What does the spread mean in forex trading?

The role of the spread should not be underestimated, whether in foreign exchange, commodity trading or any other financial market. What does the spread mean in forex trading? In forex trading, the spread is the difference between the bid and ask price of a currency pair.

There are always two prices in a currency pair, the bid (buy rate) and the ask (sell rate). The buy rate is the price at which you can sell the base currency, while the sell rate is the price you would use to buy the base currency. The difference between these two prices is called the spread, also known as the ‘bid/ask spread’. The spread is how “no commission” brokers make their money. Instead of charging a separate fee for making a trade, the cost is built into the buy and sell price of the currency pair you want to trade. From a business point of view, it makes sense. The broker provides a service and has to make money somehow.

The base currency is shown to the left of the currency pair and the variable, quote or counter currency to the right. The pairing tells us how much of the variable currency is equivalent to one unit of the base currency. The quoted buying price will always be higher than the stated selling price, with the underlying market price somewhere in between.

The brokers make money by selling the currency to you for more than they paid to buy it.

The brokers also make money by buying the currency from you for less than they get when they sell it. This difference is called the spread.

Most currency pairs on the forex market are traded without commission, but the spread is a cost that applies to all transactions you make. Instead of charging a commission, all forex trading providers will introduce a spread into the cost of making a trade, as they calculate a higher buying rate relative to the selling rate. The size of the spread can be affected by various factors, such as the currency pair you are trading and how volatile it is, the size of your trade and the provider you use.

Some of the major currency pairs include:

EUR/USD

USD/JPY

GBP/USD

USD/CHF

What does spread mean?

In the foreign exchange market, the spread is measured in pips, which is a small unit of movement in the price of a currency pair, and the last decimal point of the price quote (equal to 0.0001). This is true for most currency pairs, except for the Japanese yen where a pip is the second decimal point (0.01).

When there is a larger spread, it means there is a larger difference between the two prices, so there is usually low liquidity and high volatility. A lower spread, on the other hand, indicates low volatility and high liquidity. Thus, there will be a smaller cost when trading a currency pair with a tighter spread.

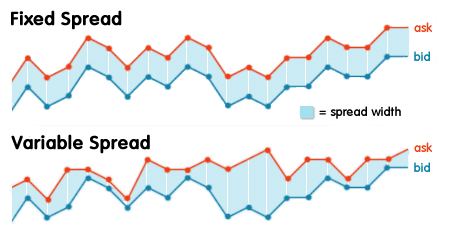

When trading, spreads can be either variable or fixed. For example, indices have fixed spreads. The spread for currency pairs is variable, so when the buying and selling rates of the currency pair change, the spread also changes.

What types of spreads are available in Forex?

The type of spreads you see on a trading platform depends on the forex broker and how they make money.

There are generally two types of spreads:

- Almost

- Variable (also known as ‘floating’)

What are fixed spreads in Forex?

Fixed spreads are the same regardless of market conditions at any given time. In other words, whether the market is volatile or quiet as a mouse, the spread is not affected. It remains the same.

Fixed spreads are usually offered by brokers who act as a market maker or operate a ‘trading desk’ model while variable spreads are offered by brokers who operate a ‘non-trading desk’ model. Using a brokerage table, the broker buys large positions from its liquidity provider and offers these positions in smaller sizes to its own currency clients. This means that the broker acts as a counterparty to his clients’ trades. A brokerage table allows this forex broker to offer fixed spreads as they can control the prices they show their clients.

What are the advantages of trading with fixed spreads?

Fixed spreads have less capital requirements, so trading with fixed spreads offers a cheaper option for traders who don’t have much money to start trading with.

Trading with fixed spreads also makes it more predictable to calculate transaction costs. As the spread never changes, you are always sure of what you can expect to pay when you open a trade.

What are the disadvantages of trading with fixed spreads?

Requotes can occur frequently when trading fixed spreads because pricing comes from just one source, your broker. There will be times when the currency market is volatile and prices change rapidly. Since the spreads are fixed, the broker cannot widen the spread to adapt to current market conditions.

So if you try to make a deal at a certain price, the broker may “block” the trade and ask you to accept a new price. You will be “Requotas” with a new prize. The Requote message will appear on your trading platform letting you know that the price has moved, and asking you if you are willing to accept that price or not. It is almost always a price that is worse than the previous price.

Slippage is another problem. When prices move quickly, the broker cannot consistently maintain a fixed spread and the price that you finally end up with after you start trading will be completely different from the intended entry price.

What are variable spreads in Forex?

As the name suggests, variable spreads always change. With variable spreads, the difference between buy and sell prices of currency pairs is constantly changing. Variable spreads are offered by non-trading desk brokers. Non-trading desk brokers obtain their pricing of currency pairs from multiple liquidity providers and pass these prices on to traders without the intervention of a trading desk.

Normally, spreads widen ahead of economic data and other periods when market liquidity is reduced, such as during holidays.

For example, you may want to buy EUR/USD with a spread of 2 pips, but just as you are about to click buy, the US unemployment report is released and the spread quickly grows to 20 pips.

What are the benefits of trading with variable spreads?

Variable spreads eliminate the experience of requotes. This is because of the variation in spread factors in price changes due to market conditions. Trading currencies with variable spreads also provides more transparent pricing, especially when you consider that access to prices from multiple liquidity providers usually means better pricing due to competition.

What are the disadvantages of trading with variable spreads?

