How to trade safe haven currencies

What are safe haven currencies and how to trade them? This article provides a guide to trading safe haven currencies and how to trade them. Safe-haven currencies are currencies that tend to maintain or increase in value during times of uncertainty and market instability. Safe havens tend not to have a correlation with the performance of stocks and bonds, making them ideal for trading during market crashes.

In this piece, we will look at some of the currency pairs that Forex traders can choose from, explore why they offer protection and reveal how to trade them to protect themselves from downturns.

What qualifies a currency as a safe haven currency?

When considering the question of what qualifies a currency as a safe haven currency or sanctuary, the factors to consider may relate to the currency itself. These include strong liquidity, as well as the broader economic climate of the issuing country – such as a stable political system, economic growth and stable finances.

However, these factors are not always fully reliable as indicators of a safe haven currency. For example, the Japanese yen is seen as a safe haven despite the country’s weak financial situation, which includes the world’s highest ratio of government debt to GDP.

Factors that actively undermine a currency’s safe haven status should be considered by traders. One of these is that governments can intervene to prevent a nation’s currency from becoming too strong. An example of this is the Swiss central bank, which has repeatedly flooded the country’s market with francs to protect exports.

The Japanese yen experiences a similar pattern; it tends to float during periods of global risk-off sentiment. Because the country is so dependent on exports, the rising yen can be problematic – when exports become less competitive, Japanese companies are less profitable and their share prices can fall. As a result, Japan’s government can sell yen and buy US dollars, or, as in 2016, even adopt negative interest rates in an attempt to maintain a depressed currency.

Four safe havens in the foreign exchange market

The list of safe haven currencies includes the Japanese yen, the Swiss franc, the euro and the US dollar.

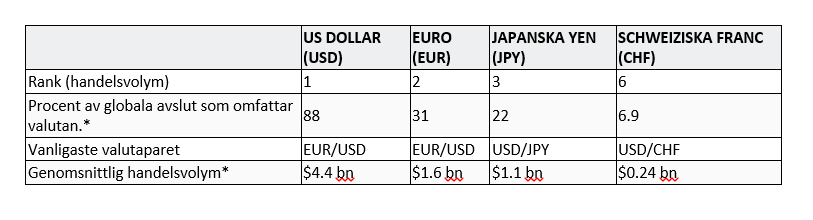

Source: Bank for International Settlements (2016).

Source: Bank for International Settlements (2016).

*Net-net basis, daily averages April 2018

Japanese yen (JPY)

The yen as a safe haven is driven by factors such as Japan’s strong current account surplus, placing it as the world’s largest creditor nation. The yen is also a popular currency for carry trade, meaning that investors often borrow yen from Japan, where interest rates are low, to buy currency in a country where interest rates are higher. This can increase the price of the Yen during financial turmoil, as international speculators choose to unload risky positions and repay Yen loans.

In recent years, examples include the Yen’s appreciation during the 2008 financial crisis, with the exchange rate rise against the British pound and the US dollar, the uncertainty of Brexit in 2015 and the 1998 collapse of the Long Term Capital Management Hedge Fund.

As both USD and JPY are considered safe currencies, sometimes they do not move.

USD/JPY

-market does not move strongly, but crosses like

GBP/JPY

, AUD/JPY and NZD/JPY often do.

US dollar (USD)

The security status of the US dollar is maintained by the reliability of the US Treasury to pay its investors. Since the financial crisis, the received wisdom has been that during times of market turbulence, investors sell risky assets and turn to US Treasuries and the US dollar.

However, in recent years there have been cases where the Yen and the Euro have been the safe haven over the USD, and some analysts argue that there is no evidence that the USD is bought in meaningfully larger quantities than other safe haven currencies during economic difficulties.

Euro (EUR)

As with the US dollar, there are disputes about the euro’s security status in the current climate. The euro has certainly shown the hallmarks of a safe haven in recent years – in 2015, analysts turned increasingly bullish on the euro, driven by a positive outlook on selected European economies. In addition, the low interest rates in major European economies led to expectations of the euro acting as a safe haven.

However, in early 2018, after a fall in US stocks, the expected buying of euros did not happen. It was business as usual for the Japanese yen, which attracted buyers.

Swiss Franc (CHF)

The safe haven status of the Swiss franc is supported by a stable Swiss government and a strong financial system. This is coupled with low inflation and high confidence in the country’s central bank, the Swiss National Bank.

One example of the CHF showing its allure was in 2011, when the US dollar and euro poured into the franc as nervous investors flocked to hedge against the debt crisis on either side of the Atlantic. This caused the USD to fall against the CHF from 0.99400 in early 2011 to 0.779 in July, meaning that one US dollar could only buy 0.79 Swiss francs. On the euro side, in July 2011 the EUR fell against the CHF to around parity, from around 1.3000 at the beginning of the year.

As with the Japanese yen, carry trade speculators like to borrow Swiss francs without financing costs and pay back the loans when the position goes against them.

Using safe havens in forex trading

When using safe havens in forex trading, forex traders should be aware that, as discussed above, some currencies react differently to market events than others. Moreover, there is not always agreement on which currencies can be considered safe havens.

For example, while some see the Norwegian krone as a safe haven, citing the country’s lack of net debt and its current account surplus, others believe it is not the best option as the Norwegian krone lacks liquidity and is too correlated with many other commodity currencies.

In addition to using currencies for safe havens, gold is a popular consideration for traders who want to protect themselves from excess risk. Gold is seen as a safe haven due to its proven ability to retain value, market usage and a price that is generally unaffected by central bank interest rate decisions.

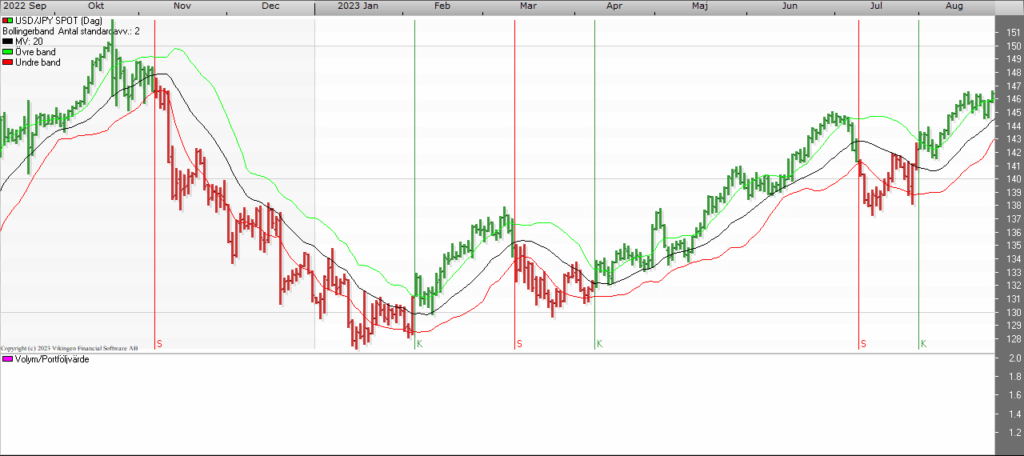

Source: Vikingen.se

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, price data, tables and stock prices, you can sort out the most interesting ETFs, shares, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)