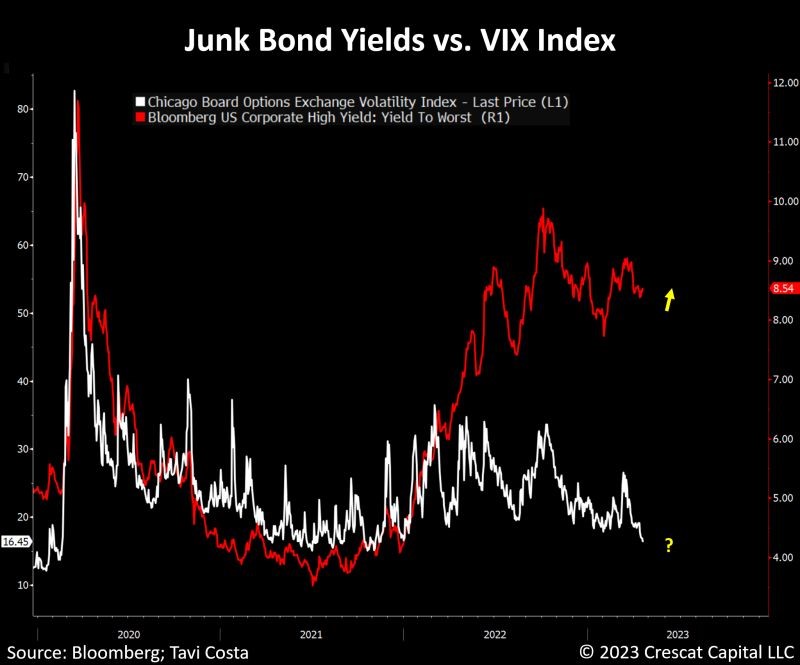

Junk bond yields diverge from stock market volatility

Junk bond yields diverge significantly from overall equity volatility, which appears to be unduly suppressed. To put this in perspective, the last time junk bonds provided a return close to current levels, the VIX hovered around 50. Today, equity volatility is at the same level as it was at the height of the S&P 500 in December 2021.

High-yield bonds are not the only instruments that present this issue. Yields on investment grade bonds are also elevated and fully decoupled from VIX levels, which are now at their lowest level in two years.

Assessing the relevance of historical events, the current high multiples of US stock markets have not yet taken into account the potential impact of a shrinking economy and a cost of capital that exceeds the historical average.

Therefore, the current low volatility of the overall stocks is unwarranted and is likely to rise significantly in the future.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, price data, tables and stock prices, you can sort out the most interesting ETFs, shares, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)