Don’t Fight the Fed

Don’t Fight the Fed and 12 other investment rules. Marty Zweig’s investment rules provide a framework for investment success, now more than ever. For the last ten years, there has been a simple market advice that has worked better than any other. That advice is Don’t Fight the Fed or “don’t fight the Fed.”

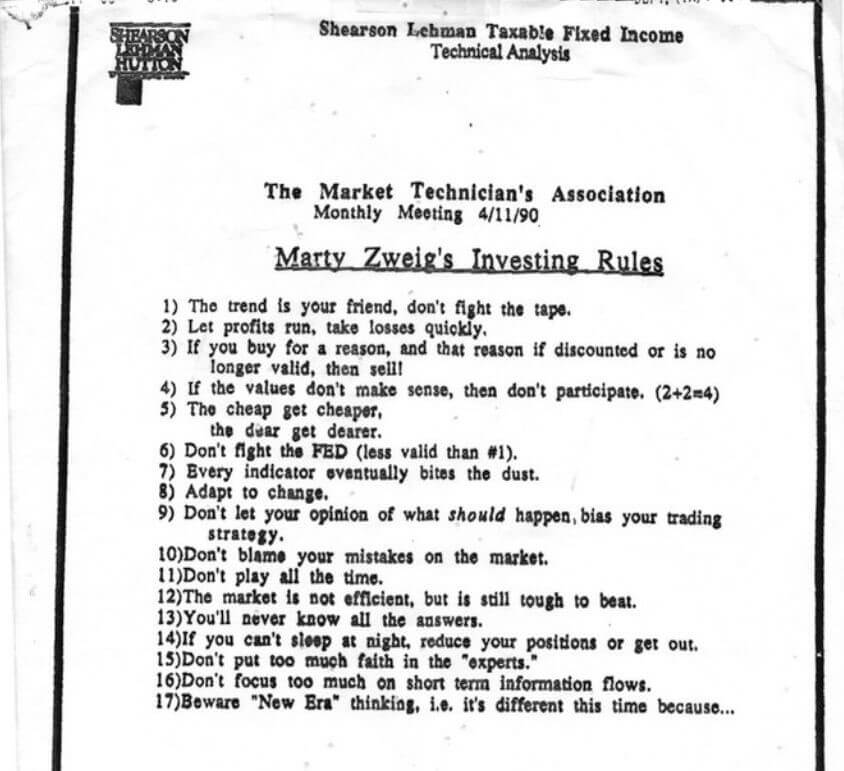

Marty Zweig, who was a well-known trader and investment advisor, is generally given credit for the succinct advice. Zweig is also known for predicting the 1987 Black Monday crash when he appeared on the TV show Wall Street Week.

Zweig had a number of investment rules in addition to “Don’t Fight the Fed” that can be very helpful to review regularly. These rules are mostly common sense, but it is easy to lose sight of common sense in difficult markets. These rules were published almost exactly 30 years ago but they are more valid today than ever.

They are:

1. The trend is your friend, don’t fight the band. Price measures should always be the most important factor. It will tell us more about the market than anything else.

2. Let profits run, take losses quickly. The way you make big money is to stay with businesses that work and to quickly reduce those that do not.

3. The cheap get cheaper, the dear get more expensive. The valuation of shares is driven by emotions. Investors are driven to sell cheap shares and buy expensive ones.

4. Each indicator eventually bites the dust. What works changes all the time. Once traders understand and internalize indicators, they will move forward and make them no longer work.

5. Adapt to change. The market is constantly evolving and we must recognize this and adapt to deliver exceptional results.

6. Don’t let your opinion on what should happen influence your trading strategy. The market does not think in the same way as we do. Just because we think a certain action is logical does not mean that it will happen.

7. Don’t blame the market for your mistakes. If the market does not do what we want it to do, then either our strategy was wrong or we were unlucky. The market did not cause our losses.

8. Do not play all the time. There is not always a range of great trading opportunities. We have to be patient and wait for the right approach to be developed.

9. You will never get all the answers. We will never have perfect information. If we do not act when we have partial knowledge, we will never act.

10. Don’t rely too much on the experts. Anyone who is active in the market will be wrong quite often. It does not matter how experienced, wealthy or knowledgeable they may be. They are fallible.

11. Beware of “New Era” thinking, i.e. “It’s different this time”. While news and facts may change, human nature never changes.

12. The market is not efficient but is still hard to beat. Even when we have good information that is not widely known, it does not guarantee positive results.

All good traders understand these rules to some extent. The common thread is that we are at the mercy of the market and we need to understand that in order to navigate effectively. Human nature is always at play to some extent and will influence the market more than anything else.

Traders often get caught up in watching small movements daily, but it’s concepts like “don’t fight the Fed” and “the trend is your friend” that determine our success more than anything else.

Martin Edward Zweig was an American stock investor, investment advisor and financial analyst. His particular investment methodology was based on selecting growth stocks that also have certain value characteristics, through a system that uses both fundamental analysis and market timing.

About the Viking

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, price data, tables and stock prices, you can sort out the most interesting ETFs, shares, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)