Aktietipset week 42, a large Danish company!

This week’s Aktietips from Vikingen and Aktieutbildning.nu!

The tips published in this blog and in our social media are primarily written for educational purposes (and less as a concrete buying advice). Evaluate first what you think and remember that the stock market gives as well as takes. Welcome to follow us on

FB, Linkedin and X so that you see what we publish. Please tell your friends and acquaintances to do the same!

Do you want to read this blog in Swedish? Click here.

Recommended purchase week 42: FLSmidth & Co. A/S

The share is now trading at around DKK 466.20.

Target is approximately 560 DKK. Stoploss 360 DKK.

Why now is a good time for FLSmidth & Co. A/S?

FLSmidth is a large Danish industrial group supplying machinery, know-how and services to the cement and mining industry. You can find out more about on their website and also in their webcasts.

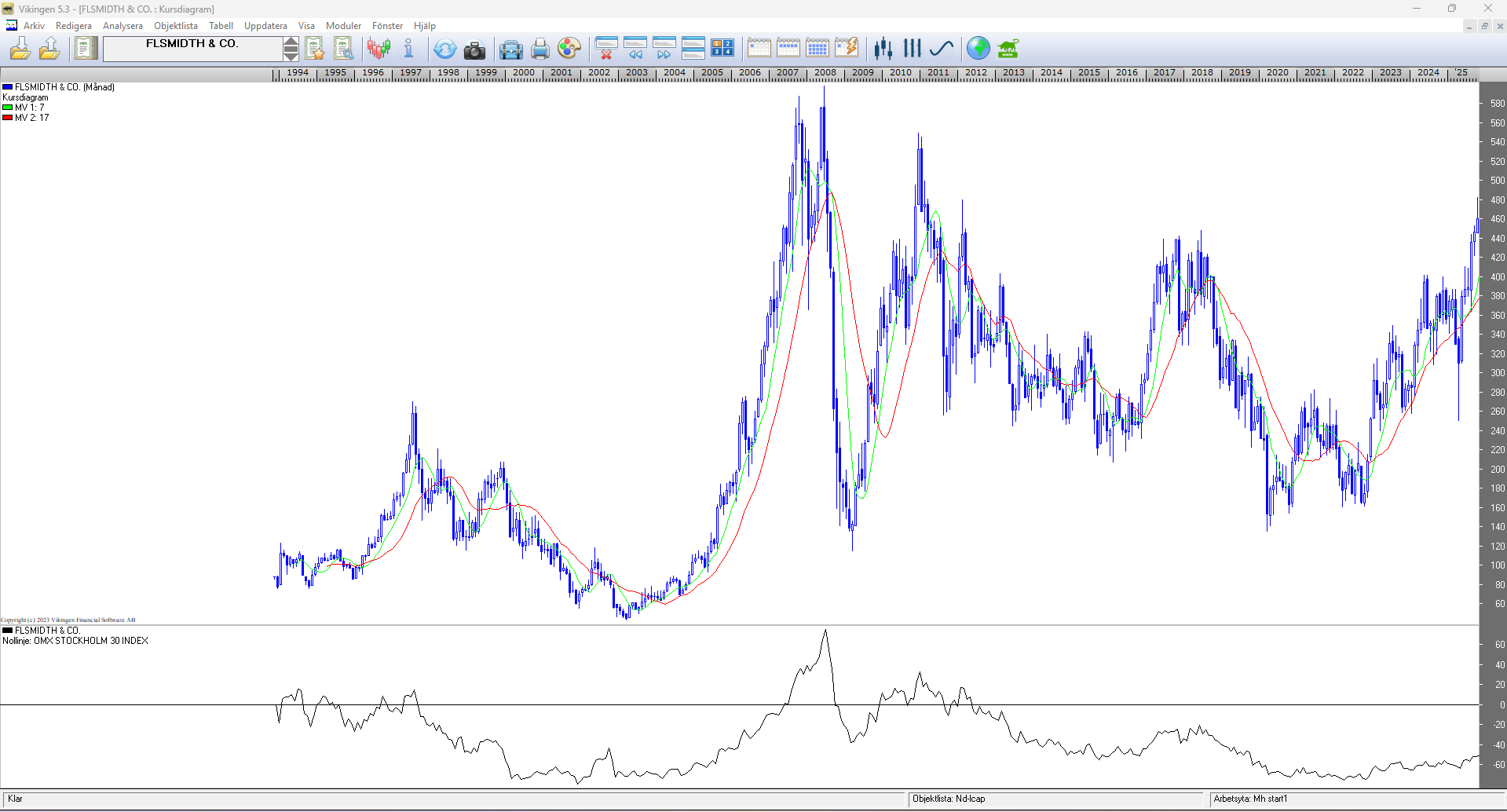

Technical analysis

(see also charts below)

- Strong upward trend seems to have started. Long-term trend break upwards.

