Number of high-yield corporate bond defaults rises sharply

The default of high-yield corporate bonds is accelerating and could produce a $46 billion wave of distressed debt in 2024, says Bank of America. The US could see a $46 billion wave of distressed high-yield debt next year, BofA warned. The bank points out that this is because default rates are accelerating and could increase 1.5 times faster next year. Continued high interest rates could cause defaults and bankruptcies to peak in early 2024, experts warn.

Warning that a wave of distressed debt will hit the market as higher borrowing costs cause corporate bankruptcies to rise, Bank of America warned.

The bank’s strategists expected more pain from higher interest rates, with the central bank having raised its fed funds rate target to the highest level since 2001.

“We expect defaults to continue to accelerate into 2024” warned Bank of America in an analysis on Friday. “From USD 30 billion in DM USD HY depreciated nominal value over the last 12 months, we expect the pace to increase 1.5x to USD 46 billion over the next year for a 3.4% default rate.”

Most of these defaults are likely to take place in three areas, the bank said, with an estimated $14 billion in distressed debt emerging in technology, media and telecoms, $13 billion in the health sector and $8 billion in the cable sector.

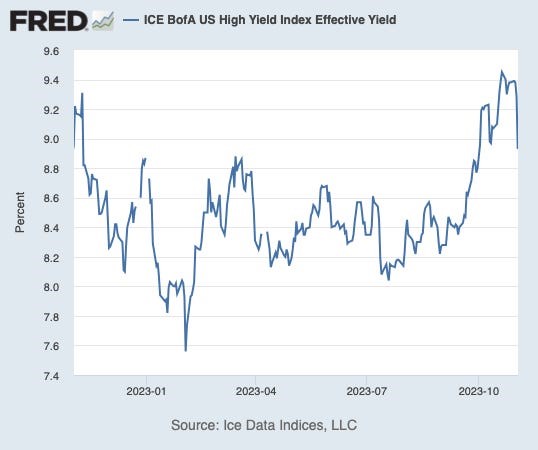

That amounts to $35 billion in these three sectors alone, or about 75 percent of all high-yield defaults expected next year, strategists said. However, benchmark government bond yields have fallen sharply this week after rising last month to their highest level in 16 years. Meanwhile, effective yields on some high-yield corporate bonds are trading at between eight and nine percent, according to the ICE Bank of America US High Yield Index.

Experts have warned that a wave of defaults and bankruptcies will hit the market, especially as interest rates remain higher for longer.

Fitch Ratings recently estimated that the high-yield bond rate will range between 4.5% and 5% by the end of this year. Meanwhile, the total number of US bankruptcies and debt repayments could peak sometime in the first quarter of 2024, Charles Schwab estimated.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)