In this Week’s Analysis, choose the right thing!

Aksjeanalyser.com looks at a large and well-known company in Sweden!

The company is listed on Nasdaq Stockholm Stock Exchange: Cloetta AB

(ticker on Nasdaq Stockholm: CLA B)

The stock is showing strong development and has recently triggered new technical buy signals. Read more below by the technical analysis of Cloetta AB (CLA B). For your information, Cloetta AB has a market capitalization of approximately SEK 10.4 billion with today’s share price around SEK 37.00.

About the company, Cloetta AB

Cloetta (ticker on Nasdaq Stockholm: CLA B) is a manufacturer, seller and marketer of confectionery products. The company’s products are sold globally via its own brands and mainly include candies, chocolates, pastilles, chewing gum and nuts. The brands include Red Band, Malaco, Kexchoklad, Venco, CandyKing, Ahlgren’s cars, Jenkki, Läkerol, Mynthon and Juleskum. Most operations are found in the Nordic and European markets. The company was founded in Copenhagen in 1862 and today has its headquarters in Sundbyberg.

For more information about the company, visit their website here.

Technical Analysis of Cloetta AB

(ticker on Nasdaq Stockholm: CLA B)

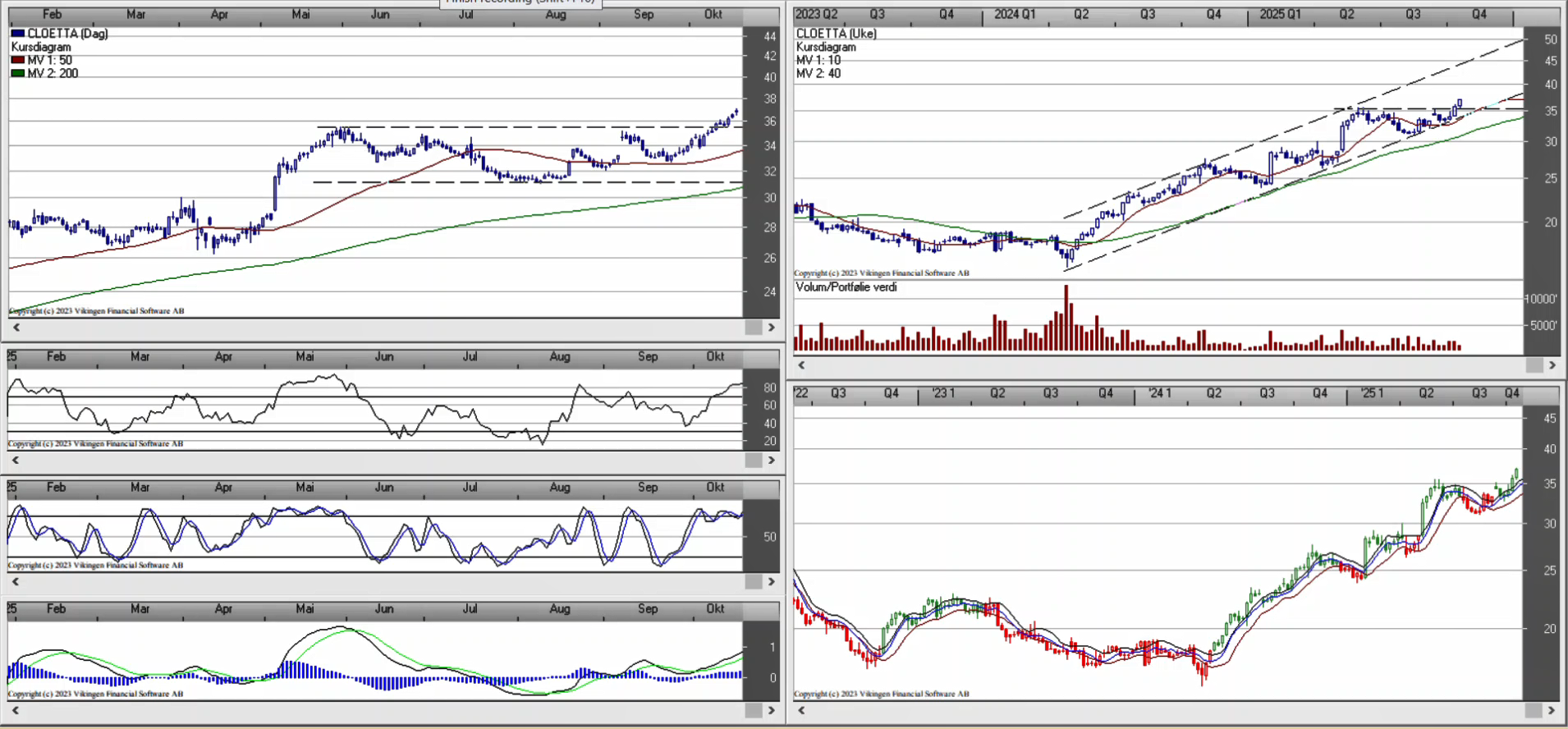

The Cloetta share shows a strong development within a long-term rising trend, and further increase is now signaled for the share within this positive trend (cf. weekly chart above).

The Cloetta share shows a strong development within a long-term rising trend, and further increase is now signaled for the share within this positive trend (cf. weekly chart above).

The stock has recently triggered a strong technical buy signal after breaking upwards from a larger consolidation formation, and upwards through an important technical resistance level around the SEK 35.00 level.

There should now be significant technical support for the share around the SEK 35.00 level in the event of a downward correction.

There is now little technical resistance for further upside for the Cloetta share, and according to the long-term rising trend that the share is moving within (cf. weekly chart) a potential for the share to reach the SEK 50.00 level within just the next 2-3 months is indicated.

The stock is otherwise above both the 50-day and 200-day moving averages, and the 50-day moving average is above the 200-day moving average. This confirms that both the short-term and long-term trend for the stock is positive.

The BEST model in Vikingen is also in a buy signal for Cloetta. This popular and effective technical analysis model was developed by Peter Östevik. He finalized the the BEST model around 2019, and after 30 years of experience with technical analysis and Vikingen Financial Software.

Based on this overall positive technical picture for Cloetta (CLA B), Aksjeanalyser.com find Cloetta a very interesting buy candidate at the current price level of around SEK 37.00. The potential for the share is estimated to be up to around SEK 50.00 in just the next 2-3 months.

What could possibly change the currently very positive technical picture for the Cloetta share would be if the share were to break below a currently important technical support level around SEK 35.00 and below the 50-day moving average (which is currently around SEK 33.80).

Don’t miss out on Vikingen’s new offer!

Until October 31 you get a 30% discount on Nordic Complete, annual subscription!

Use the code 2OCT30

The offer cannot be combined with other offers.

Here is a link to the Vikingen online store where you can choose other Viking programs and add-ons that suit you best.

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Sincerely yours