In this week’s analysis: a European crypto giant!

Aksjeanalyser.com has again taken a look at a favourite in the Nordics: Hilbert Group AB

(ticker: HILB B)

About Hilbert Group AB

Interesting update September 3, 2025:

Hilbert Group is becoming a European giant in the crypto area, and there is a very large upside for the stock. Read more below under the technical analysis of the Hilbert share.

Aksjeanalyser.com is definitely not alone in having great faith in Hilbert Group as a company and the Hilbert share, and yesterday, September 3, 2025, there was positive news: investment manager Russell Thompson acquires shares in Hilbert Group for as much as NOK 25 million. Such a significant insider purchase gives very positive signals for the future development of the share. Source.

Russel Thompson made a statement in connection with the announcement yesterday regarding his purchase:

“I am investing because I believe deeply in Hilbert’s future,” said Russell Thompson, CIO of Hilbert Group. “In the past I have founded and exited a world class asset manager, Cambridge, which we built in to a multi-billion dollar AUM business. I believe the potential with Hilbert is bigger than that. We are building a first-class digital asset management and financial platform, with the scale and capabilities to lead globally. I want to increase my stake to demonstrate that conviction and to share fully in the value creation ahead.”

The Hilbert share price quadrupled in just 2.5 months from the end of April 2025 to mid-July 2025, rising from around SEK 4.00 to SEK 16.00. The share then suffered a correction down to almost 50% and it is not unnatural after having quadrupled in just 2.5 months that there will be some profit protection.

Now, the technical picture for the share and everything positive that is currently happening in the company, indicates that the Hilbert share is likely to see a new sharp rise to around SEK 25 – 30, preferably in just the next 3-6 months. Read about this below. For more information about Hilbert Group, visit their websites here.

Hilbert Group launches its crypto exchange “Syntetika”!

Aksjeanalyser.com is very impressed with the management, board and employees of Hilbert Group AB, and they are now becoming a European giant in crypto.

The next big trigger for the Hilbert share now is the launch, in September, of Hilbert Group’s crypto exchange ‘Synthetics‘. Hilbert Group expects a very large increase in revenue and capital under management through Syntetika.

On Tuesday, September 02, 2025, it was announced that Hilbert Group has completed the acquisition of Nordark, a crypto bank in very strong growth, and the company stated in the stock exchange announcement, among other things, the following:

“The acquisition of Nordark positions Hilbert Group to unlock substantial new revenue streams by combining its proven asset management and DeFi strategies with Nordark’s banking, trading, and lending infrastructure. With a loan book pipeline of approximately USD 2.5 billion, tier-1 institutional clients already onboarded, and a diversified revenue model spanning banking fees, trading commissions, and loan interest income, Hilbert now has the foundation to scale Nordark into a multi-hundred-million SEK revenue business. By integrating yield-enhancing hedge fund products with Nordark’s platform and loan demand, Hilbert is set to create a powerful, recurring, and high-margin revenue engine across the digital finance ecosystem.”

Furthermore, around 10,000 bitcoin (BTC) will be available very soon via our partner Xapo Bank for management at Hilbert Group. This will dramatically increase AUM (assets under management) for Hilbert Group AB, and 10,000 bitcoin corresponds to around SEK 11 billion under management. Hilbert Group currently has around SEK 5 billion under management and has a stated goal of having around USD 2 billion under management by the end of 2025. With the launch of Syntetika this September, which the company expects will result in a significant increase in AUM, and with almost 10,000 bitcoin under management via partner Xapo Bank. Yes, it seems very likely that Hilbert Group will reach its stated goal of reaching an AUM (assets under management) of USD 2 billion by the end of 2025. That’s equivalent to around SEK 20 billion in assets under management! This will result in very good management fees and potentially very large success fee fees.

Hilbert Group AB (HILB B) is now very well positioned to become a highly profitable company from 2026 onwards and the upside is enormous in the years to come.

Chief Investment Officer of Hilbert Group, Russel Thompson has described Hilbert Group as a ‘Unicorn’. The name given to a start-up company with a market capitalization of over USD 1 billion. Hilbert Group has been publicly traded for a couple of years now, but it’s now that it’s really developing into a European crypto giant. Hilbert Group currently has a market capitalization of around USD 100 million, so if Russel Thomson is right, it means a tenfold increase for the Hilbert share. No time perspective is given here, but Aksjeanalyser.com will assume that it is no more than 1-3 years.

In summary: many positive things are happening in Hilbert Group right now and Aksjeanalyser.com believes in a multiplication (5-10 doubling) of the Hilbert share price during 2026/2027 from the current price level of around SEK 11.00.

