Have you also managed a 40% increase this year?

Have you also managed a 40% rise this year, if you have, you can stop reading here. If you have received less than 40%, the following may be an interesting read for you. Below I share my best practices over the years. I have tried buying options, writing options, buying shares, foreign and domestic shares. I have bought leveraged derivatives and futures. I have been a day trader and managed to grow from 300,000 SEK to 3 million SEK in six months. Only to lose most of it again on options.

What has always worked well over the years are shares and funds.

Here’s how I’ve managed to get a 40% increase in shares this year

My requirements for buying shares

- Buy stocks that are going up.

- Buy stocks that have a positive medium or long term upward trend. Have a long trend behind you. Good to have if it temporarily goes down. “Let the trend be your friend”.

- If the stock keeps going up, let it keep going up. “Let the profits run”.

- Look at the latest interim report. Turnover and profits may increase.

- Look at historical key figures in Vikingen. P/S preferably below 4, P/B below 3. Turnover growth over several years. High dividends are an added bonus.

- Buy shares with good turnover.

- Sell stocks that break the weekly trend or have a reversal signal. For example, double or triple peaks in the weekly RSI. One day key reversal. BEST month. Or an optimized sell signal with the “best model” feature.

How to get a good rise

- Go on autopilot 03 Buy Signals all shares month-week-day-best.

- Produce a workspace consisting of 5 models. RSI week, Multimodel day, BEST month, Trend day, Price band week.

- Browse the Prospects object list created by the autopilot 03

- Right-click on the stocks that look interesting and add them to an item list, such as “Buy”.

- Activate a country’s item list, for example-SE-Stocks.

- Go on autopilot 17 Inclination (regression) – day. The model regression change should be set to 5 days.

- Select the shares in the list with the highest slope, right click, create a new item list, for example with the name “0”.

- Activate object list “0” and scroll through the list with the workspace mentioned in point 2 above.

- Activate the next exchange, such as Nasdaq, and start again from point 6. Run through each exchange and item list such as Futures, DK-ETF, DE-ETF, PPM funds and equity funds.

- In the end, I have come up with a list of the best securities among 10s of thousands of items. Unfortunately, I have little money and can’t buy them all.

- Browse the results and buy the best

Which stocks are worth buying to receive a 40% gain in 3 months?

This text “ Have you also managed a 40% rise this year?” is of course based on buying shares at times when the shares look like they will continue to rise after I buy.

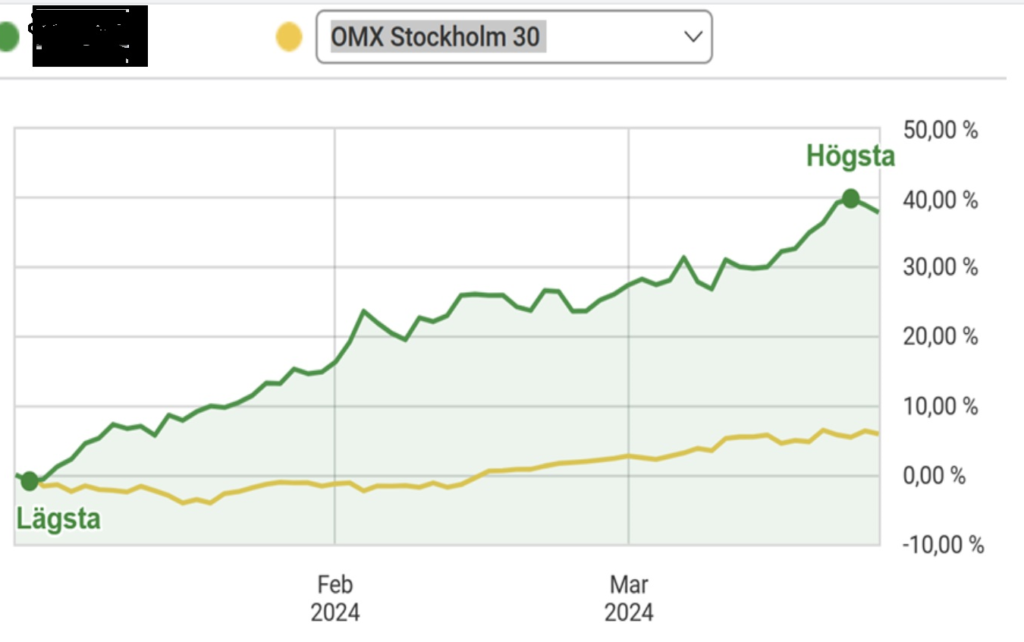

This is the situation for the Bruker I bought in February (I have sold it at a good profit).

At the top left of the picture the stock breaks up from a rectangle with good volume. The stock should go up at least by the distance in the rectangle. Buy signal in multi-model. RSI rising. Buy signal in Price band, week, in addition there was a long rising trend in BEST month, down to the left and buy in BEST month, however the positive slope was a bit weak (regression) in the monthly chart, but acceptable. Ok interim report. Good industry. I found the stock using the method I describe above.

The Viking is a good stock market program to find the winners, perhaps the best program.

It is easy to use the automatic filters available in Vikingen Exchange/Trading/Maxi, the so-called “autopilots”. I use the Viking Maxi, English version because the monthly BEST and mRudolph3 models give excellent purchase signals. Looking back, I realise “I should have done that”. Both are practical models where you can keep up, though they are not always the best models, but they work in practice.

Our holdings 28 March 2024

My and my partner’s holdings:

| APPLOVIN A |

| AUTOLIV SDB (SEC) |

| USER |

| DANSKE BANK |

| DELPHI GLOBAL |

| MPC CONTAINER SHIPS |

| NORDEA BANK(SEC) |

| NUVEI |

| NVIDIA |

| PICTET – JAPANESE EQ OPP P JPY |

| PICTET-DIGITAL-R USD |

| SAAB B |

| SBBB4D1 |

| SKANDIA GLOBAL EXPOSURE |

| SKANDIA TIME GLOBAL |

| SPILTAN SMALL CAP FUND |

The content may be different tomorrow.

Disclaimer

It is up to you whether you follow the recommendations above and you take all the risk yourself. The hope is of course, that you’ll make money from the tips, but we can’t promise that.

It’s always the way it is; if it goes down, it goes down, that’s just the way it is. Then you act accordingly. Same in reverse, if it goes up, it goes up, even if the bad news on TV says otherwise. The Viking is objective, just showing you how it is. It took me many years to accept.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of the oldest stock exchange programs in the Nordic region. Tell your friends and acquaintances about the Viking.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)