The stock tip for week 38! For this company it’s personal!

This week’s Stock Tip from Vikingen and Aktieutbildning.nu!

The tips are published in this blog and in our social media, so please follow us on FB, Linkedin and X so you don’t miss anything. Please tell your friends and colleagues to do the same!

Recommended buy week 38: Raysearch Laboratories B

The share is now trading at around SEK 262.50

Target is about 300 SEK. Stoploss 230 SEK.

Why is now a good time for Raysearch?

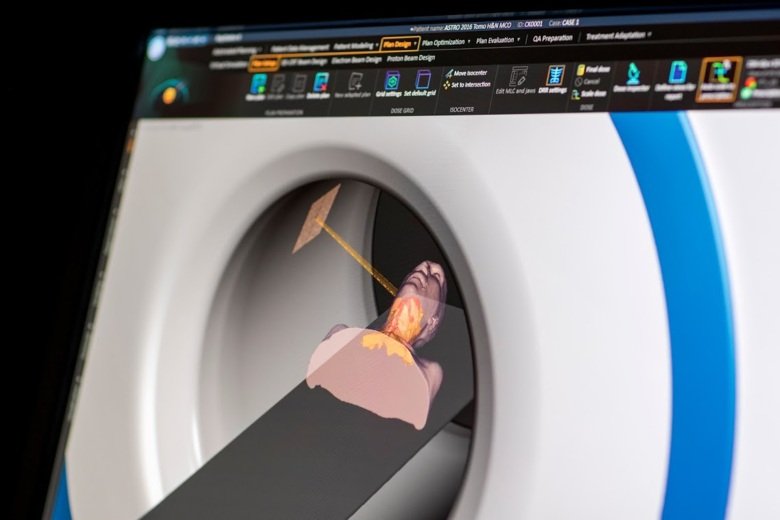

Picture of Raystation. Photo: Håkan Lindgren.

Picture of Raystation. Photo: Håkan Lindgren.

