McRib and its impact on the US stock market

Ritholtz Wealth Management COO and “Of Dollars And Data” founder Nick Maggiulli even calculated a correlation between the S&P 500 and the availability of the McRib at McDonald’s.

“When McRib is available, the S&P 500 has an average daily return that is about 7 basis points (0.07 percent) higher than on days when it is not available.”

“To put it in perspective, when annualized, the difference would be 19 percent each year.”

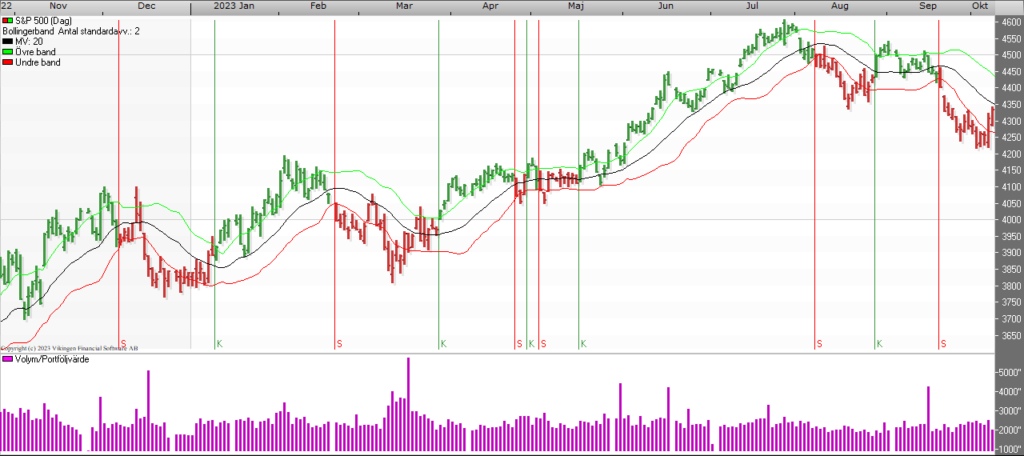

Source: The Viking

Source: The Viking

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, price data, tables and stock prices, you can sort out the most interesting ETFs, shares, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)