S&P upgrades Greece to investment grade

This upgrade of Greece makes S&P the second rating agency among the four that the European Central Bank consults before accepting a country’s government bonds as collateral for lending to commercial banks. Standard & Poor’s has upgraded Greece’s sovereign credit rating back to investment grade after 13 years, a move welcomed by the Greek government.

The rating agency announced on Friday that it has raised the Greek credit rating to “BBB-“, from “BB+”, with a stable outlook, explaining that “significant fiscal consolidation has placed Greece’s fiscal trajectory on a steadily improving track.”

It also said it expects the Greek budget to end the year with a primary surplus of 1.2 percent of gross domestic product (GDP), compared to a government target of 0.7 percent of GDP. It also predicts growth of 2.5% this year.

Greek Prime Minister Kyriakos Mitsotakis had said after his re-election on 25 June that one of his government’s main objectives was to restore Greece’s investment grade rating.

The upgrade to investment grade by S&P is “another official seal on the recovery of the Greek economy”, he commented on social media on Saturday.

The upgrade confirms that Greece has left behind a serious crisis and is consistently moving towards development,” he added.

This upgrade of Greece makes S&P the second rating agency among the four that the European Central Bank consults before accepting a country’s government bonds as collateral for lending to commercial banks. Six weeks earlier, Canada-based DBRS Morningstar had also granted Greece investment grade.

Other rating agencies such as Scope Ratings and R&I have also upgraded Greece to investment grade.

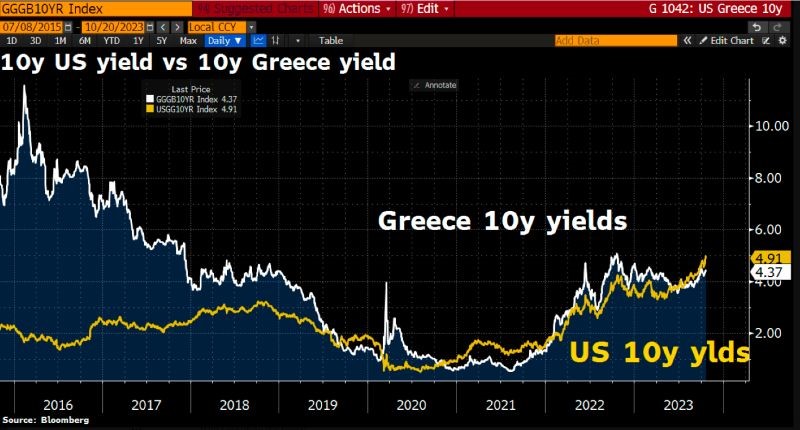

Pays a lower interest rate than the US

Greece has to pay less than the US for 10-year bonds. Markets had already priced in Greece’s return to investment grade. Greece has an average debt interest rate of 1.5% (mostly fixed to official creditors) with an average maturity of 18-19 years. Primary surplus in 2023 and 2024E. And debt/GDP is now down to 150% (compared to the previous 200%).

A one-step upgrade from BB+ to BBB- is expected to significantly increase market confidence in the Greek economy, attract investment and lower borrowing costs. The center-right government hailed it as a great success.

It came more than a decade after Greece’s bonds were relegated to sub-investment – or junk – class amid the financial crisis that pushed the country to the brink of financial collapse and forced three massive international bailouts.

To secure the bailout loans, successive Greek governments undertook to impose painful spending cuts and tax increases while broadly reforming the economy and balancing the state budget.

S&P said Greece’s outlook was stable, while a further reduction in the country’s debt as a percentage of annual output could lead to another future upgrade.

“Supported by a very rapid economic recovery, the Greek government has been able to regularly exceed its own budget targets despite gradually increasing social transfers,” S&P said.

Ensuring investment quality was a key goal for Prime Minister Kyriakos Mitsotakis, who won a second term in a landslide victory in the June elections.

In early September, the rating agency DBRS Morningstar also upgraded Greece’s credit rating to investment grade. Days afterward, an upgrade by Moody’s raised the country’s bonds to just a notch inside junk territory.

Moody’s, Standard and Poor’s, DBRS and Fitch are the four rating agencies considered by the European Central Bank – with Fitch expected to reassess Greece’s rating by the end of the year.

About the Viking

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)