Commodities, a way to reduce risk and increase portfolio returns

One of the main advantages of investing in commodities is the fact that they tend to protect investors from the negative effects of inflation. In general, demand for commodities tends to be high during periods of high inflation, putting upward pressure on prices.

Another advantage is that it provides diversification. Any savvy investor knows that you can’t put all your eggs in one basket. While it may not completely reduce risk, diversifying your investment portfolio can help you achieve your investment goals by maximizing your returns.

What is commodity trading?

Commodity trading goes back centuries, people started trading commodities even before stocks and bonds changed hands. It was a very important activity, connecting different cultures and people. From spices and silk in the early days to the stock exchanges where these assets are now traded, commodities are still popular investment instruments. In fact, they are even more important now than they were then. In Sweden, for example, we have no oil to speak of, so it is necessary to trade and import crude oil from elsewhere in the world. On the other hand, Sweden has large deposits of base metals such as iron ore and copper that are exported worldwide.

When the world got its first commodity exchange in the mid-19th century, there was a need to standardize the properties of raw materials. This is where the English concept of commodity came into play. That is, when you trade a commodity like wheat on the exchange, you are not buying and selling a specific farmer’s wheat, but wheat of a standardized quality. For some strange reason, the Swedish language, like many other languages, has never had an accepted translation for commodity.

A commodity traded on exchanges is a standardized product sold without differentiation by suppliers. Although a good or service may be considered a commodity when it is sold by many suppliers in an undifferentiated system, the term generally refers to physical goods that are the building blocks of more complex products, traded on commodity exchanges such as the Chicago Board of Trade (CBOT), the London Metal Exchange (LME) or the New York Mercantile Exchange (NYMEX). Some examples of commodities are oil, sugar, soybeans, aluminum, rice, wheat, gold and silver. Trading in commodities is mainly done through trading in futures contracts.

The correct term to use in this text would be commodity and commodities, but we have chosen to continue to use the terms raw material and raw materials, as this is the common term used in the industry.

1848 was the year the world’s oldest commodity exchange was established. This was named the Chicago Board of Trade [CBOT]. Subsequently, many such exchanges were established around the world. Trade was – and still is – conducted in the same way, through standardized contracts, which include:

– Place of trade, where delivery is immediate or in the shortest possible time,

– Forward contracts, where the buyer and the seller agree on a price for a good to be delivered at a mutually agreed time and quantity; and

– Forward contracts, where the terms are the same as the forward contract, but executed on a forward exchange.

Before the advent of the Industrial Revolution, trade was mainly in agricultural commodities such as corn, oats, wheat, cattle and pigs.

How to shop for raw materials?

Investors who want to gain exposure to commodities can do so in several ways. Commodity-hungry investors may consider investing directly in the physical commodity, or indirectly by buying shares in commodity companies, mutual funds or exchange-traded funds (ETFs). Another way to trade commodities is by buying exchange-traded products listed on, for example, Nasdaq Stockholm.

In simple terms, a certificate is a debt instrument that reflects the value of an underlying commodity. As it is a debt instrument, the certificate has a limited maturity which means that on a specific predetermined date it is liquidated and converted into cash which is paid to the owner. The value of the certificate on that day determines how much money is paid out.

What are certificates?

A certificate is a debt instrument issued by an issuer. Unlike traditional money market certificates that pay a fixed interest rate, the return on these new certificates is linked to the return on an underlying commodity.

Exchanges such as NASDAQ OMX, together with the issuer, offer trading in a number of different types of certificates. Currently, there are open end certificates, credit certificates, coupon certificates, max certificates and others. We will take a closer look at all these product types in the autumn. The supply of certificates varies over time and is adjusted in line with demand. Different types of certificates have different types of underlying goods. For example, shares and mainstream indices are most common on Max certificates, while more exotic indices and commodities are more common on open-end certificates.

It is of course possible to trade commodities directly with a broker with representation on the major commodity exchanges in New York or Chicago, but this requires significantly more capital than a certificate. Moreover, it is not easy for a European to open a depository in the US.

