CBDCs on Ethereum, Solana Gets More Decentralized, and More!

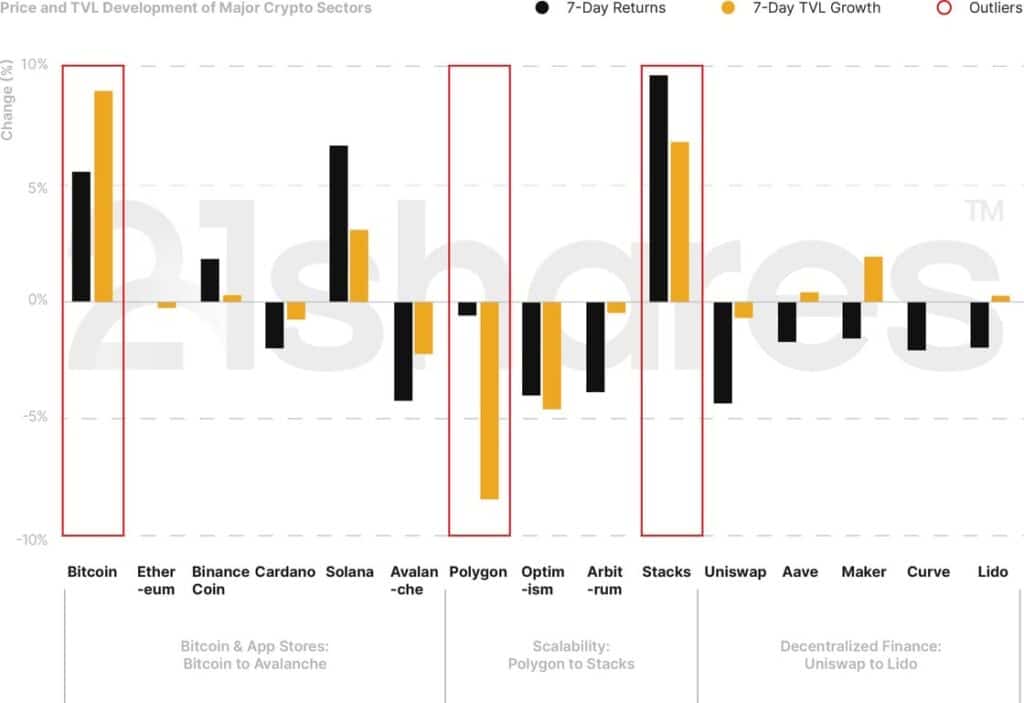

Bitcoin increased by 5.54% week-over-week, while Ethereum barely moved, decreasing by 0.05%. Polygon was the biggest negative outlier, dipping by 8.4% in assets under management over the past week, as shown in Figure 1. Stacks, on the other hand, was the biggest positive outlier, jumping by 9.68% week-over-week, as developer activity increased on the Bitcoin network by 34.7% over the past month. Solana came in third, after Bitcoin, increasing by 8.46% from last week, as it celebrates its latest upgrade, which we’ll delve deeper into in this report.

Figure 1: Weekly Price and TVL Developments of Cryptoassets in Major Sectors

Source: 21Shares, CoinGecko, DeFi Llama. Close data as of October 18, 2023.

4 Things to Remember in Markets this Week

• China’s Shadow Banking Crisis Led to A Flight to Bitcoin

Over the past two months, Chinese real estate giants sparked a debt crisis in the country, leading Chinese developers Evergrande and Sunac to file for Chapter 15 bankruptcy protection in the U.S. in August. On Monday, the People’s Bank of China (PBOC) pumped the equivalent of over $100B (net ~$40B) in medium-term lending to keep liquidity in the banking system adequate, marking the biggest injection in three years. At the brink of the pandemic in January 2020, the PBOC pumped $115B into the economy by reducing the deposit reserve ratio in financial institutions by 0.5 percentage points. A week after the announcement, Bitcoin’s price jumped by 13% and active BTC addresses increased by 48%, according to data gathered by Glassnode. Moreover, we can draw parallels with the U.S. banking crisis this year. In March, Silicon Valley Bank collapsed after venture funds and startups withdrew $42B in one day. Signature Bank defaulted two days later. A week later, Bitcoin surged by 36%, while active addresses increased by 8%. Banking crises have oftentimes prompted people to resort to Bitcoin as a flight to quality, amplifying crypto’s use case as a hedge in evolving macroeconomic ramifications and an evolving geopolitical landscape.

