Trading tools to anticipate price movements in currency trading

Some technical trading tools to help you with your trading. Any type of Forex CFD trading is risky and uncertain if you are trained or unqualified. Good tools therefore play a very important role in forex CFD trading. Technical analysis and tools help forex traders to know the price movement and direction.

There are plenty of tools with HFTrading, and each one has a different purpose. For example, some indicators are useful for examining performance, while others help predict future movements. Tools include price signals, patterns, indicators, oscillators and more. However, trading decisions will ultimately remain yours, it is you who makes decisions and no one else.

Here are what we think are the three best tools. These tools are said to help predict currency market movements.

Top 3 indicators for predicting currency market movement

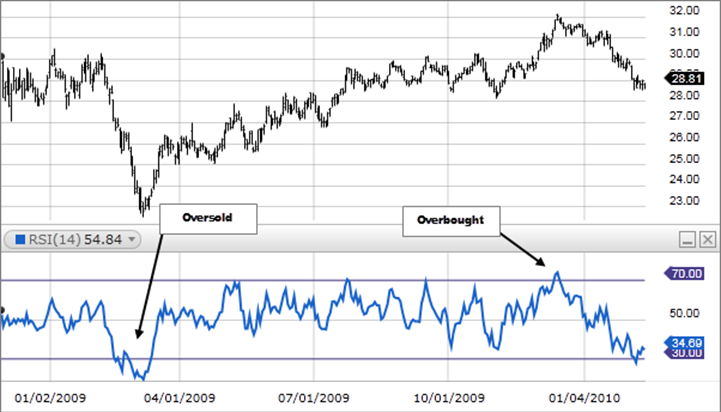

RSI: RSI is an important tool for most Forex CFD traders as it tells you whether a currency pair is oversold or overbought. It is an oscillator tool that ranges between 0 and 100. The indicator helps traders to know the existence of buying or selling power for a particular financial asset.

Usually, if RSI of an asset goes above 70, the instrument is overbought. On the other hand, if the price line is below 30, then the product is oversold. Overbought means an extended price movement to the upside, while oversold means an extended price movement to the downside. When prices reach potential extreme levels, a reversal is possible. Consequently, RSI can be used as a potential indicator by Forex CFD traders.

You can also adapt the 70-30 rule depending on the situation. For example, if a product is volatile, traders can instead hold these points at 80-20.

Notably, RSI is only a tool and the predictions are based on past performance. Thus, it would not be helpful to use RSI alone; instead, it is best to consider two or three other robust tools at the same time. See RSI in the chart below.

A forex trader can use such a tool on the popular MT4 trading platform available from the vast majority of forex brokers. The platform has a user interface that is smooth and easy to control. Furthermore, MetaTrader 4 facilitates users with many other services such as one-click trading, EA (automated trading algorithm), hedging, etcetera.

A forex trader can use such a tool on the popular MT4 trading platform available from the vast majority of forex brokers. The platform has a user interface that is smooth and easy to control. Furthermore, MetaTrader 4 facilitates users with many other services such as one-click trading, EA (automated trading algorithm), hedging, etcetera.

The formula for calculating the RSI

RSI = 100 – (100/1-RS); where RS is the average of upward trend days/average of downward trend days.

Most traders consider the 14-day RSI to be best for trading, but you can choose your own preference.

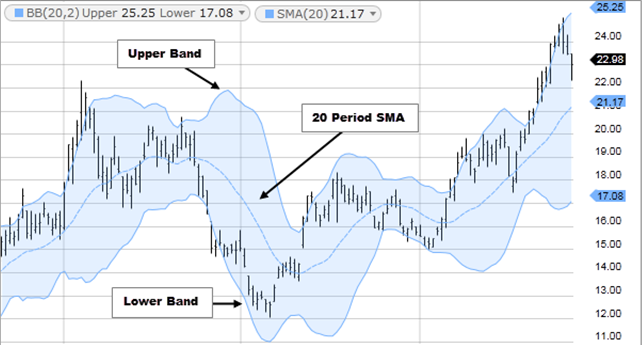

Bollinger Bands: Bollinger Band is a tool used to measure the price volatility of forex CFDs. The tool helps traders make better decisions and provides more accurate entry and exit points. The tool was developed by a market technology analyst, John Bollinger, in 1980.

The Bollinger Band is a popular trading tool among forex traders. It is a representation of the peaks and troughs of currency pairs as a relative base over a given period.

Moreover, the tool consists of three bands, namely top, middle and bottom. The middle ‘band’ is the moving average. The other two are the deviations from the moving average. Here is a diagram of the tool.

Overall, the Bollinger Band tool measures the volatility of a financial instrument by calculating standard deviation. It helps to make better trade decisions. Remember that the tool is a lagging indicator and not a leading indicator. A “lag indicator” helps a user by analyzing past performance.

The formula for calculating Bollinger bands

Peak band = Simple moving average (20 days) + (Standard deviation of price x 2)

Lower band = Simple moving average (20 days) – (Standard deviation of price x 2)

Standard or default parameters for Bollinger Bands = (20,2); where 20 is the number of days of moving average and 2 is standard deviation multiplied by two.

See the chart above for a better understanding.

The financial service provider also plays an important role in your business. It is important that your broker has all the technical tools available to help you make correct decisions. A good broker provides various fundamental as well as technical analysis tools including RSI, Bollinger Bands and Moving Average Convergence Divergence (MACD).

Moving Average Convergence Divergence (MACD)

MACD: MACD is a technical analysis tool that determines the momentum of the price of a financial instrument. It is an oscillator type that follows the trend of predicting price movements.

The tool was developed in the 1970s by Gerald Appel and was further upgraded by Thomas Aspray in 1986 when he added a histogram to it.

The MACD is determined by subtracting the 26-day EMA (exponential moving average) from the 12-day EMA. The result determines the strength or weakness of the price. If the MACD is negative, the signal is weak and vice versa. Here is a simple diagram.

Here the blue line determines the MACD. There are other two components as well, i.e. signal line and baseline. The signal line coded here is red and is the product’s nMA day EMA.

Here the blue line determines the MACD. There are other two components as well, i.e. signal line and baseline. The signal line coded here is red and is the product’s nMA day EMA.

There is another important component of the tool, the histogram. The histogram is calculated using the difference between the MACD line and the signal line. If the MACD line is above the signal line, the histogram goes above the MACD baseline, and vice versa. This histogram helps traders determine when bullish or bearish momentum is high.

MACD prediction optimization

When the MACD line crosses the signal line, it is a possible good entry point. However, remember that there are other external factors to consider as well. You can apply the MACD line and all other tools and indicators in the price chart at the same time.

PS: The sharp drop or rise in the MACD line with the signal line indicates an oversold or overbought asset.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)