US fights inflation with credit card debt

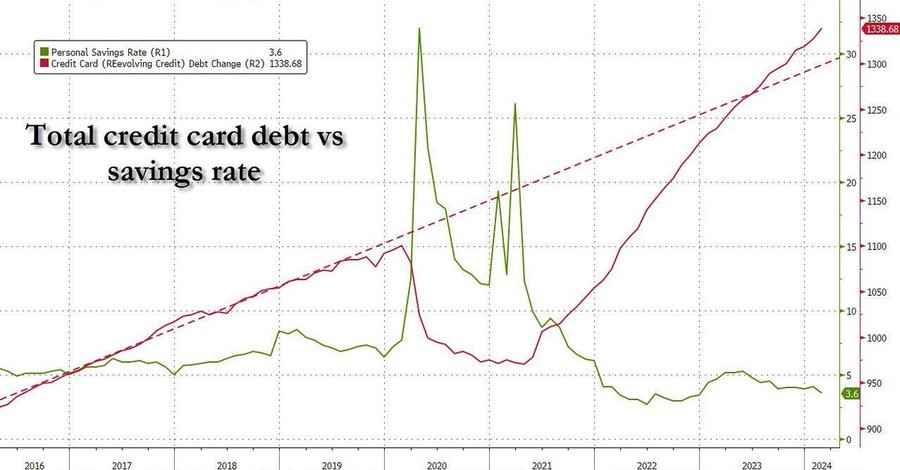

Total credit card debt is skyrocketing as savings rates have crashed. Total revolving credit in the US now stands at USD 1.3 TRILLION, up from ~ USD 960 billion in 2021. Meanwhile, the savings rate has fallen to just 3.6% as affordability reaches record lows.

Interest rates on credit card debt are also reaching record levels, close to 25%. The US has record credit card debt, record high interest rates and record low savings. Is a soft landing really that likely?

We’ve said it before: Americans “fight” inflation with debt on their credit cards. With interest rates on these credit cards reaching record highs, this can only go on for so long.

Source: Kobeissi Letter

Source: Kobeissi Letter

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)