Berkshires Silver Trade

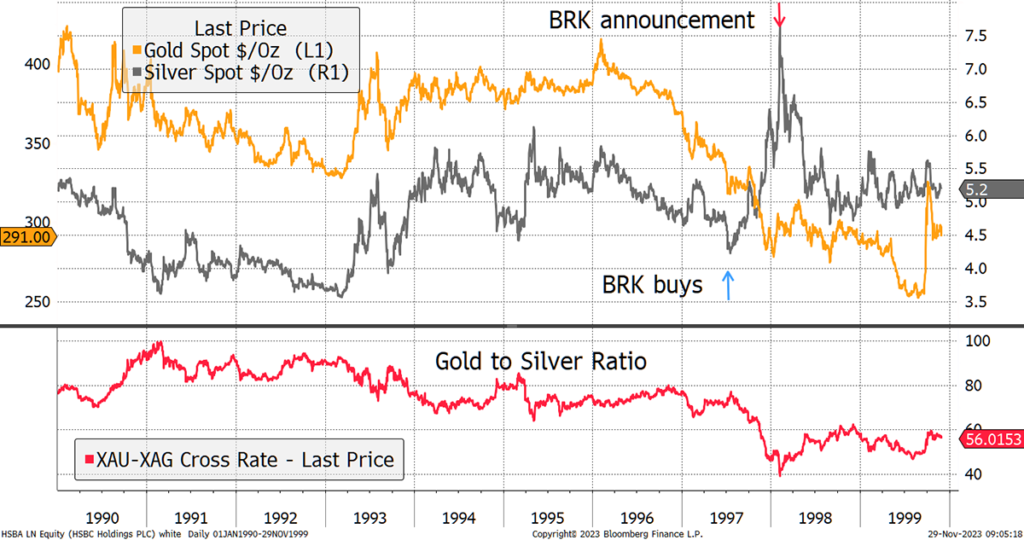

On February 3, 1998, Berkshire Hathaway shocked the silver market by announcing the Berkshire Silver Trade whereby it had acquired 129,710,000 troy ounces of silver on the London market and took delivery.

“Due to recent price movements in the silver market and because Berkshire Hathaway has received inquiries about its ownership of the metal, the company is releasing some information that it would normally have published next month in its annual report. The company owns 129,710,000 troy ounces of silver. Its first purchase was made on July 25, 1997, and its most recent purchase was made on January 12, 1998.”

Their justification was that stocks had fallen, and the market balance was likely to be only at a slightly higher price. The $3.50 level seen in 1991 and 1993 was the lowest low since the 1970s, and their entry in mid-1997 at around $5 was timely. As rumors of their purchase spread, the silver price took off, only to give back a lot after the announcement a few months later.

Berkshire bought silver

Source: Bloomberg

Source: Bloomberg

They sold their silver for a modest profit and later regretted the trade, probably because it went against their ideology of “never betting against America” and their establishment credentials. The critics would say that they were happy to tip silver when Berkshire Hathaway was worth less than $50 billion, but now they are worth $780 billion, that is no longer respectable.

The 1997 silver trade amounted to two percent of their assets. Today it would be $15.6 billion, which is 80% of all the silver held by ETFs. Perhaps they simply grew out of raw materials. Their recent investments have been more about transporting raw materials via railways and pipelines and, of course, their 25.9% stake in Occidental Petroleum (OXY).

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)