Variable spreads are not ideal for scalpers. The widened spreads can quickly eat into any gains a scalper makes. Variable spreads are just as bad for news traders. The spread can widen so much that what looks profitable can become unprofitable in an instant.

Fixed vs. variable spreads: Which is better?

The question of which is a better option between fixed and variable spreads depends on the individual trader. There are traders who consider fixed spreads better than using variable spread brokers. The reverse may also be true for other traders.

In general, traders with smaller accounts and who trade less frequently will benefit from fixed spreads. Traders with larger accounts who primarily trade during peak market hours when spreads are at their lowest will benefit from variable spreads. Traders who want fast trading and need to avoid requotes should trade with variable spreads.

How is the spread calculated?

The spread is calculated using the last major digits of the bid and ask price. When you trade forex, or any other asset via a CFD account, you pay the full spread upfront. This is compared to the commission paid when trading shares, which is paid both when opening and closing a deal. The tighter the spread, the better value you get as a trader.

For example:

The bid price is 1.26739 and the ask price is 1.26749 for the GBP/USD currency pair.

If you subtract 1.26739 from 1.26749, it equals 0.0001, which is your spread. As the spread is based on the last large number in the price quote, this corresponds to a spread of 1.0.

For most currency pairs, one pip is equal to 0.0001.

An example of a 2-pip spread for EUR/USD would be 1.1051/1.1053.

Currency pairs involving the Japanese yen are only quoted to two decimal places (unless there are fractional shares, it is three decimal places). For example, USD/JPY would be 110.00/110.04. This price reversal indicates a spread of 4 pips.

In the quote above, you can buy EUR/USD at 1.1053 and sell EUR/USD at 1.1051. This means that if you were to buy EUR/USD and then immediately close it, it would result in a loss of 2.0 pips.

To calculate the total cost, multiply the cost per pip by the number of items you are buying. So if you are trading a mini-pilot (10,000 units), the value per pip is one dollar, so your transaction cost would be $2.00 to open this deal. The pip cost is linear. This means that you have to multiply the cost per pip by the number of tickets you buy.

Increasing your position size also increases your transaction cost, which is reflected in the spread. For example, if the spread is 1.4 pips and you trade 5 mini lots, your transaction cost is 7.00 USD.

Forex indicators

The spread indicator is usually displayed as a curve on a chart to show the direction of the spread in relation to the bid and ask price. This helps to visualize the spread of the currency pair over time, with the most liquid currency pairs having tighter spreads and the more exotic pairs having wider spreads.

Factors that can affect currency spreads include market volatility, which can cause fluctuations. For example, major economic news can cause a currency pair to strengthen or weaken – affecting the spread. If the market is volatile, currency pairs can suffer gaps or the currency pair becomes less liquid, so the spread will increase.

Keeping an eye on an economic calendar can help you prepare for the possibility of wider spreads. By staying informed about what events might cause currency pairs to become less liquid, you can make an adequate prediction about whether their volatility might increase and thus whether you might see a wider spread. However, it can be difficult to prepare for news or unexpected economic data.

There will also be a lower spread for currency pairs that are traded in large volumes, such as the larger pairs containing USD. These pairs usually have higher liquidity but can still risk widening spreads if there is economic volatility.

During major market trading sessions, such as in London, New York and Sydney, spreads are likely to be lower. In particular, when there is an overlap, such as when the London session ends and the New York session begins, the spread may still be narrower. The spread is also affected by the general supply and demand for currencies, if there is a high demand for the euro, its value will increase.

Spreads and margin

If the currency spread increases dramatically, you risk getting a margin call and, in the worst case, the position is liquidated. A margin call occurs when your account value falls below 100% of the margin level, signaling that you are at risk of no longer covering the trade requirement. If you reach 50% below the margin level, all your positions can be liquidated.

It is therefore important to measure how much leverage you are trading with and the size of your position. Forex pairs are usually traded in larger quantities than stocks, so it is important to be aware of your account balance. The only way to protect yourself during times of wider spreads is to limit the amount of leverage used in your account. Sometimes it is also beneficial to hold on to a trade during spread times until the spread has narrowed.

The difference between a high and a low spread

It is important to note that the spread can vary throughout the day, between a ‘high spread’ and a ‘low spread’. This is because spreads can be affected by several factors such as volatility or liquidity. You will notice that some currency pairs, such as emerging market currency pairs, have a wider spread than the majors. Your major currency pairs are traded in higher volumes compared to emerging market currencies and higher trading volumes tend to lead to lower spreads under normal conditions.

Moreover, it is well known that liquidity can dry up and spreads can widen in the lead up to major news events and between trading sessions.

High spread

A high spread means that there is a large difference between the buy and sell price. Emerging market currency pairs generally have a high spread compared to the majors.

A higher than normal spread generally indicates one of two things, high market volatility or low liquidity due to off hours trading. Before news events or during major shocks (Brexit, US elections), spreads can widen significantly.

Low spread

A low spread means that there is a small difference between the buy and sell price. It is preferable to trade when spreads are low as in the major currency sessions. A low spread generally indicates that volatility is low and liquidity is high.

Keep an eye on changes in the spread

News usually means uncertainty in the market. News releases from the economic calendar are sporadic and, depending on whether or not expectations are met, can cause exchange rates to fluctuate rapidly. Just like regular traders, the major liquidity providers do not know the outcome of news events before they are released. Because of this, they offset some of their risk by widening their spreads.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)