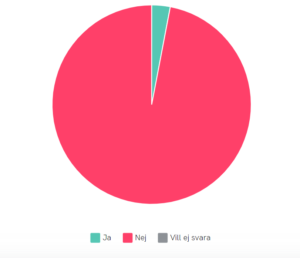

Do you trade in cryptocurrencies?

In 2021, 3 percent had bought or sold cryptocurrency according to Swedes and the Internet. It was mainly men and especially younger men who traded cryptocurrencies. However, few Swedes declare their trade with cryptocurrencies, which can be a problem, or actually several problems.

According to the service Divly, only ten percent of all Swedes who trade in cryptocurrencies actually declare them. They should be included in the declaration because transactions on the blockchain are not anonymous, they are pseudonymous. This means that we may soon see a development where those who have not paid their taxes may receive requests from the tax authorities several years later. EU regulations MiCA and DAC 8 are coming, so there will definitely be controls in the future.

Whether it is unwillingness or ignorance that makes people not declare these transactions is unclear, but it is not as easy to declare cryptocurrencies as it is with shares. There are some special rules. If you buy 1,000 Volvo Bs and sell them at a 10% profit, you’ve made a good deal, especially if you’ve bought them in an ISK or an endowment insurance policy where you tax a percentage of the value of your portfolio. However, if you have it in a regular share depository, you will pay 30% tax on your profits.

If, on the other hand, you make a ten percent loss, you get a regular share deposit with

Avanza

or

Nordnet

deduct the loss from your profits or dividends. If it is in an ISK or an endowment insurance, you cannot make any deduction, it is, as above, a percentage-based sum of the value of your deposit.

If you make a profit on a cryptocurrency, you must declare it and pay tax on the entire profit. However, if you make a loss, only 70% of your loss is deductible. This means that if you buy a Bitcoin for $22,000 and sell it for $24,200, you have $2,200 to pay tax on.

If you then make a new deal where you buy a Bitcoin for $24,200 and sell it for $22,000, you have a loss of $2,200. In practice, you are back to zero. It’s not that simple because you have to pay tax on this. You have no profit, but the Swedish tax system does not take this into account. You will pay 30% tax on your $2,200 winnings, or $660 in taxes. Against this, you can deduct your loss, but only part of it, namely 70%. This means that you have a loss of $2,200, and that 70%, or $462, of that loss is deductible. In the end, that leaves you with a tax payment of $198.

However, there is an easier way to trade cryptocurrencies. There are a variety of exchange-traded instruments that are traded on Nasdaq in Stockholm and on Xetra in Germany. As these instruments are exchange-traded, you can trade them directly in your custody account with

Nordnet

or

Avanza

or you can put them in an ISK or endowment insurance. Now, however, a completely different set of tax rules will apply.

What is an exchange-traded Bitcoin?

Let’s look at this. We use Valour’s instruments, but there are a number of other issuers, such as Global X, 21Shares, VanEck, ETC Group and other companies that offer such financial instruments.

Bitcoin Zero tracks the price of Bitcoin without charging administration fees, making investing in the world’s most famous digital asset easier, safer and more cost-effective than any other option. Bitcoin Zero is an exchange-traded product (ETP). To be specific, it is an Open Tracker certificate, listed on the Nordic Growth Market (NGM). This allows you to trade these on your account with

Avanza

or

Nordnet

whether you do it in a regular share depository, ISK or an endowment insurance.

Say you buy 1,000 Bitcoin Zero, it tracks the price of Bitcoin and you make 10%. The difference compared to trading 1 000 Volvo or one Bitcoin is non-existent, you have to pay tax on 30% of the profit, or 3% in this case.

Now, however, things are getting more interesting. Suppose that despite being informed, you make a 10% loss, what happens then? How does an exchange-traded Bitcoin in the form of a so-called ETC or ETN differ from a regular Bitcoin? You can deduct the entire loss, not just 70% as with the regular Bitcoin. You can also make the transaction in your ISK or endowment insurance. Thus, the Swedish tax system is not entirely consistent.

Do you trade in cryptocurrencies like Bitcoin, Uniswap, Aave or Ethereum? Vikingen offers price data on all kinds of cryptocurrencies but also a range of exchange-traded products. This means that it is easy to access good decision-making information and that you don’t have to spread your business across many different banks and financial institutions.

Now you have the chance to order a package of

price data on cryptocurrencies

or

ETFs listed in Germany,

including the exchange-traded cryptocurrencies. You

order it quickly

and easily at Vikingen.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed Comparison – Stock exchange software for those who want to become even richer (vikingen.se)