Technical Analysis of Hilbert Group AB

(HILB B)

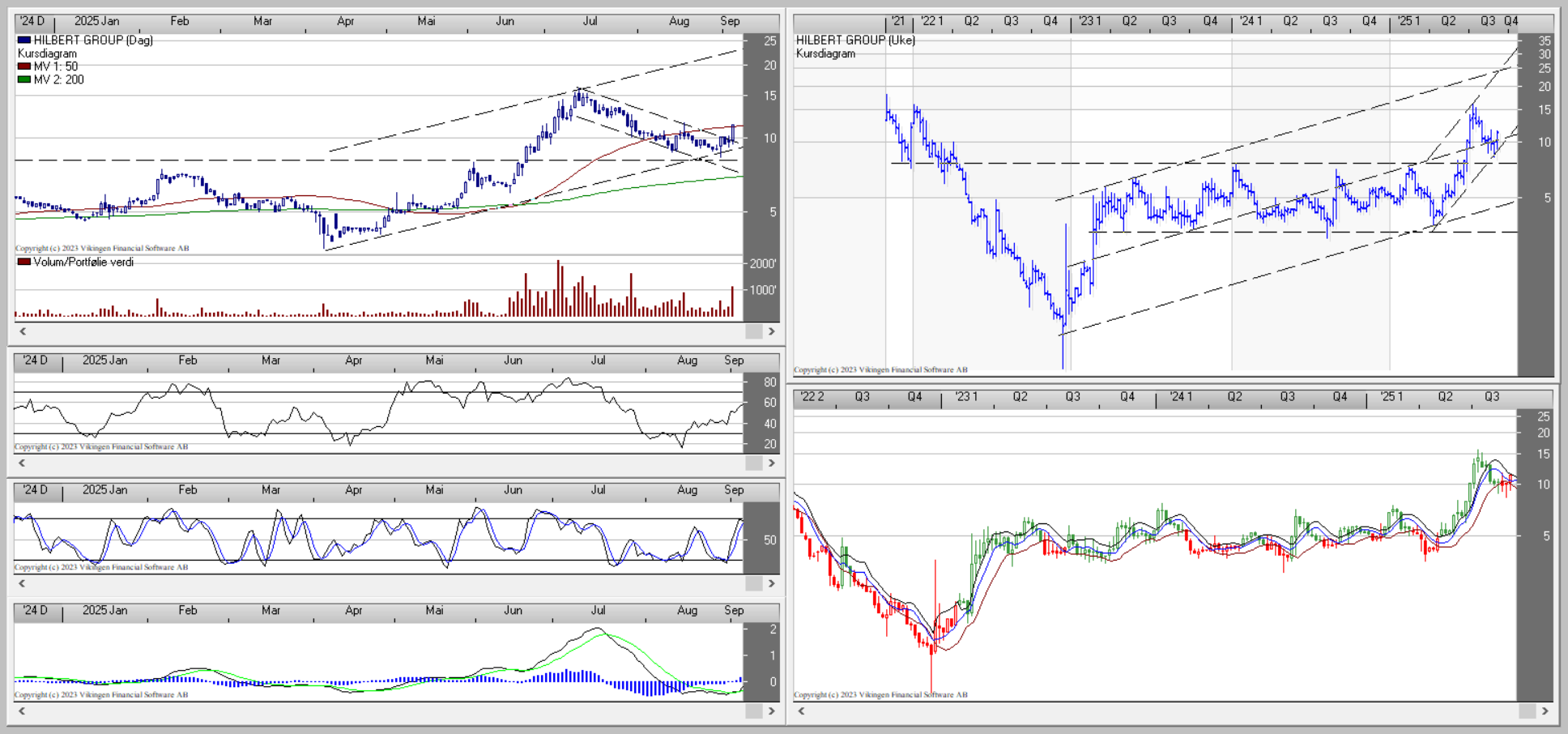

The overall technical picture for the Hilbert share is very positive and signals further strong growth for the share over the next 3-6 months. As mentioned, the share price quadrupled from SEK 4.00 to SEK 16.00 from the end of April 2025 to mid-July 2025. The share then experienced a correction of almost 50%, but on much lower volume than the previous rise. In other words, there is a positive volume balance in the share, and it is quite natural to have a major correction after a share has risen 300% in 2.5 months.

The overall technical picture is now signalling that the Hilbert share is likely to see a new sharp rise over the next 3-6 months, and within the long-term rising trend. This long-term rising trend is now signalling that the share has the potential to rise to around SEK 25-30 in the next 3-6 months.

The stock has now also broken out of its short-term downward trend, triggering positive technical signals for future development.

Various momentum indicators such as RSI, Stochastics and MACD all signal further upside for the stock in the short term.