Figure 2: Bitcoin’s Performance Amid Financial Crises

Source: 21shares, Glassnode

SEC Accepts Court-decision About Grayscale Spot ETF Application

The U.S. Securities and Exchange Commission (SEC) will allegedly not appeal an August court ruling that found it was wrong to reject an application from Grayscale Investments to create a spot Bitcoin exchange-traded fund (ETF). The news spread excitement in the industry, increasing the total crypto market cap by 4% overnight. More specifically, the gap between the trading price of Grayscale Bitcoin Trust and its net asset value (NAV) is narrowing, falling by almost 16%, as shown in the figure below, witnessing its smallest discount in two years.

Figure 3: Discount to NAV of Grayscale Bitcoin Trust (GBTC)

Source: YCharts

• Mastercard Expanding the Usability of CBDC on Ethereum in a Compliant and User-Friendly Manner

Mastercard conducted an experiment focusing on Central Bank Digital Currency (CBDC) interoperability using the Ethereum blockchain. The initiative involved tokenizing Australia’s proposed CBDC, eAUD, on Ethereum and implementing KYC verification through Mastercard’s Digital Identity solution to govern eAUD transfers. Unlike stablecoins, this pilot restricted participation solely to authorized entities. The wrapped CBDC was subsequently utilized to facilitate the exchange of an NFT among ‘white-listed’ participants.

This experiment is significant as it showcases the potential for privately-issued CBDCs to integrate with public blockchains while adhering to compliance requirements seamlessly. In addition, it illustrates the possibility of utilizing unsupported means of exchange to access the digital asset ecosystem. Further, it emphasizes the coexistence of private and public blockchains, serving distinct purposes, which is crucial as CBDCs will most likely be developed on a variety of different blockchains and DLT platforms, thus enabling interconnectivity between them is crucial on the back of experiments as such, and existing interoperability solutions like Chainlink CCIP. Finally, it offers a means for external entities to utilize public networks without engaging with the native assets using today’s established payment providers.

• Solana to Become More Decentralized while Enabling Confidential Transactions

Solana’s latest software upgrade (v1.16) introduced several notable enhancements. The improvements include significantly reducing validator hardware requirements by reducing RAM usage from 120 GB to 39 GB and fine-tuning for bandwidth constraints. However, the standout feature is the optional ability to encrypt transactional details, such as the amount of tokens being transferred and the total balance of both counterparties, while preserving auditing rights to ensure compliance via the Zero Knowledge Proofs (ZKP) decryption mechanism. ZKP refers to a method where one party can prove possession of certain information without revealing the underlying content.

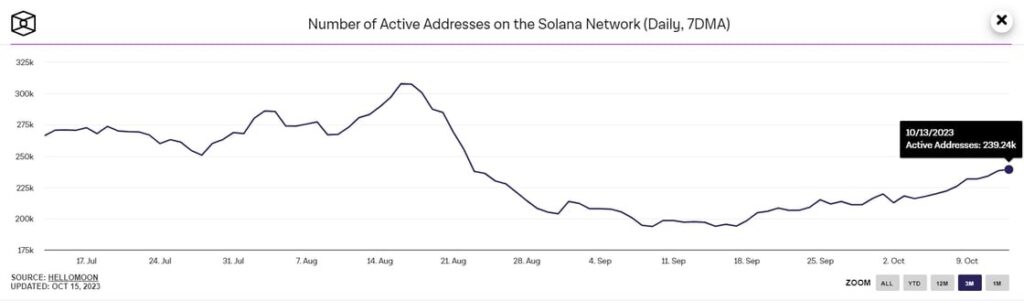

This is a vital upgrade as it enables users to transact in a confidential manner, a key factor for institutional adoption. In addition, the reduced hardware requirements would make it easier to be supported by a broader range of validators, thus making it less prone to centralization. Solana’s recent surge in inflows, reaching levels not seen since 2022 ($24M), coupled with a consistent rise in daily active users for four consecutive weeks, as seen in Figure 5, underscores the enthusiasm for this overlooked upgrade.

