Is it time to buy real estate shares?

Buy real estate stocks when interest rates fall?

Is it time to buy real estate stocks now that the Swiss central bank is cutting interest rates? There is talk that several central banks will cut their key interest rates several times during the year. This assumes, of course, that inflation will fall. All interest rates in the world follow each other. Forget that a country has complete power over its own interest rate. Each country’s interest rate follows world interest rates. While there are exceptions during financial crises, by and large all countries’ interest rates follow each other.

Below are the current 10-year interest rates from Sweden-Denmark-Norway-England-Germany-USA. Do you see any difference? No, neither do I. If you have Vikingen Börs/Trading/Maxi, you will find the interest rates in the object list X-inter.

Real estate share Balder has a new buy signal

Balder went through its opposition on Thursday, February 21, the same day the Swiss central bank announced it was cutting interest rates. In addition, the stock had good volume. Balder has moved in a rectangle with the bottom at 63 and the top at 72. The energy in the rectangle, i.e. the distance between the top and bottom, usually indicates how much the stock can go up initially. In this case 72 plus 72 minus 63 equals 81 SEK, the math is 72+(72-63)=81. The share now stands at 76 and should be able to go up another SEK 5 initially. Then you have to see what happens, it can go up or down. Balder has had the same profit for several years and yet the stock was much higher in 2021. At that time, the share price peaked at SEK 190.

Is it time to buy Cibus Nordic Real Estate?

Is it time to buy real estate shares? Yes, when it comes to Cibus Nordic, it looks good because that stock has had an upward breakout. Peak price around 290 kr, now at 132 kr. Sounds appealing?

If you look at the results from 2018 to 2022, the company has always managed to make a good profit. However, they made a loss last year. The company has provided a good dividend yield in the past.

In general, real estate companies with high levels of borrowing should benefit particularly from interest rate cuts.

You can find the key figures in Viking under View – Key figures – right click – Key figures – Select which key figures you want to see. All key figures are available under “Delphi Financial Analysts”.

You can find the key figures in Viking under View – Key figures – right click – Key figures – Select which key figures you want to see. All key figures are available under “Delphi Financial Analysts”.

A third real estate stock to buy?

Castellum jumped up by a gap. That is, there is an extra interest in the share. Castellum has been in buy in the BEST model, monthly data, since December 1, 2023. That model is very good for long-term profitable purchases. Sell when the weekly trend is broken.

Is it time to buy a real estate fund?

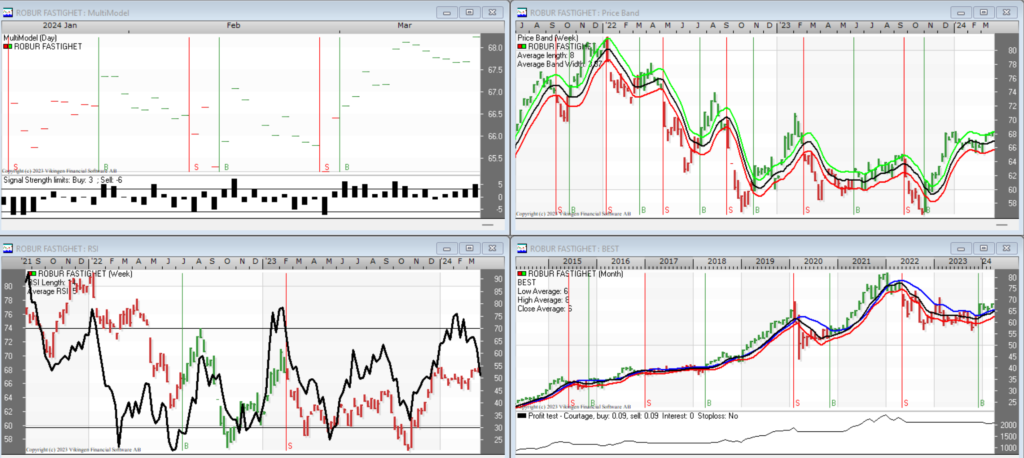

Now that several real estate shares are rising, it is of course good to buy real estate funds, such as Robur Fastighet.

To view and track real estate funds, you need the SHARE FUNDS extension. Can also be added to the Viking Mini.

Good results this year even without real estate shares

Thanks to Vikingen, my stock portfolio has gone up by 35%! Maybe we’ll switch to real estate shares, it’s tempting. Mostly because I buy stocks that go up. Sounds simple, but is so difficult. Because I have the Viking, I can always find the best stocks. Changed some this week. There has been a lot of US, mostly Nasdaq. My other portfolio, which I call the dividend portfolio, has not done well. It consists only of MPCs. There I live on hope and reinvest the dividends.

We (my partner and I) have the following holdings (may be different tomorrow):

| APPLOVIN A |

| AUTOLIV SDB (SEC) |

| USER |

| DANSKE BANK |

| DELPHI GLOBAL |

| FACEBOOK INC/NASDAQ |

| MPC CONTAINER SHIPS |

| NORDEA BANK(SEC) |

| NVIDIA |

| PICTET – JAPANESE EQ OPP P JPY |

| PICTET – JAPANESE EQ OPP R JPY |

| PICTET-DIGITAL-R USD |

| SAAB B |

| SKANDIA GLOBAL EXPOSURE |

| SKANDIA TIME GLOBAL |

| SPILTAN SMALL CAP FUND |

Disclaimer

It is up to you whether you follow the recommendations above and you take all the risk yourself. The hope, of course, is that you’ll make money from the tips, but we can’t promise that.

It’s always the way it is; if it goes down, it goes down, that’s just the way it is. Then you act accordingly. Same in reverse, if it goes up, it goes up, even if the bad news on TV says otherwise. The Viking is objective, just showing how it is. It took me many years to accept.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of the oldest stock exchange programs in the Nordic region. Tell your friends and acquaintances about the Viking.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)