The 50-day moving average is above the 200-day moving averageand the stock will trigger new positive technical signals on a break above the 50-day moving average.

The BEST model in Vikingen is also very close to now triggering a new buy signal for the stock, and that will happen if the stock breaks above approximately SEK 12. This popular and effective technical analysis model was developed by Peter Östevik. He finalized the the BEST model around 2019, and after 30 years of experience in technical analysis and Vikingen Financial Software.

Based on the overall very positive technical picture that Hilbert stock now shows, then assesses Aksjeanalyser.com the stock as a clear buy candidate and with a potential of around SEK 25 – 30 in 3-6 months’ time.

Some of the latest news about Hilbert Group

Hilbert Group CIO Russell Thompson Invests SEK 25 Million in New Issue

September 3, 2025 at 10:00 ∙ MFN

Hilbert Group AB (Nasdaq: HILB B), the Nordic listed investment firm focused on digital assets and fintech, today announced that its Chief Investment Officer, Russell Thompson, has made a substantial personal investment of SEK 25 million in Hilbert B-shares. The subscription will be done at market terms, more specifically at the minimum of SEK 10.08 and the 5-Day VWAP ending this coming Friday. The directed issue will be approved by an EGM to be announced shortly.

Thompson, who joined Hilbert in late 2024 and currently serves as CIO overseeing the Group’s multi-strategy crypto hedge funds and investment activities, emphasized that this additional purchase reflects his long-term belief in Hilbert’s business model, growth trajectory, and market position.

“I am investing because I believe deeply in Hilbert’s future,” said Russell Thompson, CIO of Hilbert Group. “In the past I have founded and exited a world class asset manager, Cambridge, which we built in to a multi-billion dollar AUM business. I believe the potential here with Hilbert is bigger than that. We are building a first-class digital asset management and financial platform, with the scale and capabilities to lead globally. I want to increase my stake to demonstrate that conviction and to share fully in the value creation ahead.”

Hilbert Group Co-Founder and board member Niclas Sandström welcomed the move as a strong signal of confidence and alignment:

“Russell is a first-rate CIO and having him significantly increase his ownership underscores the depth of belief our leadership team has in Hilbert’s strategy. This is a clear vote of confidence, not just in what we have built to date, but in the opportunities ahead,” said Sandström.

Hilbert Group continues to execute on its core business areas: asset management, Web3/DeFi ventures, proprietary investments, including the corporate treasury strategy. With recent strategic initiatives, including the acquisition of Nordark, the company is positioning itself as a full-stack digital finance platform in Europe

Hilbert Group Acquires 100% of Fast-Growing Crypto Banking Platform Nordark

2 Sep. 2025 at 08:00 ∙ MFN

Hilbert Group AB (Nasdaq: HILB B) today announced the acquisition of 100% of Nordark (Nordfinex Holding AB), a rapidly growing crypto banking platform, in an equity-only transaction.

The acquisition marks a major milestone in Hilbert’s ambition to establish itself as Europe’s leading full-stack digital finance platform.

The deal provides an initial consideration of 2,970,105 Hilbert B shares, subject to a two-year lock-up, with the potential to increase to a maximum of 16,830,596 shares if ambitious growth and profitability targets through 2027 are achieved.

The acquisition of Nordark positions Hilbert Group to unlock substantial new revenue streams by combining its proven asset management and DeFi strategies with Nordark’s banking, trading, and lending infrastructure.

With a loan book pipeline of approximately USD 2.5 billion, tier-1 institutional clients already onboarded, and a diversified revenue model spanning banking fees, trading commissions, and loan interest income, Hilbert now has the foundation to scale Nordark into a multi-hundred-million SEK revenue business. By integrating yield-enhancing hedge fund products with Nordark’s platform and loan demand, Hilbert is set to create a powerful, recurring, and high-margin revenue engine across the digital finance ecosystem.

The acquisition brings strong synergies across Hilbert’s ecosystem:

– Asset Management x Banking: Hilbert’s yield-enhancing hedge fund strategies complement Nordark’s business model.

– DeFi Integration: Nordark’s infrastructure enhances Hilbert’s Syntetika platform, opening various pathways to tokenized banking and settlement.

– Operational Efficiency: Integrated settlement between Nordark and Hilbert reduces costs and counterparty and operational risks.

“Crypto banking is heavily underdeveloped globally,” said Barnali Biswal, CEO of Hilbert Group AB. “By combining Nordark’s banking, trading, and lending capabilities with Hilbert’s proven asset management and DeFi expertise, we are creating a powerful, full-stack institutional platform capable of generating massive revenue.”