Figure 5: Solana Daily Active Addresses

Source: TheBlock

What You Should Pay Attention To

Public Announcement: We Just Published A Report on Tokenization

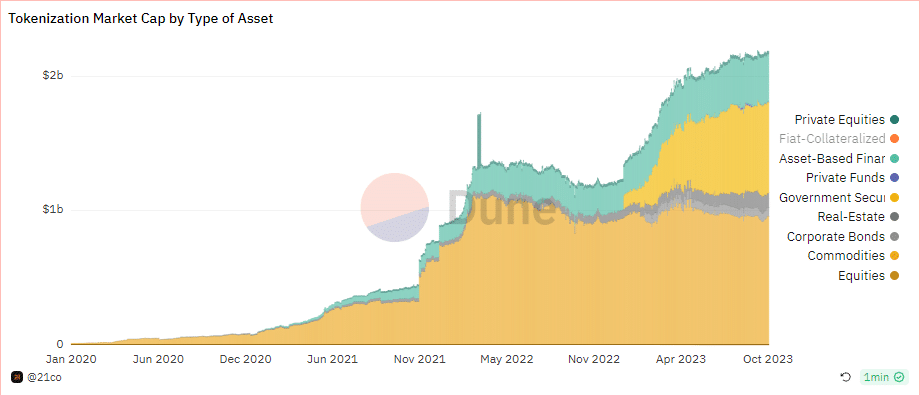

This week we aim to present key insights derived from our latest report on Tokenization, shedding light on the growth of this sector. Our enthusiasm for this niche stems from the conviction that the tokenization market is poised to evolve into a substantial asset class, potentially reaching $3.5T by 2030, and even surpassing $10T in an optimistic scenario.

Figure 6: Overall tokenization market Capitalization excluding stablecoins

Source: 21co on Dune

With this perspective, here are the key findings from the report:

• Ethereum leads in providing the infrastructure for this burgeoning industry, disrupting nine asset classes. It hosts most tokenized fiat-collateralized currencies, accounting for over 50%, while Tron follows at 38%. o This highlights a critical point: Deep liquidity and strong network effects are paramount and not easily overshadowed by lower fees or faster settlement times.

• Stablecoins were the first to achieve a product market fit due to their vital role in global remittance and trading, representing 97% of the entire tokenized asset class.

• Smaller markets like tokenized commodities and government securities are gaining traction, constituting ~1.3% and ~0.95% in market share, respectively. o Notably, government securities grew by more than 500% since the year’s start, propelled by the current decades-high interest rate regime.

• While numerous tokenized projects emerged in the past year leveraging public blockchains like Ethereum, Polygon, and Solana, access is still limited by familiar barriers from TradFi, like KYC and geographical restrictions, to uphold compliance.

• The tokenization market is at a very early developmental stage, symbolized by the fact that only 10% of crypto’s total user base, or 47 million users, have engaged with or held tokenized assets.

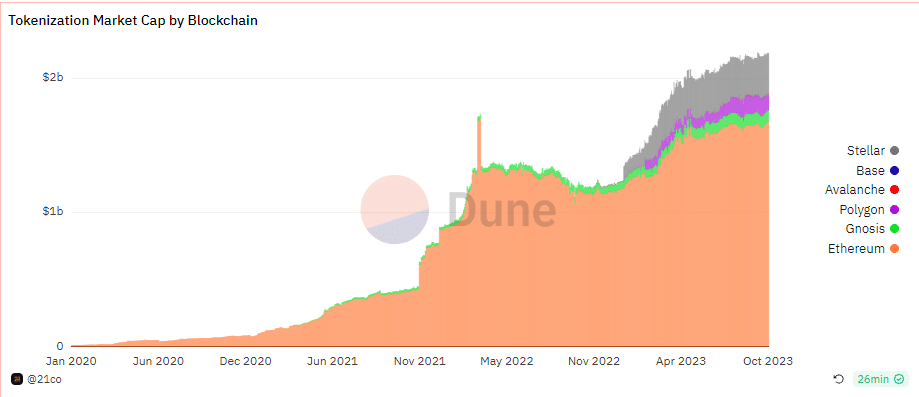

Figure 7: Breakdown of the Blockchains Hosting Tokenized Assets by Market Cap

Source: 21co on Dune

Given Ethereum’s pivotal role in the tokenization industry, it’s crucial to consider the network’s current robust fundamentals. Ethereum is the most decentralized software-as-a-service platform, boasting over 862K distributed validators.

