Four ways to value Bitcoins

Before diving into the bitcoin valuation task, we must first acknowledge that this is no ordinary undertaking. Unlike traditional assets like stocks and bonds, bitcoin lacks the typical characteristics required for traditional valuation methods. It does not generate cash flows, pay dividends or otherwise provide returns, and therefore may be more reminiscent of commodities, which are both cyclical in nature and notoriously difficult to value Bitcoins. Nevertheless, there are a number of sensible frameworks through which to view these developments in money and finance.

So, in response to the question from Franklin J. Parker, CFA, here are four bitcoin valuation methods that highlight different ways to explore the cryptocurrency’s value and provide insights into this nascent but powerful technology.

1. Compare with the alternatives

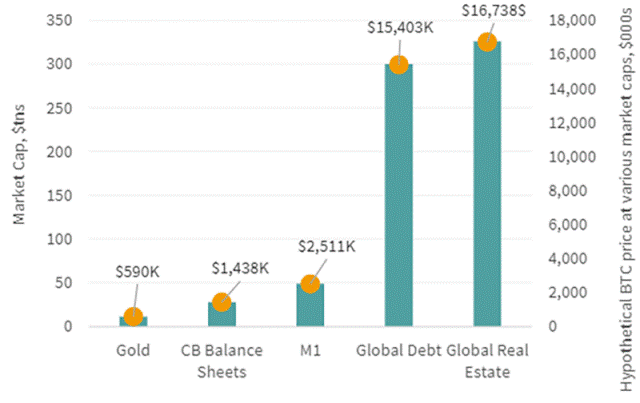

One way to measure bitcoin’s value is to determine which asset classes or securities it competes with and compare their potential value.

So, to extend our commodity metaphor, where does bitcoin – so-called digital gold – stand in relation to actual gold? Both are fixed assets, counterparty-free assets with rare and desirable monetary characteristics and are used by investors as long-term havens for capital preservation. Today, gold has a market value of about 11.5 trillion dollars.

If bitcoin reached a similar market capitalization, the price per coin would exceed $500,000.

Bitcoin valuation: Comparison of options

Sources: Glassnode, World Gold Council, Trading Economics, Savills, Visual Capitalist and Sound Money.

Sources: Glassnode, World Gold Council, Trading Economics, Savills, Visual Capitalist and Sound Money.

Of course, bitcoin has something of a technical advantage over gold. It is digital, decentralized and free from government influence. So, if its market capitalization reaches $11.5 trillion, why should it stop there? And is gold its only competition? Couldn’t bitcoin stand for other financial collateral and store of value such as global bonds or even residential real estate?

To be sure, definitive answers to these questions are elusive, but trying to find them can improve our understanding of bitcoin, bitcoin valuation and the crypto phenomenon more generally.

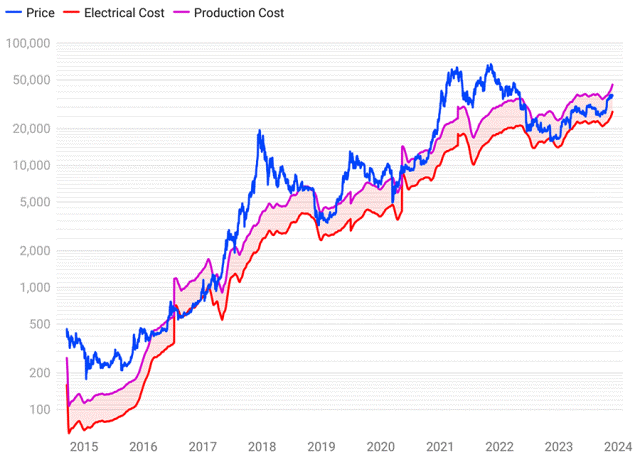

2. Base it on production costs

We keep hearing about the electricity and equipment needed to mine bitcoin. These associated expenses provide another way to determine the value of the cryptocurrency. Although estimates of these costs are highly variable and inevitably inaccurate, researchers from Cambridge University have compiled some of the most reliable data.

Bitcoin production costs

Source: Capriole Investments. Created with Data Wrapper

Source: Capriole Investments. Created with Data Wrapper

Of course, bitcoin is a store of value and an alternative monetary technology. But few users price bitcoin based on the latter quality. This is why the production costs of bitcoin serve a purpose similar to gold: they put a floor on the price, which can help determine whether the underlying is undervalued. Historically, bitcoin’s price has tended to bottom out around its production cost, such as in the second half of 2016, the first half of 2019, March 2020 and the second half of 2022.