“Joining forces with Hilbert Group is a natural next step for Nordark,” said Jonathan Granath, CEO of Nordark. “We set out to build a crypto banking platform that bridges the gap between traditional finance and the digital asset economy. With Hilbert’s global reach, asset management expertise, and DeFi innovation, we now have the scale and ecosystem to deliver on that vision for some of the world’s most sophisticated institutions”.

Closing of the transaction is subject to customary conditions and board approval and is expected to be completed by 15 of September.

Hilbert Group extends special thanks to Jockum Hultén of Snowball Capital and Web3 angel investor and Hilbert Group board advisor, John Lilic, for their important roles in making this transaction possible.

About Nordark

Nordark, which shares the same Nordic DNA as Hilbert Group, is a crypto banking platform founded in 2023 in Stockholm by Jonathan Granath, Oliver Brandtvig and Philip Granath. Nordark is offering banking, trading, and lending services tailored for digital asset businesses. Its core features include dedicated fiat accounts (USD, EUR, GBP), instant settlement for counterparties, integrated crypto trading with deep liquidity, and secure, overcollateralized crypto-backed loans. Nordark supports leading DeFi protocols, exchanges, brokers, and stablecoin issuers, bridging the gap between traditional banking and digital assets.

Hilbert Group Partner Xapo Bank Secures Gibraltar Regulatory Approval for New Bitcoin Yield

18 Aug. 10:00 ∙ MFN

Innovative product allows Xapo Bank customers to invest in the Xapo Byzantine Bitcoin Credit Fund, managed by Hilbert Capital, with near-term inflows projected at 10,000 BTC

Hilbert Group (Nasdaq: HILB B) today announced that its partner Xapo Bank has received full regulatory approval from the Gibraltar Financial Services Commission for its latest investment product. The new product, to be rolled out this autumn, enables the bank’s eligible customers to grow the yield on their bitcoin holdings through a seamless, easy to use, app.

“With this approval, we will enable our members to put their bitcoin to work and generate secure returns through a model that we have tried, tested, and refined over many years,” said Joey Garcia, Executive Director of Xapo Bank. “Our mission is to protect, store, and grow our members’ wealth. Owning bitcoin is one part of that – and putting it to work in a secure environment, is another. Just as we offer traditional banking services to put USD to work, as a Bitcoin native Bank we wanted to bring the same principle to BTC, allowing our members to grow their holdings within a tried, tested, and fully regulated environment.”

The innovative product enables eligible customers to invest their Bitcoin into the Xapo Byzantine Bitcoin Credit Fund, a dedicated investment vehicle managed by Hilbert Capital, the digital-asset management arm of Hilbert Group. By deploying Bitcoin into this fund, customers benefit from professional portfolio management alongside robust risk controls.

Xapo Bank anticipates strong market demand, forecasting inflows of approximately 10,000 BTC from existing customers in the near term.

“Hilbert Capital is proud to manage the Xapo Byzantine Bitcoin Credit Fund,” said Barnali Biswal, Chief Executive Officer of Hilbert Capital. “The Hilbert and Xapo partnership combines institutional-grade risk management with deep expertise in digital assets. Together we deliver a user-friendly experience that doesn’t compromise on compliance or security”.

The approval in Gibraltar, a jurisdiction renowned for its progressive approach to crypto and banking regulations, reinforces the commitment of both companies to regulatory excellence. Xapo Bank’s app employs industry-leading security protocols, multi-signature custody solutions, and real-time compliance monitoring to safeguard customer assets.

Xapo Bank is a Gibraltar regulated digital banking app specializing in banking and investment services for Bitcoin and USD. The Xapo Bank app seamlessly combines institutional-grade infrastructure with consumer-friendly technology, enabling clients worldwide to hold, send, and earn yield on their USD and digital-asset portfolios.

Vikingen Top 10 buy signals!

Have you checked Vikingens’s website and taken a look at this week’s Top 10 buy signals? If not, the signals for week 36 can be found here!

We now use the Nordic Complete add-on in the BEST Model. You can find more information and buy Nordic Complete here!

Here is a direct link to the Viking webshop where you can choose the other Viking programs and add-ons that suit you best.

Opportunity to participate in Börssnack!

Every week you have the opportunity to participate in Börssnack as Aktieutbildning.nu on Wednesdays, via an open online webinar at 19-20!

In Börssnack, you’ll learn how to invest in interesting companies and get answers to questions like:

How do we do better business in the stock market? Which global stock markets look the best? How should you act in the stock market? Is it time to buy/sell now? Which stocks and funds are interesting? What does Börssnack’s Portfolio look like? It is reviewed and analyzed each Wednesday. Welcome!

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Sincerely yours