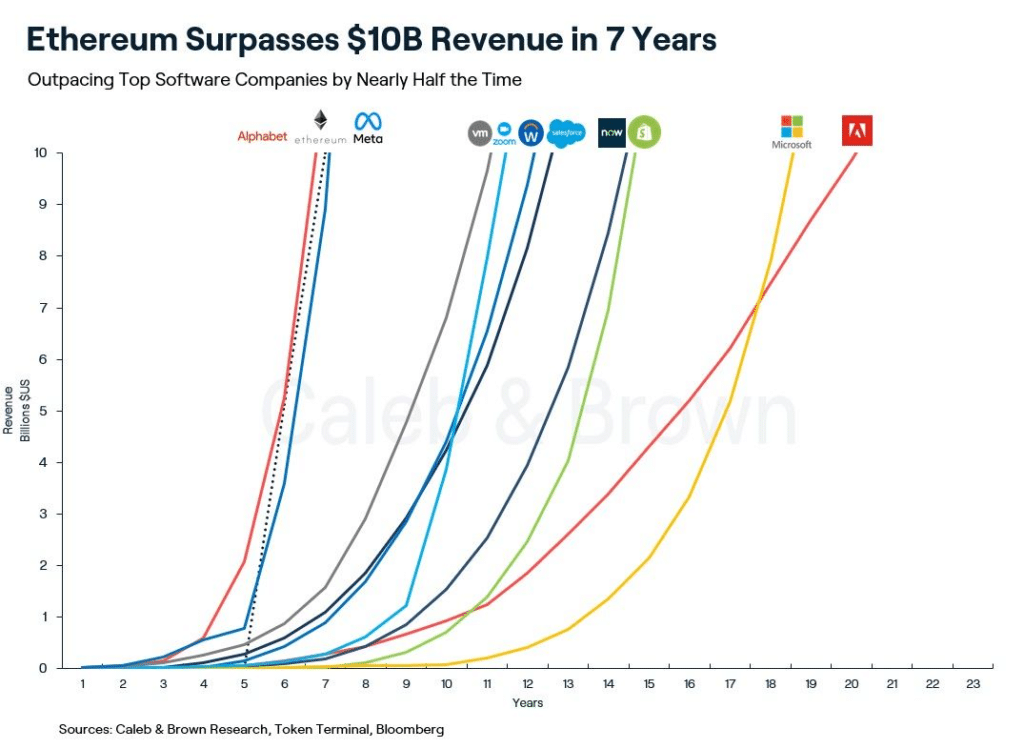

Moreover, contributing to its security has become highly accessible, evidenced by the reduction of the validator entry queue from 45 days to zero, following the Shanghai upgrade in April 2023. Concurrently, the amount of staked ETH has been steadily rising, showing vigorous demand for the asset. All in all, Ethereum’s active role in serving the crypto industry can be well understood when appreciating it has become one of the few software companies to surpass $10B in revenue in less than 7 years, beating the likes of Microsoft and Meta.

Figure 8: Accrued Revenue by Software Companies

Source: Caleb & Brown

Bookmarks

• Our State of Crypto is out! Discover how crypto is changing the world.

• Our State of Crypto is out! Discover how crypto is changing the world. Download here.

• The State of Tokenization by 21.co and 21Shares. Read here.

• Webinar — Tokenization and Interoperability: The Next Big Leap in Crypto. Watch here.

• We published a Dune Dashboard tracking the overall growth of Tokenization. Check here.

• Our Dune Dashboard tracking Bitcoin holdings of the US government got featured in the Wall Street Journal. Read here.

Next Week’s Calendar

This is what we’re monitoring for next week.

• October 19: The chair of the Federal Reserve will speak at the Economic Club of New York Luncheon.

Source: Forex Factory

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.