Cu in this week’s Stock Tip!

This week’s Stock Tips from Vikingen and Aktieutbildning.nu!

The tips are published in this blog and in our social media, so please follow us on FB, Linkedin, and X

Please tell your friends and colleagues to follow us also! Do you want to read this blog in Swedish? Click here.

Recommended buy week 40: Copper (chemical symbol Cu)

Copper is now trading at around USD 10,301

Target 13 000 USD

Stoploss: 9 600 USD

Why is now a good time for Copper?

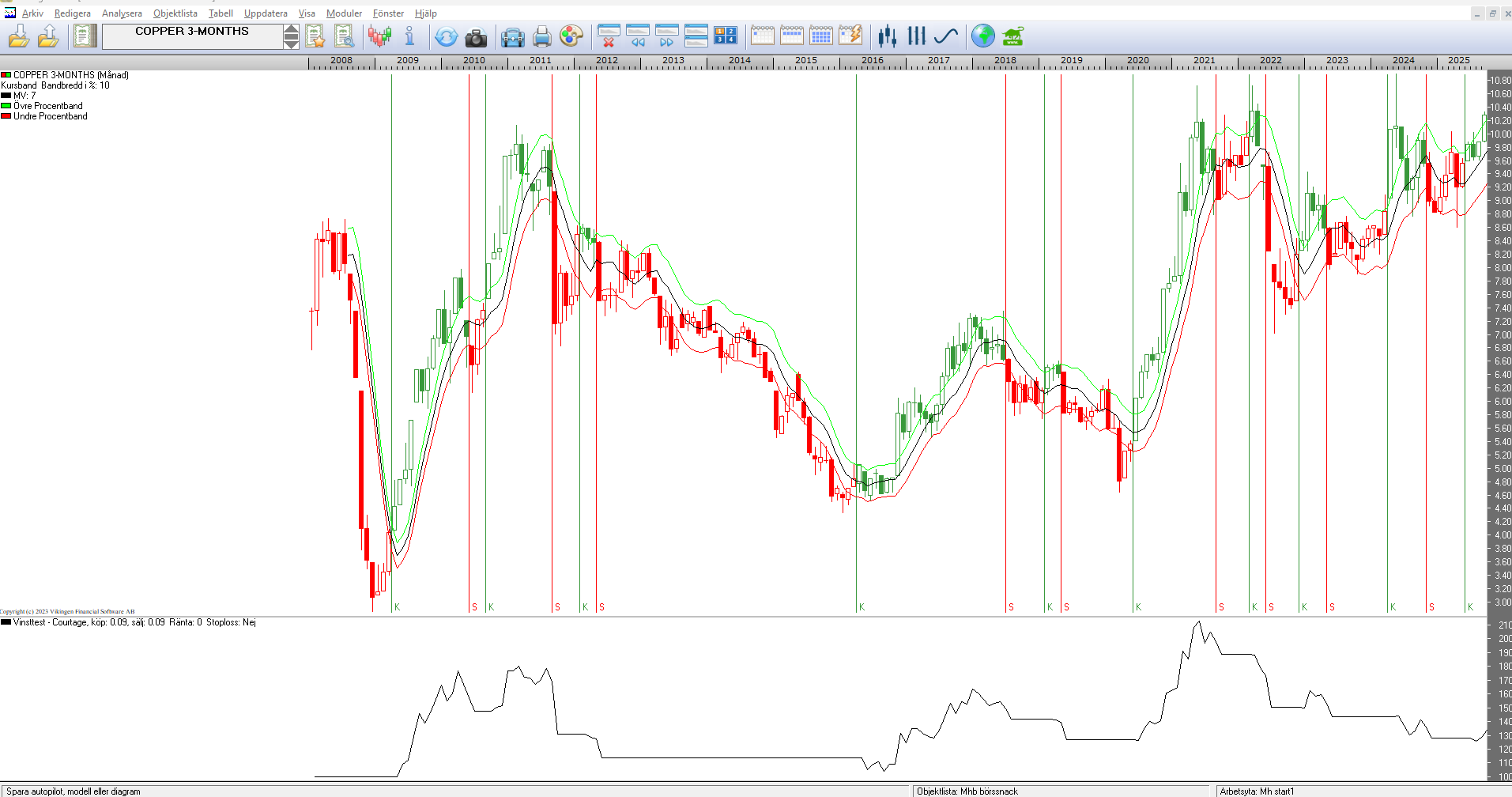

Technical analysis

See also the diagram below. Please note this is not advice to buy, this case is published for educational purposes.

- Strong upward trend.

- Large rectangle/triangle formation, since March 2020, now breaking upwards. We are moving from consolidation and low volatility to hopefully rising price and higher volatility.

- Vikingen’s Multimodellen, Kursband (weekly and monthly) and other models give a “green” light and a buy signal.

- Other metals such as gold and silver have risen sharply and are now approaching their peak? More industry-focused metals, such as platinum and palladium, have already started strong upward trends.

Strengths

- Essential for the transition: Copper is a critical metal for electrification. There is no cost-effective substitute in wiring, electric motors, transformers and batteries. An electric car needs 3-5 times more copper than a gasoline car.

- High demand: Demand is stable and growing structurally thanks to the deployment of renewable energy (solar and wind) and smart grids.

- Good recycling: Copper is one of the few metals that retains its value almost regardless of how many times it is recycled. A large part of the supply comes from recycled materials.

Weaknesses

- Geographical concentration: Much of the world’s copper production is concentrated in politically unstable regions such as Chile and Peru. This creates a high sensitivity to political conflict, strikes and regulatory changes.

- Price volatility: Copper prices are notoriously cyclical and extremely sensitive to the global economy. Downturns in China (the world’s largest consumer) can quickly bring down the price.

- Declining grades in mines: Existing large mines have gradually reduced the copper content of the ore, making extraction more expensive and energy-intensive.

Opportunities

- Global electrification: Increased deployment of electric cars, charging infrastructure and storage systems (batteries) will drive massive, decades-long demand.

- New smart grids: Modernizing the world’s electricity grids to handle renewable energy production requires huge amounts of copper.

- Technological progress: Development of more efficient methods (e.g. biotechnology) to extract copper from low-grade ores.

Threats

- Substitution risk: In some non-critical applications, copper may be substituted by aluminum, especially if the price of copper rises too quickly.

- Environmental regulations: Increased environmental requirements and difficulties in obtaining a Social License to Operate from local communities can lead to costly delays or halting of new mining projects.

- Long lead time: It takes around 10-15 years to bring a new large copper mine into full operation, making it difficult for supply to keep up with rapid increases in demand.

New offer from Vikingen!

Take advantage of Vikingen’s new offer, valid until 12/10 2025. It cannot be combined with other offers. You get 30% on Nordic Complete, which gives you access to all shares on the largest stock exchanges in the Nordic region! Use code OCT30 Welcome!

Learn more in Börssnack!

Every week you have the opportunity to participate in Börssnack that Aktieutbildning.nu

offers on Wednesdays, via an open webinar at 19-20 CET!

In Börssnack, you’ll learn how to invest in interesting stocks, commodities and more. You’ll get answers to questions like:

How do we do better in the stock market? Which global stock markets look best? How should you act in the stock market? Is now the time to buy/sell? Which stocks and funds are interesting? What does Börssnack’s portfolio look like? It is reviewed and analyzed every Wednesday. A warm welcome!

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Yours sincerely