An Offshore Company in this week’s Analysis!

This week Aksjeanalyser.com takes a closer look at one of the major offshore companies!

The company Subsea 7 at the Oslo Stock Exchange!

(ticker on Oslo Stock Exchange: SUBC)!

Several positive technical signals have been triggered for Subsea 7 recently, and the stock may have significant potential. More on this below under the technical analysis. The oil and offshore sector could be helped by an oil price that is about to break above an important technical resistance level around USD 80 (Brent Spot), triggering a strong technical buy signal. The technical picture for the oil price (Brent Spot) indicates a possible rise to around USD 100 in the next 6-12 months.

First a little about the company, Subsea 7

(ticker on Oslo Stock Exchange: SUBC)

Subsea 7 is an offshore company that offers technology and installation services, which include technical and integrated solutions used in the analysis of natural resources in deep water. The solutions are used in environments that are tough and demanding. Subsea 7 was established through the merger of Acergy and Subsea 7 Inc. in 2011. The company’s head office is located in London. Here you can find more information about the company’s operations and here investor related information.

Technical Analysis of Subsea 7

(ticker on Oslo Stock Exchange: SUBC)

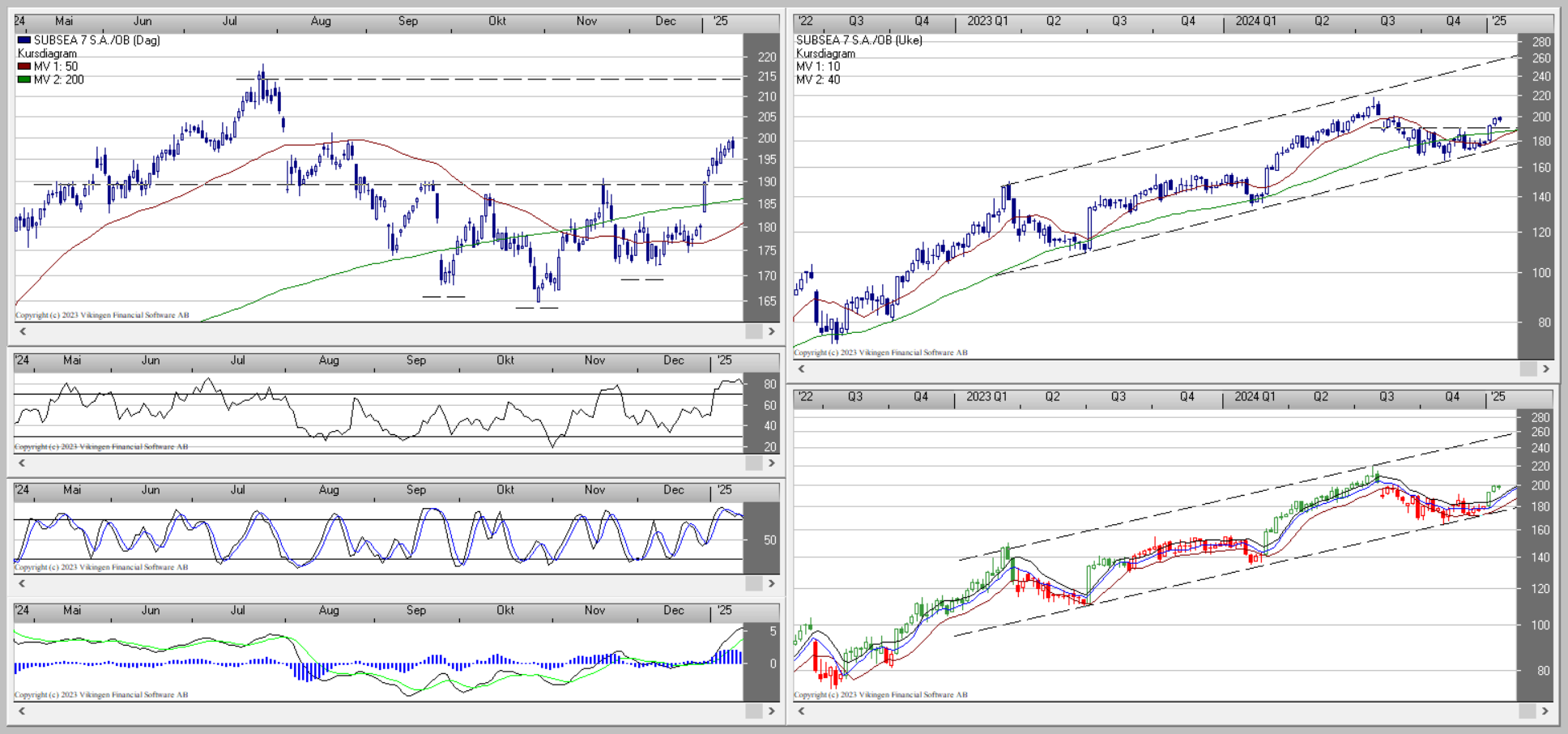

Subsea 7 shows a positive development both in the short and long term, and the share is moving within a long-term rising trend channel. The stock has recently turned upwards after testing the support level at the lower trend line in this long term rising trend channel. A technical buy signal has also been triggered for the Subsea 7 share from an inverse head and shoulders formation (see daily chart). The potential according to this signal is initially up to around the NOK 215.00 level. According to the long-term rising trend channel, a potential for the share to reach up to NOK 260.00 – 280.00 in 6-12 months’ time is indicated. Also momentum indicators such as RSI and Stochastics show an overbought situation for the share in the very short term, and thus indicate that there may be a consolidation before a further rise. In the event of a consolidation/correction, there will now be a significant technical support level for the share around the NOK 190.00 level.

Subsea 7 – a good buy candidate!

Aksjeanalyser.com considers the share a good buy candidate at around NOK 190.00 – 200.00, and sees a potential for the share at around NOK 260.00 – 280.00 in 6-12 months’ time. The BEST model in Vikingen is also in a buy signal for the Subsea 7 share. This popular and effective technical analysis model was developed by Peter Östevik. He finalized the BEST model around 2019, and after 30 years of experience with technical analysis and Vikingen Financial Software. What could potentially change the current positive technical picture for the share would be if the share were to break down below the current technical support level around NOK 190.00 and below the 200-day and 50-day moving averages (which are currently around NOK 185.00 and 180.00 respectively).

Also Morgan Stanley sees potential for the Subsea 7 share

Aksjeanalyser.com is not alone in having faith in the Subsea 7 share, and today (January 14th, 2025) it was announced that Morgan Stanley raises its price target for the Subsea 7 share to NOK 240 (previously NOK 235), and reiterates its recommendation of overweight in the share. Read more here!

Viking Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Yours sincerely