Stock tips and Vikingen Black Week, week 48!

This week’s Stock Tips from Vikingen and Aktieutbildning.nu!

Don’t miss out! 40% off everything in Vikingens’s webshop during Black Week (Nov 24th – Nov 30th 2025).

Read about and take advantage of this generous offer here!

The stock tips published in this blog and on our social media are primarily written for educational purposes. Evaluate first what you think, and remember that the stock market gives as well as takes. Welcome to follow us on FB, X, Linkedin, and Instagram

You can also find interesting educational videos here on our website and on YouTube!

Do you want to read this blog in Swedish? Click here.

Recommended buy week 48: BioArctic (BIOA B)

The share is now trading at around SEK 294.20.

The target is about 390 SEK. Stoploss 255 SEK.

Why is now a good time for BioArctic?

Technical Analysis of BioArctic AB

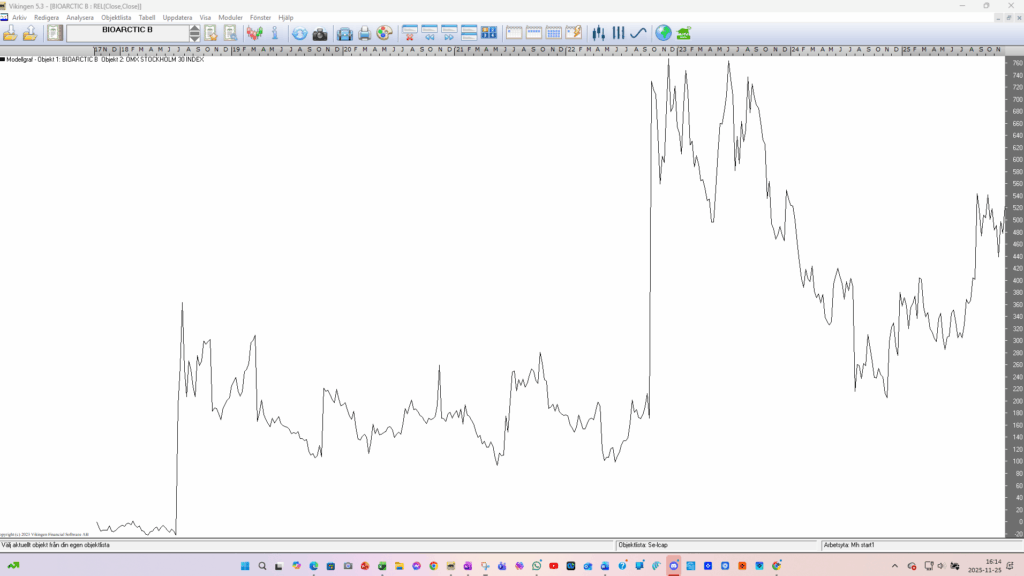

(See also charts below)

- Strong upward trend seems to have started. Long-term upward trend break

- Large round bottom formation, since August 2023, now breaking upwards

- We go from consolidation and low volatility to hopefully rising prices and higher volatility

- The Vikingen BEST model, Price band model (weekly and monthly), and other models give “green” light and buy signal

- The relative graph breaks upwards in a similar way, which is very positive, i.e., the company accelerates upwards relative to the OMX in a similar formation to the absolute graph, i.e., large investors probably drive the price upwards

- Biotech in the US has been rising for some time and is relatively stronger than most. Incl Mag7 and others

Fundamental Analysis of BioArctic AB

The trading portfolio invests in BioArctic AB

Carnegie (or DNB Carnegie, which often publishes the analyses) has provided several updates since the initial target price of SEK 334 was set.

The most recent update from DNB Carnegie is from November 18, 2025.

Below is a summary of Carnegie/DNB Carnegie’s analysis flow:

Previous (strongest) analysis

- Initial Target Price (February 2025): 334 SEK

- Recommendation: Buy

- Main thesis: The February 2025 analysis was titled “Harvest time for successful research” and highlighted the great potential of the Alzheimer’s drug Leqembi, estimating that the product accounted for SEK 258 of the total value of SEK 334 per share.

SWOT Analysis: BioArctic AB

SWOT Analysis: BioArctic AB

Strengths

- Royalties from Leqembi: The biggest strength. BioArctic is entitled to ongoing royalties (which have increased by over 180% in the last nine months of 2025) on the global sales of Leqembi, providing a stable and growing revenue stream without having to bear all development costs.

- Strong Collaboration: The strategic partnership with global giant Eisai is crucial. Eisai bears the heavy cost of commercialization, clinical development and marketing globally. BioArctic also has collaborations with Novartis. @all

- Innovative Platform: The company has a broad pipeline of antibodies for other neurodegenerative diseases such as Parkinson’s disease and ALS, as well as new projects for the treatment of Alzheimer’s disease.

- BrainTransporter™ Technology: The company’s proprietary technology, which can potentially transport antibodies across the blood-brain barrier, may increase the efficacy of future treatments.

Weaknesses

- Dependence on Partner: BioArctic is highly dependent on Eisai’s ability to successfully commercialize Leqembi globally. Any failures or delays in Eisai’s marketing efforts immediately impact BioArctic’s revenues.

- Negative Quarterly Result (Operating Result): Despite high royalty income, the company still reports an operating loss (Q3 2025) due to costs to develop the rest of the pipeline.

- Risky Research: Although Leqembi is approved, other projects in the pipeline (Parkinson’s, ALS) are in early phases (Phase 1/2), which means a high risk of clinical failure.

Opportunities

Opportunities

- Subcutaneous Leqembi (New administration form): The approval and launch of Leqembi in auto-injector format (under the skin, Iqlik) for maintenance treatment makes the treatment easier and cheaper to administer (outside hospital). This is expected to drive sales volume strongly.

- Expanded Global Reach: Leqembi has not yet reached its full potential in Europe and has just been launched in many countries (now approved in over 50 countries). This will drive royalty income in the coming years.

- Out-licensing of Pipeline: Possibility to conclude more lucrative license agreements, similar to the one with Eisai, for other projects (such as the Parkinson’s antibody), which could yield large one-off payments.

Threats

- Adverse reaction risks (ARIA): The risk of ARIA (swelling or bleeding in the brain) is a persistent risk that may limit the wide use of Leqembi. Negative news about safety can quickly damage sales.

- Competition in Alzheimer’s: Other pharmaceutical companies are developing similar antibodies (e.g. Eli Lilly’s Donanemab) that could eat into market share or require price cuts.

- Political Pricing: Strong political pressure in the US and EU to limit the prices of new, expensive Alzheimer’s drugs may limit the overall revenue potential.

- High Volatility: The stock is extremely volatile, which has been seen in both positive and negative news historically.

Would you like more information from Aktieutbildning.nu?Join us at the trading portfolio. Read more here.

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Yours sincerely