In helping to determine whether bitcoin is undervalued, production costs are a crucial input to its valuation. But since they can hardly quantify the upside price potential associated with bitcoin’s monetary premium, they are also a limited bet.

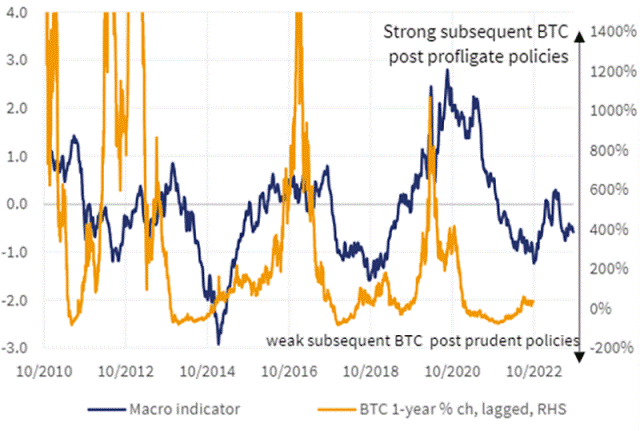

3. Look at the US dollar

So, how do we value bitcoin’s monetary premium? As an alternative monetary technology, bitcoin must be assessed in the context of the prevailing monetary system: the US dollar. Real interest rates, money supply growth and fiscal policy, among other factors, all affect bitcoin’s valuation.

Elevated real interest rates and limited money supply growth are indicators of sound monetary and fiscal policies. They help measure whether authorities are protecting the value of the dollar. Such factors should be a headwind for bitcoin prices. If policymakers look to the existing monetary regime, investors are less likely to look for an alternative.

For Bitcoin valuations, caution on dollar policy matters

Source: Glassnode, Google Finance, and Sound Money

Source: Glassnode, Google Finance, and Sound Money

Of course, monetary policy makers often adopt wasteful measures that depreciate the value of the dollar. The last 15 years of quantitative easing (QE) and other monetary stimulus created low and negative real interest rates and rapid money growth. These were ideal conditions for bitcoin and fueled the crypto boom.

Under tighter macro conditions, bitcoin is worth less. Under loose conditions it is more valuable.

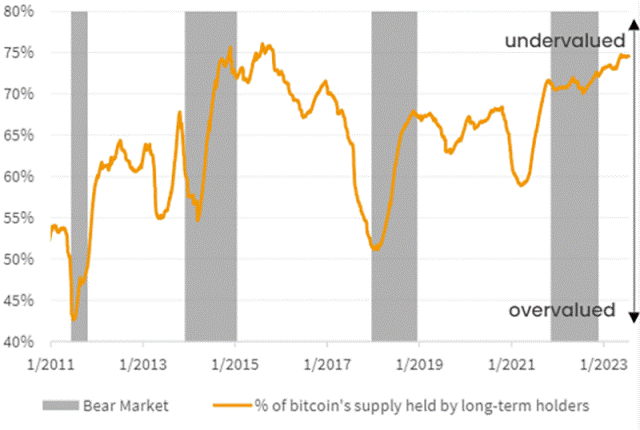

4. Measure the conviction of Bitcoin holders

Using a more behavioral approach, we can also evaluate the underlying beliefs of long-term versus short-term bitcoin holders for clues to bitcoin’s value. The proportion of long-term owners tends to increase during bear markets and decrease during bull markets.

Long-term percentages for Bitcoin holders indicate under/overvaluation

Source: Glassnode and Sound Money

This suggests that bitcoin is overvalued when short-term speculators have more of the supply and undervalued when long-term holders dominate.

Those used to discounted cash flows, price-to-earnings ratios and other traditional measures may find bitcoin valuation methods unconventional. But unconventional or not, they offer a way forward. Results and outcomes may vary, but this is no surprise when it comes to emerging and potentially transformative technologies.

Bitcoin’s many detractors may well be right. Bitcoin and crypto in general can all end in failure, with an intrinsic value of effectively zero. But crypto advocates may also be on to something when they expect bitcoin to become a global reserve asset.

Few assets have ever attracted such diverse opinions. As the financial industry delves deeper into the crypto valuation issue, we should remember that the printing press, steam engine, internet and other revolutionary technologies have always been difficult to value, especially in their early stages. But these innovations eventually changed the world in ways that people did not initially imagine. Crypto can do the same. Or maybe not. We just have to see.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)