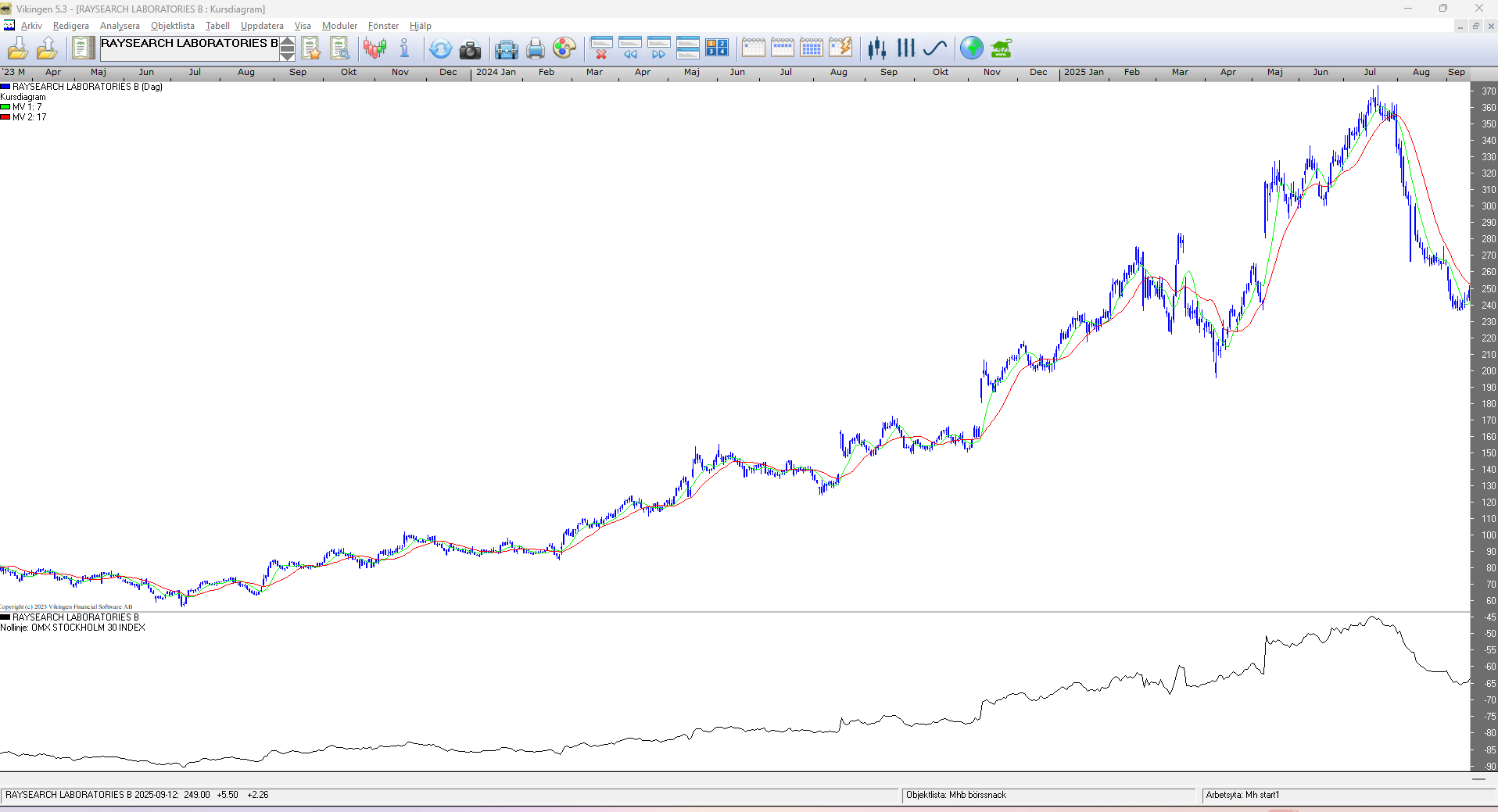

Technical analysis

Sharp drop from about 340 to 240 and now about 249kr.

