MetaTrader4 lets you make money in the forex market while you sleep

Making money in the forex market without being active sounds like a dream, but it actually works. There are both robots and platforms that can help you with this. One example of a software is MetaTrader4, which allows you to make money in the forex market while you sleep. MetaTrader 4 is a platform for trading Forex, analyzing financial markets and using Expert Advisors. Mobile trading, trading signals and the market are the integral parts of MetaTrader 4 that enhance your Forex experience. However, this is only a fraction of all the things that can be done with this platform. MetaTrader 4 (MT4) is the world’s most popular Forex trading platform. There are hundreds of brokers and thousands of servers ready for anyone who wants to trade forex using your MetaTrader 4 (MT4), there is even an Android app for this If you are already trading forex then log in to your broker and check your account to see if you can trade and analyze the forex market using technical indicators and graphical objects. MetaTrader4 has been developed by MetaQuotes Software which has released a number of versions of the MetaTrader platform since 2002. MetaTrader 4 was a significantly improved version and was released in 2005. Between 2007 and 2010, a number of brokers added the MT4 platform as an optional alternative to their existing trading software. These forex brokers did this because of the popularity of the MT4 platform with traders and the large number of third-party scripts and advisors. In October 2009, a significantly recoded MetaTrader 5 was released as a beta test. The first live MT5 account was launched almost a year later, by InstaForex in September 2010. In 2013 and 2014, the MQL4 programming language was eventually revised and reached the level of MQL5.

Graph from MT4 trading screen MetaTrader allows users to work with the client terminal’s built-in editor and compiler with access to software, articles and help. The software uses a proprietary scripting language, MQL4/MQL5, which allows traders to develop Expert Advisors, custom indicators and scripts. MetaTrader’s popularity is largely due to its support for algorithmic trading. Yahoo! hosts a large community of over 12,000 members dedicated to the development of free open source software for MetaTrader. There are thus a variety of places to get inspiration and ideas for your own scripts to facilitate your own forex trading. MT4 is designed to be used as a standalone system where the broker manually manages their position and this is a common configuration used by brokers. However, a number of third-party developers have written software bridges that allow integration with other financial trading systems for automatic hedging of positions. In late 2012 and early 2013, MetaQuotes Software began working to remove third-party plugins for its software from the market, suing and warning developers and brokers.

Types of trade orders

MetaTrader provides two types of trading orders, Pending orders and Market orders. Pending orders will be executed only when the price reaches a predefined level, while market orders can be executed in one of the four modes: Immediate execution, Request execution, Market execution and Exchange execution. With immediate execution, the order will be executed at the price displayed on the platform. Its advantage is that the order will be executed at a known price. However, a good trading opportunity can be missed when volatility is high and the requested price cannot be obtained. Request execution mode allows the trader to execute a market order in two steps – first a price quote is requested, then the trader decides whether to buy or sell with the received price. A forex trader has several seconds to decide whether the received price is worth trading on. Such a mode offers some knowledge of price combined with guaranteed execution at that price. The trade-off is the reduced speed, which can take much longer than other modes. With market execution, the order will be executed with the broker’s price even if it differs from the one displayed on the platform. The advantage of this mode is that it allows trading without any form of re-quotes. However, deviations can become significant during volatile price changes. In Exchange execution mode, the order is processed by the external execution facility (the exchange). The trade is executed according to the current market depth.

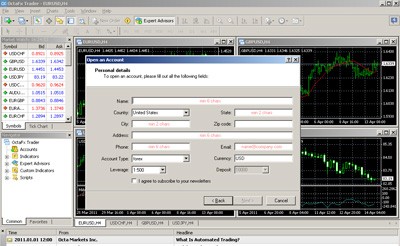

MetaTrader is easy to install

Your broker will provide you with a link to install Metatrader 4 on your computer, or you can download it from the Metatrader website. Download and run the installation. You will then be presented with a page asking you to confirm the license agreement. Most people tend to just click through, but it’s a good idea to read this before you start installing the program. You then choose where to install the program on your computer. It is also possible to let the installation take place by default. Click OK to start the installation and your computer will now request the files from Metaquotes Data Network. Once the software is installed, it is time to run it. You will see the image below. Now press CANCEL.  After skipping the first screen, log in to your MT4 account with your account number and password. Once this is done, you can use Metatrader 4 on your PC. You can also download the program for Mac, phone and tablets, both iPad and Android.