- Large rectangle/round bottom formation, since February 2020, breaking upwards. We are moving from consolidation and low volatility to hopefully rising price and higher volatility.

- The Vikingen BEST model and other Vikingen models gives a “green” light and buy signals.

- The relative graph breaks upwards in a similar way, which is very positive, i.e. the company accelerates upwards relative to OMX in a similar formation to the absolute graph, which probably indicates that large investors are driving the price upwards.

- Other metals like gold and silver have risen sharply. But perhaps most importantly, more industrial metals such as platinum and palladium have already started strong upward trends. The mining and metals sector index is rising and we have been positive about Boliden and Lundin Mining for some time.

Fundamental analysis

Fundamental analysis

Strengths

- Strategic focus on Mining (CORE’26): By divesting the Cement business and focusing entirely on Mining, the company has strengthened its margins and become a pure player in a sector with strong long-term trends. This has led to significantly improved profitability.

- Leading Technology: FLSmidth is one of the world’s leading suppliers of mineral processing technology and equipment. They have a strong position in full flowsheet technology.

- High Service Share: A large part of revenue comes from service, which provides more stable revenue and higher margins compared to just selling equipment.

- MissionZero: The company’s sustainability goal (“MissionZero” – zero emissions in the mining and cement industry by 2030) is a strong strategic focus that drives demand for its green technology solutions.

Weaknesses

- Cyclical Exposure: The mining industry is cyclical and sensitive to global economic developments and commodity prices. Despite the focus on service, the company can be affected by downturns in demand for new equipment.

- Challenges in some segments: Some segments, such as the traditional products (Mining Products), have had a softer demand compared to the strong service part.

- Integration risks: The major restructuring, including the divestment of the Cement business and the integration of previous acquisitions (such as TK Mining), has brought costs and risks to the transformation.

Opportunities

Opportunities

- The Green Transition: The need for critical metals (such as copper) for electrification is driving long-term investment in the mining sector. This creates a huge demand for FLSmidth equipment.

- Digitalization and Automation: The ability to deliver digital and automated solutions(Global PerformanceIQ Hub) to improve customers’ efficiency and profitability is a major growth driver.

- Share buybacks: The ongoing share buyback program signals management’s belief in undervaluation and could support the share price, while creating value for shareholders.

Threats

- Geopolitical and macroeconomic risks: Global instability, inflation and uncertainty may lead mining companies to postpone major investments.

- Competition: The company faces strong international competition from giants such as Sandvik, Metso and ThyssenKrupp.

- Supply chain: As a global supplier, the company depends on a stable global supply chain.

Vikingen Top 10 buy signals and a new offer!

Viking’s top 10 buy signals for this week is renewed! You’ll find them here!

We use the Nordic Complete add-on in the BEST model and have increased the volume to 1 000 000.

Don’t miss Vikingens’s new offer: until October 30th you get 30% discount on the add on Vikingen Nordic Complete,

annual subscription. Use the code 2OCT30

Here is a direct link to the Vikingen web shop where you can choose from all Vikingen programs and add-ons and find what suits you best.

Don’t miss Börssnack!

Every week you have the opportunity to participate in Börssnack that is given by Aktieutbildning.nu

Wednesdays, via an open webinar at 19-20! Here you’ll find more about Börssnack.

In Börssnack you’ll learn how to invest in interesting companies and get answers to questions like:

How do we do better in the stock market? Which global stock markets look best? How should you act in the stock market? Is now the time to buy/sell? Which stocks and funds are interesting? What does Börssnack’s portfolio look like? It is reviewed and analyzed every Wednesday. A warm welcome!

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Yours sincerely