In short, a certificate on coffee gives you the same exposure as buying coffee on commodity exchanges – it is a mirror of the price. There is more detail than that, but let’s not go into all the details in this text as it would make it far too long.

Avanza has something called KAFFE AVA, which cannot be traded at Nordnet. However, this company has several other products to offer, such as the exchange-traded certificate, WisdomTree Coffee.

The same kind of opportunities exist in most other commodities, at least those traded on exchanges around the world.

What affects the price of raw materials?

Since commodities are traded on exchanges, their prices are not set by a single individual or entity. In fact, there are many economic factors and different catalysts that influence and move their prices every day.

Like equity securities, commodity prices are primarily determined by the forces of supply and demand in the market.

For example, if the supply of oil increases, the price of a barrel falls. Conversely, if demand for oil increases, which often happens during the summer, the price rises. Gasoline and natural gas belong to the category of energy commodities.

Weather plays an extremely important role in price changes for crops or agricultural commodities, especially in the short term.

If the weather affects supply in a particular region, it has a direct impact on the price of the product. Raw materials that fit into this category include corn, soybeans and wheat. Cotton, coffee and rice are called soft commodities.

Gold is one of the most traded commodities as it is used to produce jewelry and other goods. Gold is also considered a reliable store of value and is often bought by the central banks of different countries, which today own a large part of the world’s gold. This precious metal is also considered a profitable, long-term investment. Silver and platinum are other examples of raw materials in the precious metals group.

Livestock is another group of raw materials. This category includes live animals, such as pigs and cattle. All these groups have different responses to changes in interest rates, supply shocks and increased demand.

Spot vs. Futures Price

Commodities are traded via futures contracts on exchanges. If you buy a certificate, the issuer of that certificate will trade wheat when you buy a certificate, and they will sell wheat when you sell. These forward contracts oblige the holder to buy or sell a good at a predetermined price on a delivery date in the future. Not all futures contracts are the same. In fact, their details differ depending on the item being traded.

The market price of a commodity listed in the media is often its market futures price. The futures price is different from the spot or cash price, which is the actual price of the commodity today.

For example, if an oil refinery buys 10,000 barrels of oil at $80 per barrel from an oil producer, $80 per barrel is the spot price. The forward price can be more or less than the spot price at any given time.

Many traders use commodity futures to speculate on future price movements. They generally do not buy the physical goods themselves. This is because it is not practical to buy barrels of crude oil or bushels of wheat. These investors analyze market activity and map patterns to speculate on future supply and demand. They then enter long or short futures positions depending on the direction in which supply and demand move prices.

The role of speculators

Speculators are different from hedgers, who are often end users trying to protect interests in the commodity by selling or buying futures contracts. If a soybean farmer believes that prices will fall in the next six months, they can hedge their harvest by selling soybean futures today. Hedgers and speculators together represent much of the buying and selling interest in commodity futures, making them important parties in determining commodity prices from one day to the next. If you choose to buy a certificate, you are likely to be considered a speculator.

How do you start trading raw materials?

