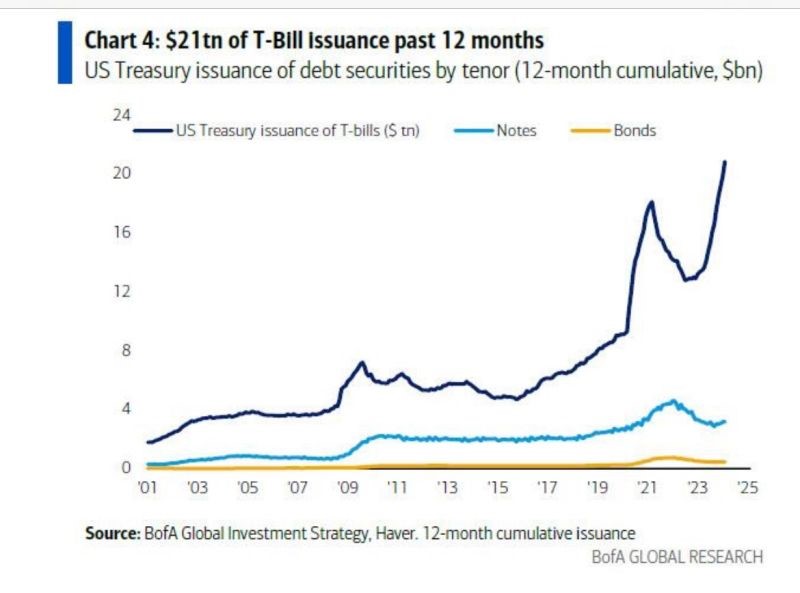

The FED is printing treasury bills at an increasing pace

The US Treasury Department is issuing more Treasury bills at an accelerated pace. In a fiscal dominance regime, the central bank is forced to cut interest rates to help finance government deficits. With the CBO projecting 5-7 percent deficits in the coming decades, the only real leverage is to lower hashtag#interest rates on government borrowing as the government continues to shift borrowing to the front end.

It seems that gold and digital gold are already starting to anticipate this dynamic as lowering interest rates to support government borrowing will lead to currency weakness/monetary deterioration and higher inflation over time.

Source: LukeGromen, GraphFinancials, BofA, Craig Shapiro

Source: LukeGromen, GraphFinancials, BofA, Craig Shapiro

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)