The weekly analysis is back with Biotechnology! And the offer is on this week only!

In this week’s analysis, Aksjeanalyser.com takes a closer look at Oncopeptides

(ticker on Nasdaq Stockholm: ONCO)

About the company

Oncopeptides (ticker on Nasdaq Stockholm: ONCO)

Oncopeptides is a biotechnology company that develops drugs for difficult-to-treat hematological diseases. The company uses its PDC platform to develop peptide-drug conjugates that selectively deliver cytotoxic drugs into cancer cells. The company has drugs under commercialization and several drug candidates in development. Oncopeptides’ head office is located in Stockholm.

Oncopeptides’ vision is to bring hope to patients through passionate people, innovative science and transformative medicines.

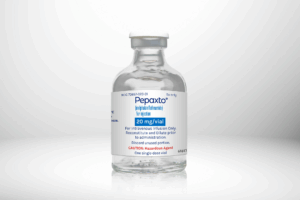

The company is science-driven, entrepreneurial and committed to bringing innovation to patients with diseases where there is a clear unmet need. Oncopeptides’ first drug, Pepaxti, has received full approval for the treatment of adult patients with multiple myeloma in Europe. Based on the Peptide Drug Conjugate (PDC) platform, our first innovative drug offers patients robust efficacy, reduces treatment burden and maintains quality of life.

The pipeline includes other drug candidates built on the PDC platform, as well as the Small Polypeptide-based Killer Engagers (SPiKE) platform. We have a value-driven culture and an inclusive organization that welcomes people with different backgrounds and perspectives. The company is headquartered in Stockholm, Sweden, with 75 employees and a modern preclinical drug development facility in Solna, outside Stockholm.

Oncopeptides is listed on Nasdaq Stockholm with the ticker ONCO.

For more information about the company, visit their website here.

Technical Analysis of Oncopeptides

Oncopeptides (ticker on Nasdaq Stockholm: ONCO)

Oncopeptides (ONCO) is showing strong development and, as mentioned, the share has multiplied several times in just the past two months, with a sharp increase in volume.

This gives very positive technical signals about the further development of the share, and according to the overall technical picture for the share, a further increase to around SEK 12.00 – 15.00 is initially indicated.

This gives very positive technical signals about the further development of the share, and according to the overall technical picture for the share, a further increase to around SEK 12.00 – 15.00 is initially indicated.

Today, Wednesday, August 27, 2025, the share is trading at around SEK 4.90. The share may thus have the potential to double or even triple in value over the next few months.

The company has completed a share issue and is solidly financed going forward (cf. case from Swedish research firm Redeye.se) until 2026.

The stock finds good technical support around the SEK 4.00 level and where there is support down towards the 50-day moving average.

Furthermore, the 50-day moving average is above the 200-day moving average, and the share price is above both the 50-day and 200-day moving averages. This confirms that both the short-term and long-term trend for the stock is now positive.

There is some technical resistance for the share around the SEK 6.00 level, but if that level is breached, further gains towards SEK 12.00 – 15.00 will be signaled, preferably within the next 2-3 months.

Based on the overall positive technical picture shown by the stock, Aksjeanalyser.com rates Oncopeptides (ONCO) as a very exciting and interesting buy candidate.

The potential for the share is therefore considered to be around SEK 12.00 – 15.00 over the next 2-3 months. What could potentially change the current positive technical picture for the share would be if it were to break below the support level of around SEK 4.00 and below the 50-day moving average.

CEO Sofia Heigis interviewed by Redeye

August 25, 2025 – Redeye’s analyst Richard Ramanius interviews Sofia regarding the Q2 report 2025 and rights issue. The interview is held in Swedish. Watch the interview via this link.

Some recent news around the company

Oncopeptides is today traded on Nasdaq Stockholm excluding subscription rights in rights issue

27 Aug. at 06:21 ∙ Finwire

The research company Oncopeptides is today, August 27, traded on Nasdaq Stockholm excluding subscription rights in a rights issue. The terms are 2:9, meaning that nine existing shares entitle the holder to subscribe for two new shares at a subscription price of SEK 3.20 per share. The subscription period runs from September 1 to 15 and trading in subscription rights takes place from September 1 to 10.

———-

Oncopeptides CEO Sofia Heigis buys shares for SEK 0.25 million

26 Aug. at 09:35 ∙ Finwire

Research company Oncopeptides’ CEO Sofia Heigis purchased 56,820 shares in the company on August 26. The shares were purchased at a price of SEK 4.40 per share, a transaction of SEK 250,000. The transaction was made on Nasdaq Stockholm. This is stated in the Swedish Financial Supervisory Authority’s transparency register.

Heigis owned 86,908 shares in Oncopeptides at year-end, according to the ownership service Holdings

———–

Redeye: Oncopeptides Q2 2025 – Funded Until Profitability

22 Aug. 10:45 ∙ MFN

Redeye comments on Oncopeptides’ 2nd quarter report, which saw significant sales progress in the core German, Spanish, and Italian markets. Although still early in its rollout, there are now signs that Pepaxti may become a commercial success in Europe. The rights issue of SEK150m announced at the same time should cover operations through 2026 and until there is a positive cash flow.

This is the final week, with 30% discount on everything in Vikingens webshop!

Both on the basic programs and on all interesting add-ons. Use the code SOL30 which is valid until August 31, 2025 on everything in Vikingens webshop. The offer cannot be combined with other offers. Here you can read about all the benefits of Vikingen (in Swedish).

And here you can watch free trainings (in Swedish) about Vikingen Mini, Börs, Trading and Vikingen Maxi programs.

Welcome to participate in Börssnack!

Every week you have the opportunity to participate in Börssnack that is held by Aktieutbildning.nu on Wednesdays, via an open online webinar at 19-20!

In Börssnack, you’ll learn how to invest in interesting companies and get answers to questions like:

How do we do better business in the stock market? Which global stock markets look the best? How should you act in the stock market? Is it time to buy/sell now? Which stocks and funds are interesting? Are cryptos like Bitcoin and Ethereum interesting? What does Börssnack’s Portfolio look like? The portfolio is reviewed and analyzed every Wednesday. Welcome!

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Sincerely yours