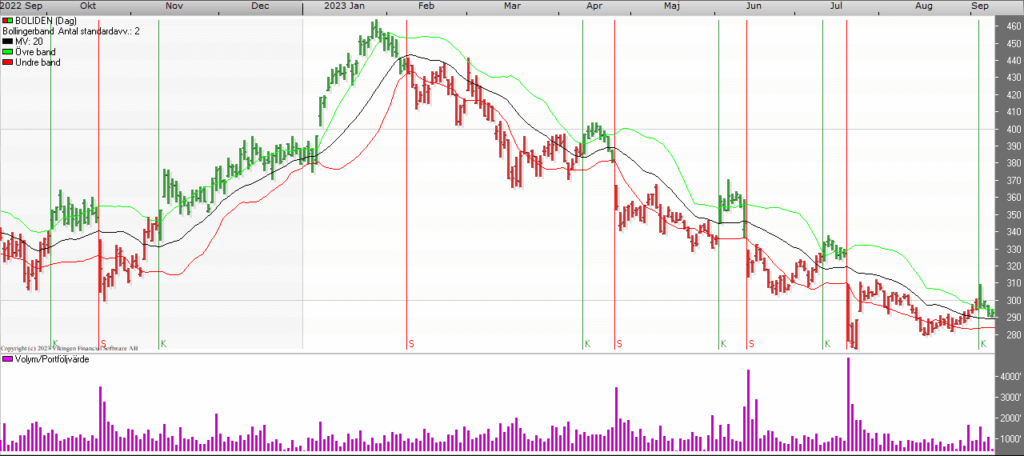

Investors can start trading in commodities in several ways. Speculators can trade in commodity futures that are traded on several major commodity exchanges. Those unfamiliar with how futures work can opt for exchange-traded funds (ETFs) or shares in companies involved in commodities, such as energy or gold mining companies. In Sweden, for example, Boliden is a major raw material company.

Source: Vikingen.se

Once you feel ready, it’s time to log in to your bank or internet broker and take the knowledge test required to trade certificates with them.

What are the best raw materials to buy?

At the moment, cocoa is a very popular commodity, partly because there is a shortage of cocoa from major producers in Africa, which has pushed the price high. Add in the commodity phenomenon called El Niño and the shortage of cocoa may continue, ultimately driving up the price of the chocolate we as consumers buy.

Source: Vikingen.se

Source: Vikingen.se

Another commodity that traders follow closely is wheat, the grain found in flour and bread, which we all use on a daily basis. The war in Ukraine has left Ukraine, a country known as the breadbasket of Europe, struggling to both produce and export wheat and other grains. Since Ukraine produces 12 percent of the world’s wheat, this obviously has an impact on the price of wheat.

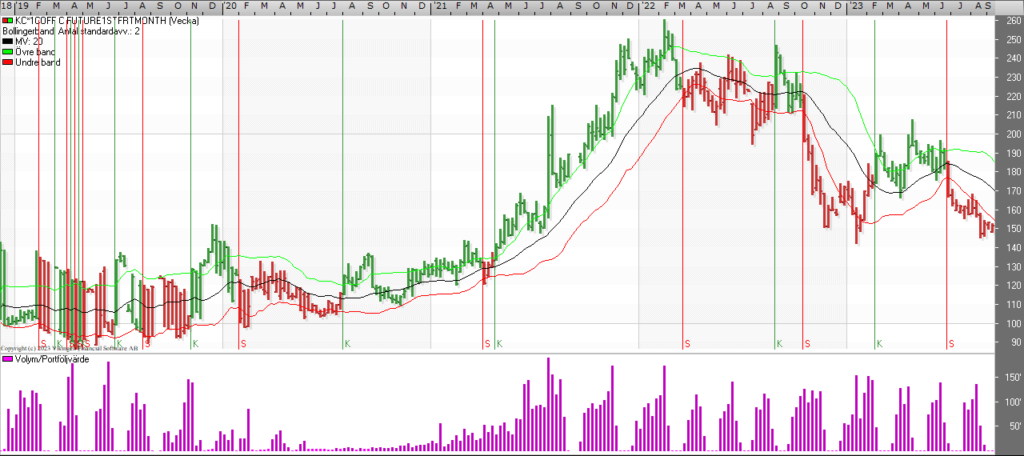

Coffee on a downward trend but that could change

Coffee is a commodity that most of us have a relationship with, which means that the price of coffee has a direct impact on our lives. This commodity rose sharply last year, but has lost momentum this year. Coffee traders are keeping an eye on the weather in Brazil, India and Vietnam, all three major coffee producers. They are currently concerned that the El Niño weather phenomenon will cause problems in these countries. Too much rain will result in reduced harvests, while too little rain will cause exactly the same problem.

Source: Vikingen.se

Source: Vikingen.se

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)