After skipping the first screen, log in to your MT4 account with your account number and password. Once this is done, you can use Metatrader 4 on your PC. You can also download the program for Mac, phone and tablets, both iPad and Android.

Components

MetaTrader 4 includes – MetaTrader 4 Client Terminal – the client part. Provided free of charge by brokers for real-time online trading and as a demo account. This one offers real-time trading, charts and technical analysis. The internal C-like programming language allows users to program their trading strategies, indicators and signals. 50 basic indicators are included, all of which can be further customized. The software runs on Windows 98/2000/XP/Vista/7. Some users have reported success using Wine on Linux for the client terminal and on Mac using WineBottler. – MetaTrader 4 Mobile – control a trading account via mobile devices such as cell phones or PDAs. Runs on Windows Pocket PC 2002/Mobile 2003, iOS, and Android. – MetaTrader 4 Server – the core of the system, the server part. Designed to handle user requests to perform trading operations, display and execution of warrants. Also sends price quotes and news, registers and maintains archives. Works as a service. Does not have a separate interface. – MetaTrader 4 Administrator – is designed to remotely manage the server settings. – MetaTrader 4 Manager – designed to manage the trading and client accounts. – MetaTrader 4 Data Center – a specialized proxy server and can be an intermediary between the server and client terminals. It reduces the sending of the price data on the main server.

Products and services

The Metatrader platform is focused on margin trading. Some brokers use MetaTrader 4 to offer trading in CFDs but it is not designed for full-time work in the stock market or exchange-traded futures. At the same time, MetaTrader 5 also offered with stocks and exchange-traded commodities. Both MetaTrader 4 and MetaTrader 5 can use custom indicators and trading software (called Expert Advisors) for trading automation.

What is a Forex Expert Advisor and how does it work?

Forex (FX) trading doesn’t always go smoothly and sometimes it can be frustrating. Some forex traders can get greedy or fearful, and for that reason, they are often prone to making bad decisions that can negatively affect their accounts. One way to avoid this issue is to use an Expert Advisor or EA. An EA is an automated trading system, which automatically initiates and closes trades based on preset rules. While we do not recommend specific EAs due to their unpredictability, some professional traders have found that working with such is to their advantage. Forex trading is a 24/5 market. Being active around the clock is not possible for humans, but a machine can trade for several days without having to take a break. Moreover, EAs can be used on a number of FX trading platforms. Some of them allow traders to fully customize their trading systems and then use them on a personal account, such as MetaTrader 4 and MetaTrader 5. This article will focus on what EAs are and how they work.

GPS Forex Robot

This is the first Forex Expert Advisor service in our list. This FX Expert Advisor provider undoubtedly has something to offer traders. If you already have experience and moderate knowledge of the financial markets, you can benefit from using these R. If you trade with the MetaTrader 4 terminal, it would be preferable to use the advanced trade copier. Traders who invest heavily in the forex markets every month often prefer this product. There is no monthly subscription to GPS Forex Robot. In contrast, this EA comes with a one-time fee. Overall, GPS Forex Robots are user-friendly and provide easy access to great customer support – the contact details are clear and they respond almost immediately, which technically serves a user’s well – which is another reason why they are in the list of best Forex Expert Advisor providers.

Itic- Software

Itic Software offers FX traders a wide range of services. They indicate to their clients when it is an appropriate time to implement buy and sell actions for the main currency pairs in the forex market, based on analysis. Itic Software Expert Advisors has several trading strategies. The wide service they offer is continuously tested by professional traders, the products are not copied, Itic Software Expert Advisors always provides the source code and uses only unique mathematical algorithms.

