FED rate cuts may not be what you think

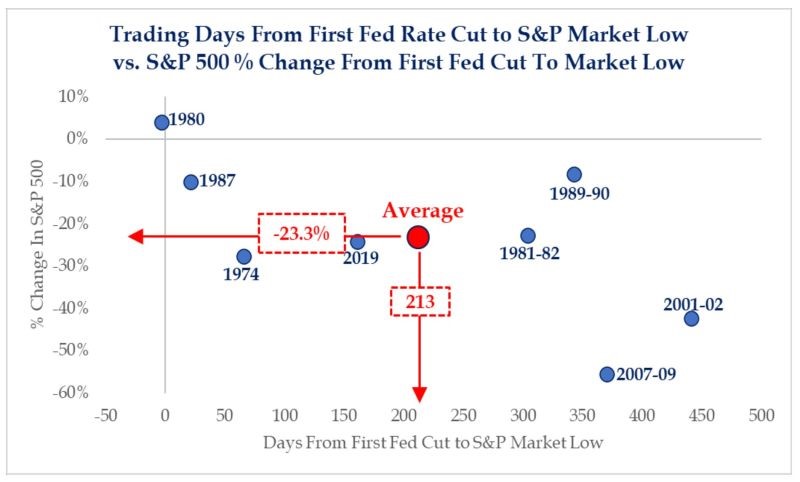

Don’t get too excited about the Fed’s rate cuts. A review of Fed interest rate cycles since the 1970s has shown that investors have more to fear from the first cut in a cycle than the pause.

On average, the US benchmark index S&P500 has increased by five (5) percent over 100 days between the last Fed tightening and the first cut. The situation on a broader market is -23% over 200 days after the first cut in a series, SRP has calculated.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)