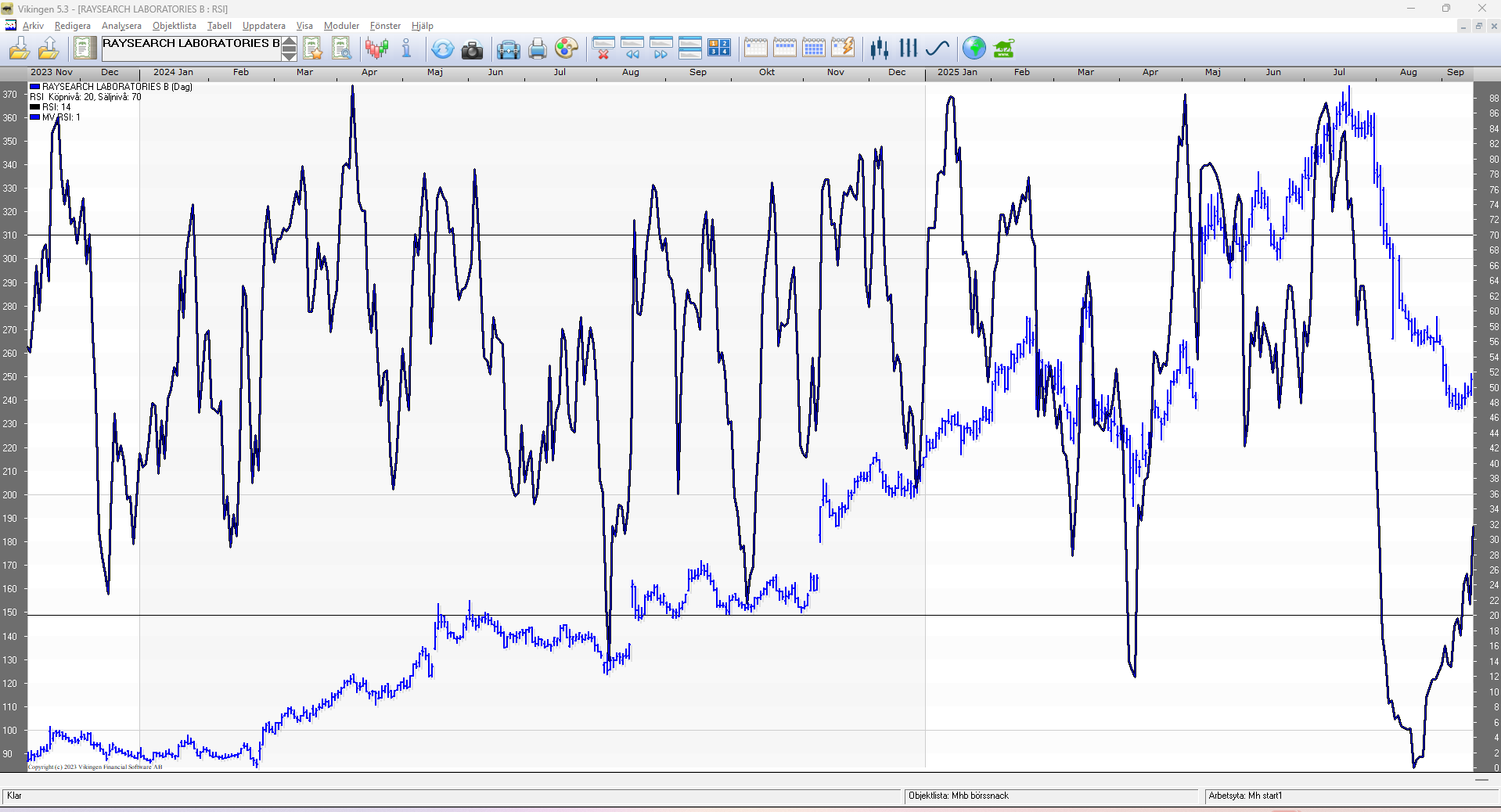

The stock trend is heavily oversold and the RSI extremely oversold. The stock is turning up after a big fall, see picture below.

RSI, relative strengh index, heavily oversold and turned upwards after the big fall.

The relative trend against the OMX index looks much the same, heavily oversold, now turning upwards.

I.e. the company is doing better than the market after a sharp fall. Hopefully big funds will now step in and buy.

Fundamental analysis

Fundamental analysis

Share prices and analysis for RaySearch Laboratories, aquality company that has fallen sharply.

Over the past year, RaySearch’s share price has experienced some volatility, with a high of approximately SEK 373.50 and a low of approximately SEK 149.00. The latest information shows that analysts have issued target prices that are significantly higher than the current price.

SEB initiated its coverage of RaySearch in early 2025 with a Buy recommendation and a target price of SEK 335.

Other analysts, such as those followed by Investing.com and Stockopedia, have an average target price of around SEK 365-370.

These target prices indicate that analysts generally see significant upside in the stock from current levels.

Business Idea

Business Idea

Business concept of RaySearch Laboratories

RaySearch Laboratories’ business concept is to develop and market advanced software for radiation therapy of cancer. The goal is to make cancer treatments more effective, safe and personalized. The company sells its software directly to clinics, but also has license agreements with leading medical technology companies to reach out globally.

SWOT Analysis for RaySearch Laboratories

Strengths

Innovative Technology and Product Portfolio: RaySearch is known for its pioneering systems such as RayStation for treatment planning and RayCare as a complete oncology information system. Their continuous investment in research and development, including AI, keeps them at the forefront.

Strong R&D Culture: The company was founded with a strong academic connection to the Karolinska Institute, which has created a corporate culture that prioritizes innovation and scientific excellence. This drives the development of next generation products.

Global Partnerships: By licensing its software to major medical device companies, such as Varian and Elekta, RaySearch gains a huge global reach that it could not achieve on its own. These partnerships are a fundamental part of their business model.

Recurring Revenue: The majority of the company’s revenue comes from annual maintenance contracts (ASC) and upgrade fees, creating a stable and predictable financial base.

Johan Löf. CEO RaySearch Laboratories. Photo: Håkan Lindgren.

Weaknesses

Dependence on a Specific Niche: RaySearch is almost entirely focused on radiation therapy software. This means that their growth is directly linked to the development and market in this specific, albeit growing, area.

Intense Competition: The market is highly competitive. The company faces competition from larger players with a wider product range and greater financial resources, which can make it difficult to capture new market share.

Challenges of Large Projects: The implementation of advanced systems like RayCare can be time-consuming and complex, leading to long sales cycles and challenges in project delivery.

Vikingen Top 10 buy signals and a fresh offer!

Vikingen’s top 10 buy signals for week 38 are here! We use the Nordic Complete add-on in the BEST model.

Don’t miss Vikingen’s new offer: From September 17 – 28 you receive a 30% discount on the Vikingen Mini program and Swedish Certificates! Use the code SEP30

Here is a direct link to the Vikingen webshop where you can choose from all the Vikingen programs and add-ons that suit you best.

Image above from www.vikingen.se, Silver AVA

Image above from www.vikingen.se, Silver AVA

Opportunity to participate in Börssnack!

Every week you have the opportunity to participate in Börssnack that Aktieutbildning.nu gives on Wednesdays, via an open webinar at 19-20! Here is a recorded version of Börssnack from Sept 17th.

In Börssnack, you’ll learn how to invest in interesting companies and get answers to questions like:

How can our investments perform better in the stock market? Which global stock markets look the best? How should you act in the stock market? Is now the time to buy/sell? Which stocks and funds are most interesting? What does Börssnack’s portfolio look like? It is reviewed and analyzed every Wednesday. A warm welcome!

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Yours sincerely