What is an expert advisor?

The first question is – what is an Expert Advisor? As mentioned earlier, an EA is an automated FX trading system. In MetaTrader, they are written in MetaQuotes Language 4 and are developed for use under the MT4 and MT5 trading platforms. EAs can be programmed to automatically generate trading signals and notify you of various trading opportunities. Another type of automated trading system is a Forex robot which, like an EA, is a program that can identify market patterns and generate trading signals. However, unlike an EA, a Forex robot can automatically trade currency a trader. An EA, on the other hand, will always require a trader to authorize a trade manually. Every expert advisor is based on preset rules, but EAs may differ in the rules they follow to trade. As with all automatic software, they reduce the chance of making emotional and irrational trading decisions, which often affects novice or inexperienced Forex traders. A Forex Expert Advisor follows a very strict and consecutive plan, free from any human intervention.

Trade Forex with Expert Advisors

Before we describe the features of Forex Expert Advisors, we want to outline the four kinds of Expert Advisors that you might encounter: – The News Expert Advisor – as the name suggests, its main purpose is to capitalize on various news events and major price movements that might take place in conjunction with major news announcements. – Breakout Expert Advisor – it is specially designed to open a deal when a price breaks through provisionally determined resistance and support levels – Hedge Expert Advisor – under this category falls any Expert Advisor that plays two respective and opposite positions, reducing the loss on one and at the same time facilitating the profit on another. – Expert Advisor Scalper – such Expert Advisors aim to secure small profits when available. The EA will open and close an infinite number of trades for any profit, so your Expert Advisor can trade up to 400-500 times a day depending on market conditions.

What features does a Forex Expert Advisor have?

The best Forex Expert Advisors can be programmed to work in several ways, for example, by using a selection of technical indicators, such as moving average indicator, or MACD – moving average convergence/divergence indicator) or by searching for trends and breakouts. By applying the various indicators, the EA can analyze the market as well as the behavior of individual financial instruments and can generate a signal of trading opportunities. EAs are similar to Forex robots, which are another type of automated trading software. When using strict definitions, the difference between an EA and a Forex robot is that an EA will generate signals while a robot will execute trades with no manual closure required. However, the terms are often used interchangeably, meaning that many so-called Expert Advisors are capable of much more than just generating signals. Some Expert Advisors are designed to take full control of your account. The idea here is that it will look at the balance of your account before deciding how much of your balance can be risked. The general rule of thumb is to only risk one to two percent of your account balance in each trade. In addition, your EA can review the trade and decide whether there should be a trailing stop loss, or a simple profit-taking or stop-loss. As soon as Forex Expert Advisors have the necessary information, they also take into account the prevailing market conditions. Therefore, you will be notified when to open a particular position.

What you should be aware of before starting your EA

If you want to create and use your own EA, here are some tips on what to do to make it work properly, outside of using a Forex Expert Advisor generator (this is a tool where you enter the parameters of your desired trades and the tool generates the EA program for you).

The importance of data

The first tip is to be careful about the reliability of backtest results. You might think that good backtest results are proof that your system is ready to generate profits. Unfortunately, it’s not that simple. These results are dependent on the quality of the data used in the backtest, which means that bad data can lead to unreliable results. The default data in MT4 and MT5 can only reach a modeling quality of up to 90 percent. While this seems good, it can cause significant differences in backtesting and the live experience, especially when smaller timeframes are involved. Fortunately, there are sources of freely available historical data and instructions on how to prepare the data needed for MetaTrader.

Understanding your execution speed

Reliable data is the first step in customizing an EA to trade on a live account. The next step is to understand your execution speed. MT4 and MT5 require trading activity for more than 30 seconds, which is called a trading session. If you are using a free Forex Expert Advisor during your session, it will be automatically canceled if there is no trading activity more than the period mentioned above. This requires the IP address to be automatically authenticated with a password and a login. It may take some time, even up to two seconds at some brokers. While it may seem insignificant, delays of this magnitude in times of high volatility can have a significant impact on your trading results.

