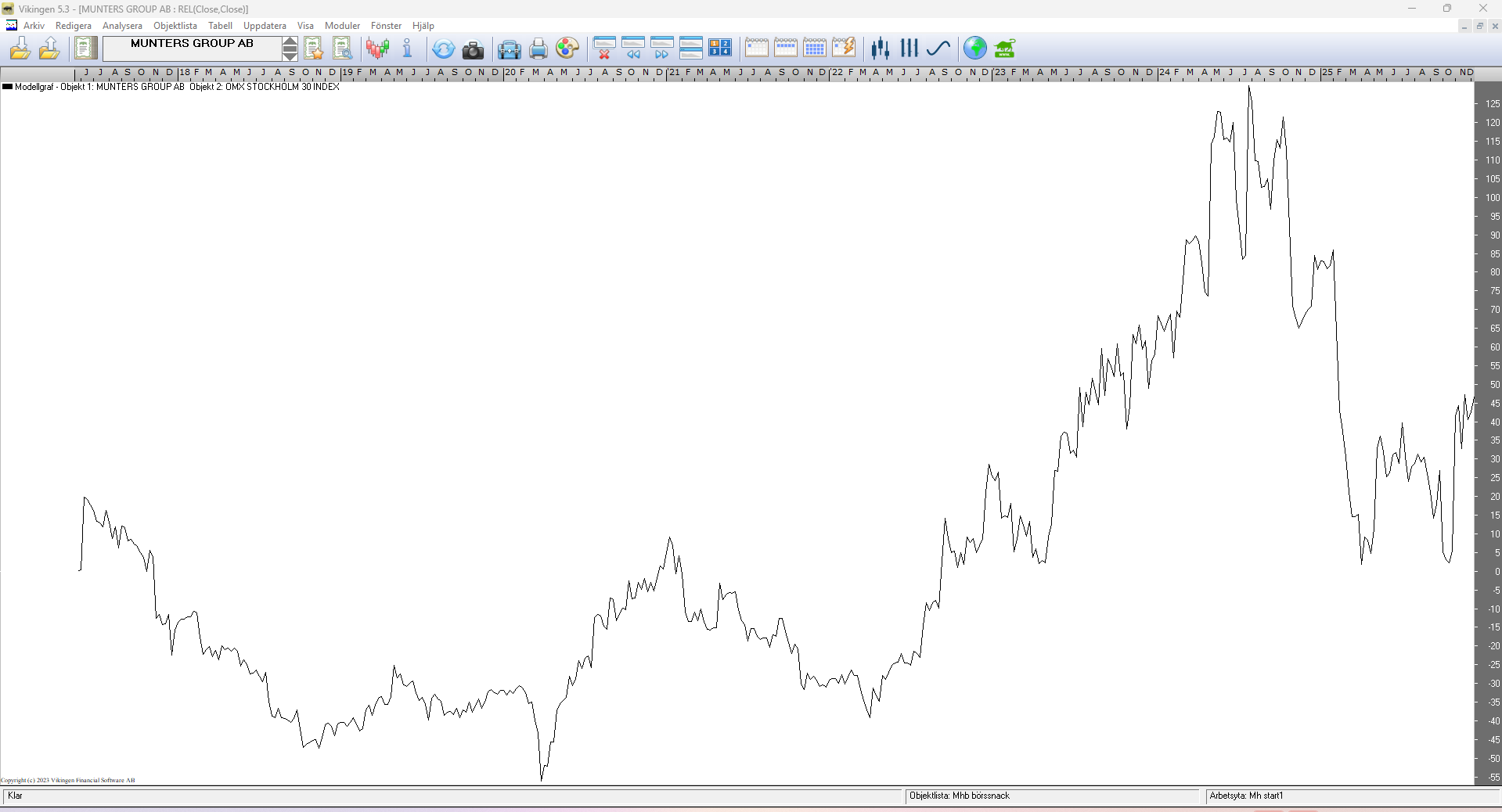

See also charts from Vikingen below

- Strong upward trend seems to have started. Long-term trend breaks upwards.

- Large round-bottomed formation since April 2025, now breaking upwards.

- We are moving from consolidation and low volatility to hopefully rising prices and higher volatility.

- Viking’s BEST model, Kursband model (weekly and monthly), and other models give a “green” light and a buy signal.

- The relative graph breaks upwards in a similar way, which is very positive. This means that the company is accelerating upwards relative to the OMX in a similar formation to the absolute graph, i.e., large investors are probably driving the price upwards.

- We have known for a long time that USA Tech is going up and is relatively stronger than most.

Fundamental Analysis

Below is a SWOT analysis of Munters Group AB, a world-leading provider of energy-efficient solutions for air treatment and climate systems. The company is particularly interesting at the moment because of its connection to the fast-growing data center and battery manufacturing sector. Watch a video about Munters here.

Below is a summary of the latest target prices and analysis for Munters Group AB, as of December 2, 2025

The market’s view of Munters has brightened in the fall of 2025, driven by a strong Q3 report that showed continued strength in the data center segment (DCT) and improved profitability. The majority of the major research houses have a buy recommendation, although there is some dispersion in the size of the upside.

