Buying and selling tips for week 41

Buying and selling tips for week 41

Buy and sell tips for week 41 are heavily influenced by the fact that most stock markets are falling. Which is quite natural for this time of year.

Autopilot verified buying tips 03

Verified means that a background check has been done on the company whose stock has a buy signal according to autopilot 03. That is, why does the stock have a buy signal?

These three stocks have interesting background facts:

| LIQUIDITY SERVICES |

| CREDO TECHNOLOGY |

| BOOZ ALLEN HAMILTON |

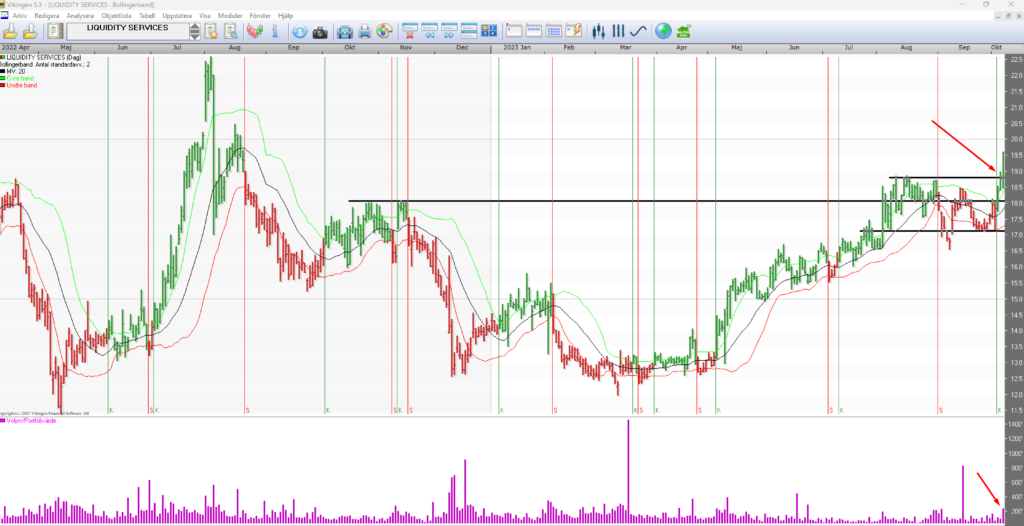

Liquidity Services

A circular economy company. They buy surplus or leftover materials and sell them via online auctions. This is how they describe themselves: “The company supports its clients’ sustainability efforts by helping them extend the life of their assets, prevent unnecessary waste and carbon emissions, and reduce the number of products going to landfills.“Investor Overview | Liquidity Services

The stock has been commissioned from a flag formation with volume growth. A good guess is that in a first step the stock goes up by the difference between the support and the resistance, in this case 18.8-17.2 = 1.6, which means that the stock probably makes a first stop at 1.6 + 18.8 = 20.4, approximately.

Many models give buy signals for the stock, such as Bollinger, BEST, Stochastics, Volatility Signal, Multimodel, MACD.

Sales increase by 16% according to the latest report. However, profits have fallen due to increased costs.

This does not include the profit on unsold assets. The valuation of unsold assets can also mean an increase in profits in the annual accounts. This is probably why the stock is getting a buy signal now.

Credo Technology Group

Operates in optical and electrical Ethernet applications. For example 100G (or Gigabits per second), 200G, 400G, 800G and the emerging 1.6T (Terabits per second) port markets. Credo sells integrated circuits (IC) for optical cards and active electrical cables (AEC) and SerDes chips.

We are increasingly becoming a connected world with more on-demand video content or doctor’s appointments requiring high speeds online,

Sales are growing very strongly. From 106 thousand to 184 USD according to the latest report Credo Technology Group Holding Ltd Reports Fourth Quarter and Fiscal Year 2023 Financial Results | Credo Technology Group Holding Ltd (credosemi.com)

Unfortunately, the company is making a loss, but the loss is decreasing and is relatively small. From minus USD 0.25 per share to 0.11. Could be a turn-around.

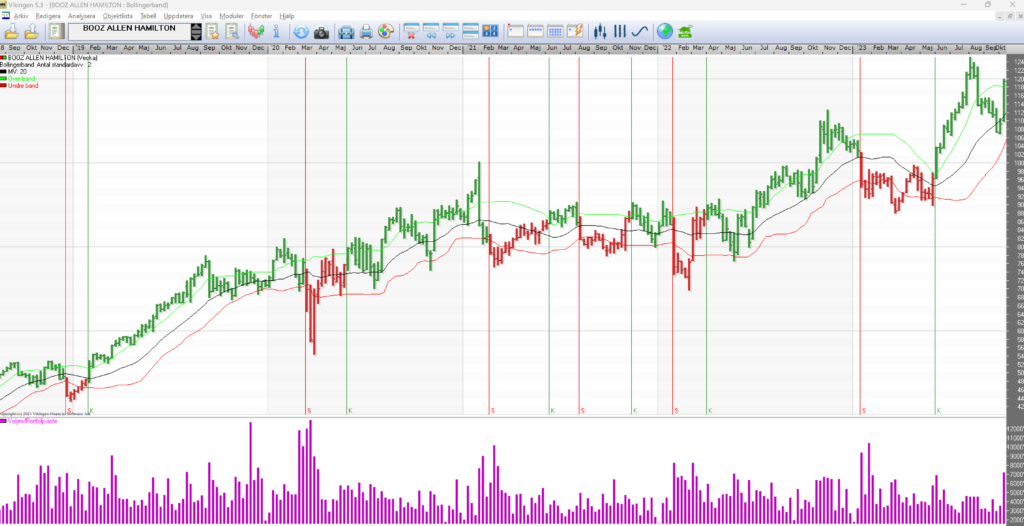

Booz Allen Hamilton

Booz Allen Hamilton Holding is a consulting firm that provides management and technology services to the United States government in the defense, intelligence, and civilian markets. The company offers economic and business analysis, information technology, intelligence and operations research, modeling and simulation, organization and other consulting services. The company was founded in 1914 and is headquartered in McLean, USA.

They have received a large order and the share price rises on this news.

“ Awarded a seven-year, $630 million contract with the US Space Force to support systems engineering and integration of next-generation space-based missile warning, environmental monitoring and surveillance, reconnaissance and tracking.” According to the company’s website.

More buying tips for week 41

| Alleima |

| Höegh Autoliners |

| Pandora |

Weak stocks ahead of week 41

Most stocks are either at a standstill or on the move. Here is a list of stocks that look set to continue to fall.

Personally, I would have sold them and parked the money in a fixed income fund. If you hold stocks to make money, why should you hold stocks that go down? If you have other reasons, it may of course be justified to keep the shares.

| AAK sell signal below 190 |

| Aker sells |

| Autostore, strong sales |

| BW- LPG strong sell |

| Citycon |

| Corem |

| Elkem |

| Embracer |

| Ericsson B |

| Finnair |

| Hexagon |

| Husqvarna |

| Instalco |

| ISS |

| Kesko B |

| K-Fast Holding |

| Nel |

| Nilfisk |

| Noble |

| Nokia |

| Outokumpu |

| OX2 |

| Royal Unibrew |

| SAAB B? |

| Scatec Solar |

| SDIPTECH |

| The Great Forest |

| Thule Group |

| Vitec Software AB |

| Örsted |

Look for yourself in the Viking and you will see that stocks are trending downwards, increasing in volume and may even have recently gone through a downward support.