Troubleshooting

If you’ve spent time writing a complex Expert Advisor in MT4, you probably know how difficult it is to debug the code. MetaQuotes policy shows that they cater to the needs of brokers over those of forex traders, you will find that a debugger is not included in the list of tools available – it doesn’t matter if your EA is a free Forex Expert Advisors or a paid one like any of these complex Expert Advisors. Fortunately, there are a few things available to make your life easier. One method is to feed print functions directly into your code, although this can get very difficult to manage, especially if you have thousands of lines and don’t know where the problem is. You can also download Microsoft DebugView to view a methodically formatted log.

Test your MetaTrader connection

Our final tip about your EA is the following – make sure to test your MetaTrader connection. Your platform needs to be activated and connected directly to your broker to run your Expert Advisor. There is nothing more disappointing than thinking you have an EA only to see it disconnected and unable to reconnect. While MT4 and MT5 are designed to automatically connect to the server without any problems, it doesn’t always work as expected. If you have multiple MetaTrader accounts, sometimes the wrong credentials are used during the reconnection process. The best resolution is to remove your unauthorized accounts from the Navigator window in MT4/MT5. While this is not necessarily a significant problem, it can be quite frustrating if you are disconnected and your Expert Advisor is not running continuously.

How do MetaTrader expert advisors work?

Anyone with a subscription can write an Expert Advisor, you can assume that there are a large number of MT4 and MT5 Expert Advisor. Some of them have been developed specifically to trade on news events and to then stand outside the market at all times, while other EAs are meant to remain active around the clock. Experienced Forex traders who have developed their own FX systems for manual trading often trade MQL4 programmers to automate their systems and thus create a customized EA. All Expert Advisor have an identical purpose, and that is to automate the Forex trading process and produce a profit while doing so. The Expert Advisor uses technical indicators to gauge the conditions in the market and then make trading decisions. Before using an Expert Advisor, it must first be attached to a chart on the MT4 platform. An MT4 or MT5 Expert Advisor can take into account dozens of factors and elements to determine what the next action will be. This capacity to consider such a wide range of price influencing elements, as well as the discipline of an emotionless automated trading system, can often lead to quite a useful and successful combination.

Is it possible to run more than one EA at once?

The answer is yes. You can use multiple instances of an EA on the MetaTrader client terminal. However, it is worth noting that not all Expert Advisors work together. This is mainly because they try to manage each other’s open trades. Programmers tend to get around this by applying special numbers in the market entry part of the Expert Advisor’s source code. However, there are some platform limitations. For example, an Expert Advisor in MetaTrader can only communicate with one trading server at any given time. If multiple Expert Advisors show a lot of activity on the same terminal, and more than one tries to communicate with the trading server, you will eventually get the error “‘trade context busy’ “ in the logs. This occurs if you have too many Expert Advisors on a single client terminal.

Does an Expert Advisor work in 2025?

EAs tend to cause a lot of debate on the internet. First of all, let’s define positive effects: – An EA doesn’t sleep – it can work around the clock – It deprives all emotions from forex trading – Nothing can distract an Expert Advisor from working – Expert Advisors are available for the MT4 platform Besides the usual disadvantages, which include the lack of creativity, there is also the fact that it is really hard to verify the accuracy of any EA, unless you have used it yourself. Let’s describe two scenarios that can occur as a result of EA use: – The first is that the Expert Advisor for MetaTrader 4 or 5 tweaks countless times, and it still cannot show stable profits on a demo account. – The second is that the EA actually performs really well on demo accounts, but for some unknown reason, when traders try to apply them to live accounts using their own funds, suddenly the EA doesn’t work so well, and traders lose money.

Conclusion

By using automated software like an Expert Advisor, you can benefit from the following advantages: it can trade while you sleep, it is not susceptible to emotions, and you can quickly run backtests. However, it is difficult to define whether an EA will help you achieve profits. When creating your own EA, make sure to take into account the tips we have shared to avoid unpleasant situations.

About the Vikingen

With the Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs. Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)