Current Indicative Courses and Recommendations

The latest updates from the end of October and November 2025 show increases in the target rates from several sources.

| Analytical houses | Recommendation | Target price (SEK) | Date / Comment |

| Pareto Securities | Buy | 210 kr | Increased from SEK 200 after the Q3 report (Oct 2025). |

| DNB Carnegie | Purchase | 205 kr | Increased from 190 kr (Nov 2025). |

| SEB | Keep | 160 kr | Increased from SEK 125, but remains cautious (Oct 2025). |

| Jefferies | Purchase | 160 kr* | Data from Sep 2025. Lowered profit estimate slightly due to AirTech. |

| Average | — | ~194 kr | Based on broader consensus data (Nov 2025). |

Current price: The share is trading around SEK 170-175 (end of November 2025), which means that the most optimistic analyses see an upside of just over 20%.

What drives the Munters share?

Analysts are mainly focusing on three areas at the moment:

- Data centers (DCT) are the driving force

This is the strongest driver for the stock. Munters’ position in data center cooling benefits from the global AI rollout.

- Order book: Capacity for 2025 was described early in the year as almost fully booked. Analysts now see the order book starting to fill up for 2026.

- Currency effects: A stronger dollar has benefited Munters as a large part of DCT sales are in the US.

- The “reporting success” in Q3 2025

After a period of uncertainty in 2024 and early 2025, the Q3 report in October 2025 came as a positive surprise.

- Margins: Adjusted EBITA margin has improved, which calmed the market.

- FoodTech & AirTech: FoodTech has shown good growth, while AirTech (industrial dehumidification) has been weaker with lower capacity utilization. It is mainly AirTech’s weakness that is causing some analysts (e.g. Jefferies) to hold back their earnings estimates slightly.

- The valuation gap (Bull vs. Bear)

- The optimists (Pareto, Carnegie): See structural growth in data centers that justifies a higher valuation (P/E ratio above 25-30). They believe that the market underestimates long-term demand.

- The Skeptics (SEB): Believe that the valuation already reflects much of the success and that the risks in the cyclical industrial business (AirTech) warrant a “Keep” stamp rather than “Buy” recommendation.

Conclusion

The momentum in Munters is currently positive. If you believe that the AI boom will continue to drive data center investments in 2026, today’s share price is below the target prices from the heavyweight research houses (Pareto and Carnegie). If you are more concerned about the economic situation in the traditional industry, SEB’s more cautious line may be worth considering.

SWOT Analysis of Munters Group AB

Strengths

- Niche market leader: Munters is a world leader in dehumidification and precision climate control. They have an extremely strong position in demanding industries where precise humidity and temperature control is critical (e.g. pharmaceuticals, food, electronics).

- Data Center Positioning (DataCenter Technologies): This is the “crown jewel” of the company right now. Munters is one of the leading suppliers of cooling systems to data centers, especially in the US. With the AI boom, more advanced cooling (liquid cooling) is required, where Munters is at the forefront.

- Strong Order Book: The company has shown an impressive order book, particularly driven by large orders from battery manufacturers and data center giants (Hyperscalers).

- Sustainability profile (ESG): Munters’ products are fundamentally about energy efficiency and resource conservation, making them a winner in the green transition.

Weaknesses

- Supply chain issues: Like many manufacturing companies, Munters has been struggling with supply chain disruptions, leading to increased costs and some delays, although this has improved.

- Dependence on large projects: In the AirTech and DataCenter Technologies business lines, revenues are often “lumpy” and dependent on a few very large projects. If a large project is delayed, it has a significant impact on the quarter.

- Margin pressure in FoodTech: The FoodTech business (climate control for livestock and greenhouses) has historically had lower margins and been more cyclical than the other parts, although SaaS (software) initiatives are trying to improve this.

Opportunities

- AI and Liquid Cooling: The explosive growth of AI requires data centers with much higher power densities. This is driving a shift from air cooling to liquid cooling, an area where Munters is investing heavily.

- Battery industry (EV): Manufacturing lithium-ion batteries requires ultra-low dew point air. Munters is a dominant player here, and the expansion of battery factories in Europe and North America is a huge growth driver.

- Service and Aftermarket: The company has a stated strategy to increase the share of service revenue. As the installed base grows, there is great potential to increase recurring revenue with higher margins.

Threats

- Macroeconomic slowdown: A deep recession could lead industrial customers (especially in battery and construction) to postpone their investment decisions (CAPEX), which would reduce order intake.

- Competition from Asia: In the battery segment, there is a risk of cheaper Asian competitors gaining market share, especially as Chinese battery manufacturers expand globally.

- Raw material prices: Rising prices for materials such as steel, aluminum and electronic components could squeeze margins if Munters fails to pass on costs to customers quickly enough.

Conclusion: Munters is a quality company riding two of the world’s strongest megatrends: Digitalization (AI/Datacenters) and Electrification (Batteries). The biggest risk in the short term is if the pace of investment in these sectors slows down, but in the long term, the stock looks very strong.

Want to learn more from Aktieutbildning.nu?

Join us at the Trading portfolio. Find out more here.

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Yours sincerely