Why a trading journal can increase your profits?

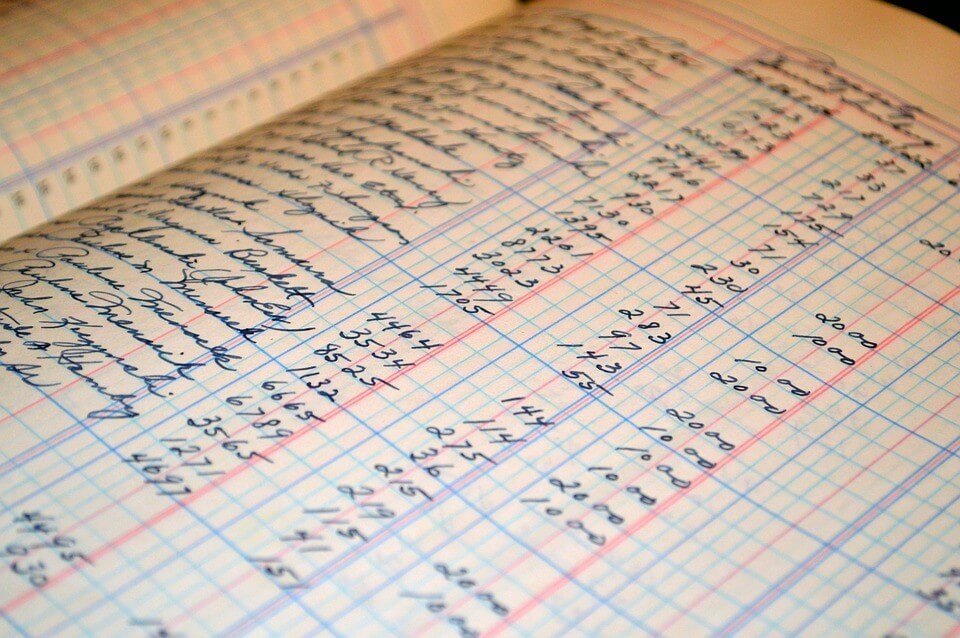

Something as simple as a trading journal, a regular diary where you record your trades, can greatly increase your profits in the forex market. The trading journal is one of the most underrated tools in the trading world. The task of keeping such a diary may seem tedious at first, and most traders lack the patience and discipline required to update it frequently. But for those who keep a trading diary for the long term, it can be very useful on the journey to becoming a successful forex trader.

A trading diary is much more than a log of trades executed. It can be what you make of it. Traders can write down their thoughts, feelings and observations. It is important to note an important observation as soon as possible, as some of it may be forgotten during a busy trading day.

Let’s take a look at the two main reasons why traders don’t start a trading journal or don’t follow it.

Time

Keeping a trading journal may seem time-consuming, especially if you are a short-term trader. Beginners in particular often say: “I don’t have time to keep a diary, I have to follow the markets!”.

In fact, as a trader you make money by identifying good opportunities and not by writing a diary. However, there is no need to write down a note after every single transaction, but instead make short notes after discovering something important. In the evening hours – when things are usually less stressful – you can then compile a quick summary of the trading day and the main conclusions.

Keeping a diary should not be a compulsory activity. If the markets are quiet or there are no new observations worth writing down – there is nothing wrong with skipping it.

The truth can sting …

A trading journal is most effective when a trader is honest with himself. This does not mean that there should be too much negativity. Comments like “I had a terrible day! I wonder if this is worth my time and if I will ever succeed” will not make you a better trader. Instead, make observations and try to identify what exactly went wrong.

Example: “I identified a good trading opportunity, but due to an abundance of information, I became uncertain and closed the deal too early.” What could be the solution to that? Perhaps the trader in this example spends too much time on Twitter and tweets from different sources that make him/her feel unsafe.

Now let’s look at how a trading diary can help you improve your trades

1. Find the right trading style

If you day trade, but your diary shows that you are often stressed and fail to manage risk properly, you may be more of a swing trader. Medium/long-term trading is not easier than short-term trading, but some traders are more comfortable with it, as they can spend much more time analyzing and don’t have to make quick decisions.

2. Identify your strengths / weaknesses

If you pay close attention to your diary, some patterns should emerge over time. You should be able to identify your key strengths and weaknesses, which will help to find the right trading style and strategy.

3. source of information

There is no trader who knows everything and can afford to stop learning. Markets are constantly evolving, strategies stop working and benefits disappear. Therefore, traders need to train themselves continuously. One way to do this is by making observations about the market and recording them. Maybe one of these observations will become an advantage for you one day?

4. discipline

After some time, keeping a trading journal will not be so boring anymore, it will be a normal part of your trading day. It helps a forex trader to be more consistent and teaches him/her discipline.

5. Figures do not lie

If you use trading statistics as part of your trading diary – even better. Together with your own observations, the statistics will give you important insights.

Starting a trading journal is pretty easy, but being consistent is the hard part. Moreover, a trade diary is very personal. There is no correct way to do it, as each trader must know for himself or herself what is most important and how he or she wants to structure it.

Are you using a demo or live account?

Whether you use a Live or Demo account, you can optimize the impact of a trading journal if you keep detailed notes on your trades. The more details you put in your trading journal, the better you will understand your trading progress.

Many professional and successful traders include trading details such as entry and exit, position sizes and other statistics. It is also useful to include emotional and psychological triggers that affect your industries. Remember that your trading day should reflect your trading experience, including the ups and downs for you to monitor and appreciate your trading progress.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)