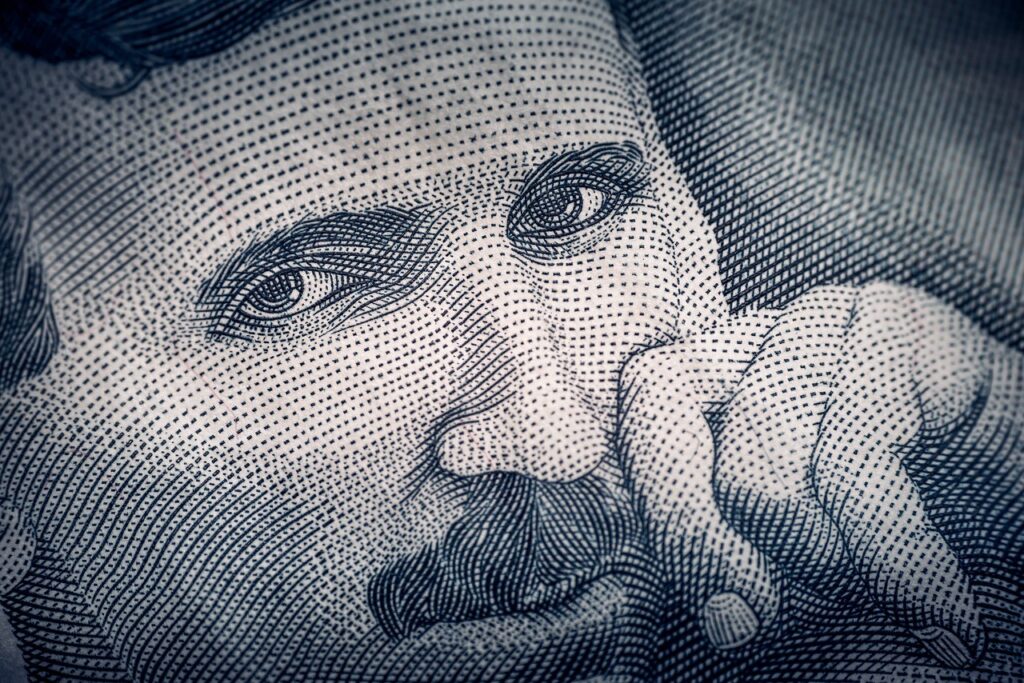

Nikola founder Trevor Milton sentenced to four years in prison for fraud

Nikola founder Trevor Milton was sentenced Monday to four years in prison in connection with deceiving investors of the struggling electric and hydrogen-powered truck maker. Milton was also fined one million dollars and could later be forced to forfeit property as part of his sentence.

The sentence was much lower than the 11 years that prosecutors had asked for at Milton’s sentencing in US District Court in Manhattan. But it was significantly more than the non-custodial sentence of probation requested by Milton’s lawyers.

“I did not intend to harm anyone and I did not commit the crimes charged against me,” Milton told judge Edgar Ramos before being sentenced, Reuters reported.

Milton has shown little or no remorse for his actions, prosecutors said. In a letter to Ramos on Sunday, prosecutors wrote that the judge should take into account Milton’s “profound denial of responsibility and insistence on blaming others.”

The judge allowed Milton to remain free on bail while he appeals his conviction, according to Reuters.

Milton was convicted in October 2022 of two counts of wire fraud and one count of securities fraud. He had been facing a recommended sentence of 60 years in prison under federal sentencing guidelines for these crimes. Repayment will be determined in a future proceeding, according to the U.S. Attorney’s Office for the Southern District of New York.

“Trevor Milton lied to investors over and over again – on social media, on television, on podcasts and in print. But today’s sentence should be a warning to startup founders and business leaders everywhere – “fake it till you make it” is not an excuse for fraud, and if you mislead your investors, you will pay a heavy price,” Damian Williams, US Attorney for the Southern District of New York, said in a statement.

Nikola agreed in 2021 to pay $125 million to settle civil charges brought by the U.S. Securities and Exchange Commission.

Milton became an overnight billionaire when he took Nikola public through a deal with a special purpose acquisition company in June 2020. The company was quickly considered one of the most promising electric car startups – valued at its peak at more than $30 billion – until allegations regarding false and misleading statements were revealed by short seller Hindenburg Research.

Prosecutors compared Milton to disgraced Theranos founder Elizabeth Holmes, who was sentenced to more than 11 years in prison last year for deceiving investors in her blood testing startup.

“Just as Holmes lied about Theranos-made blood analyzers, Milton lied about the usefulness of the Nikola One semi-truck,” prosecutors wrote to Ramos before the verdict.

Milton has tried to separate himself from Holmes, whose company was private. His lawyers argued “that Nikola is still a real company, while Theranos is not,” according to court documents.

Milton, who was the company’s largest shareholder, stepped down as executive chairman of Nikola in September 2020. He did so during an internal investigation following the Hindenburg report, which characterized the company as a house of cards built by Milton.

Since Milton’s departure, shares in Nikola have cratered and the company has failed to retain executives. Nikola Chairman Stephen Girsky, whose SPAC took the company public, was appointed CEO in August.

Shares in Nikola have recently been trading below $1, with a market value of about $296 million. The stock fell more than 9 percent on Monday.

Nikola was among the first high-profile companies to go public through a SPAC. It inspired hundreds of other start-ups to do the same before the SEC cracked down on the practice.

Prosecutors said the SPAC process, rather than a traditional IPO, allowed Milton to make many of the misleading or fraudulent statements. During the IPO process, he would not have been allowed to make public statements in the period around the company’s listing.

SPACs are publicly traded companies that have no real assets other than cash. They are set up as investment vehicles with the sole purpose of raising money and then finding and merging with a privately owned company.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)