A Norwegian company, in this week’s Stock Tip!

This week’s Stock Tip from Vikingen and Aktieutbildning.nu!

The tips are published in this blog and in our social media, so please follow us on FB, Linkedin and X so you don’t miss any tips. Tell your friends and acquaintances to do the same! Do you want to read this blog in Swedish? Click here.

Recommended buy week 39: Kongsberg Gruppen ASA

The share is now trading at around NOK 311.60.

The target is about 380 NOK. Stoploss 280 NOK.

Why is it a good time now for Kongsberg Gruppen ASA?

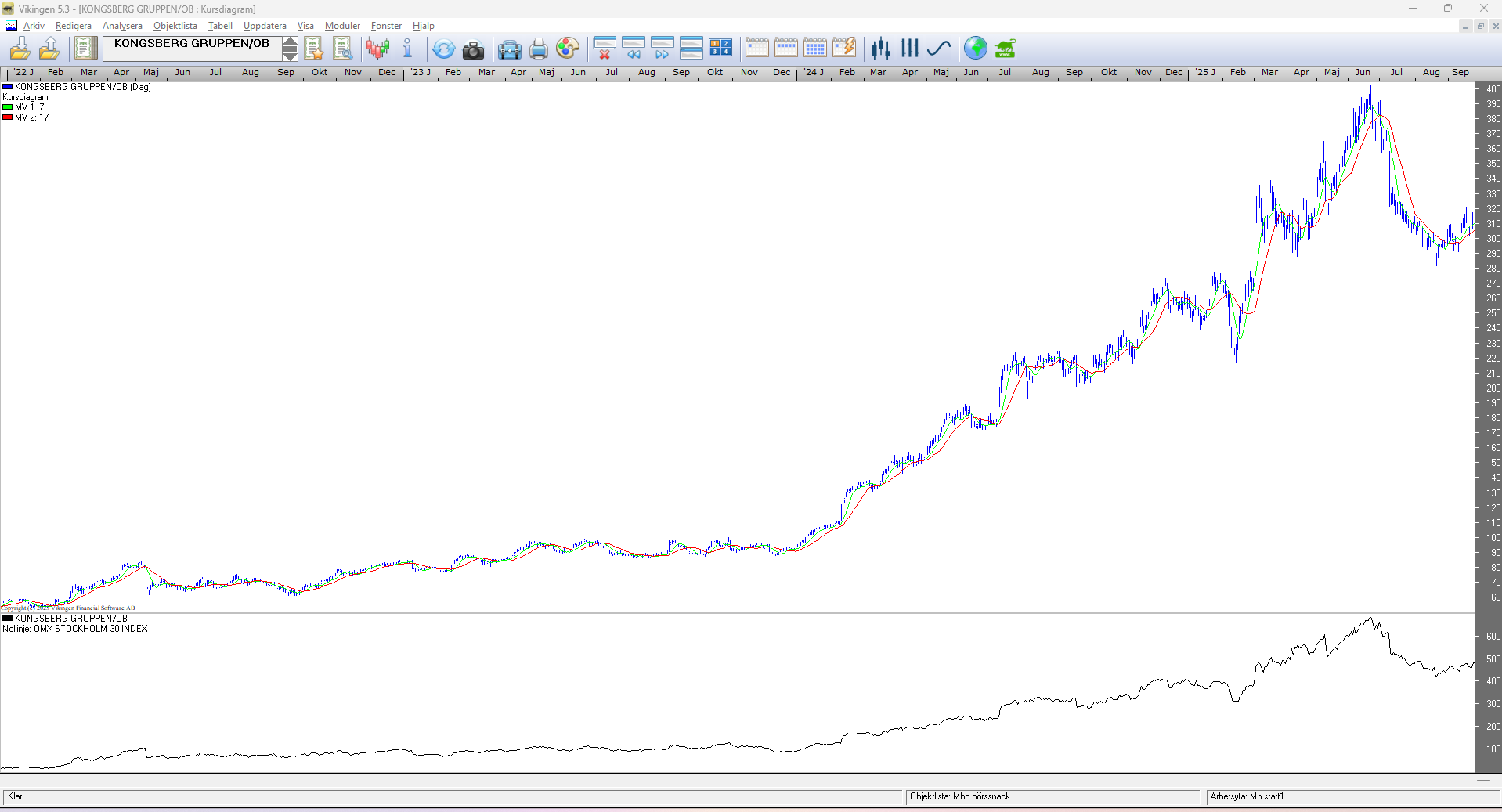

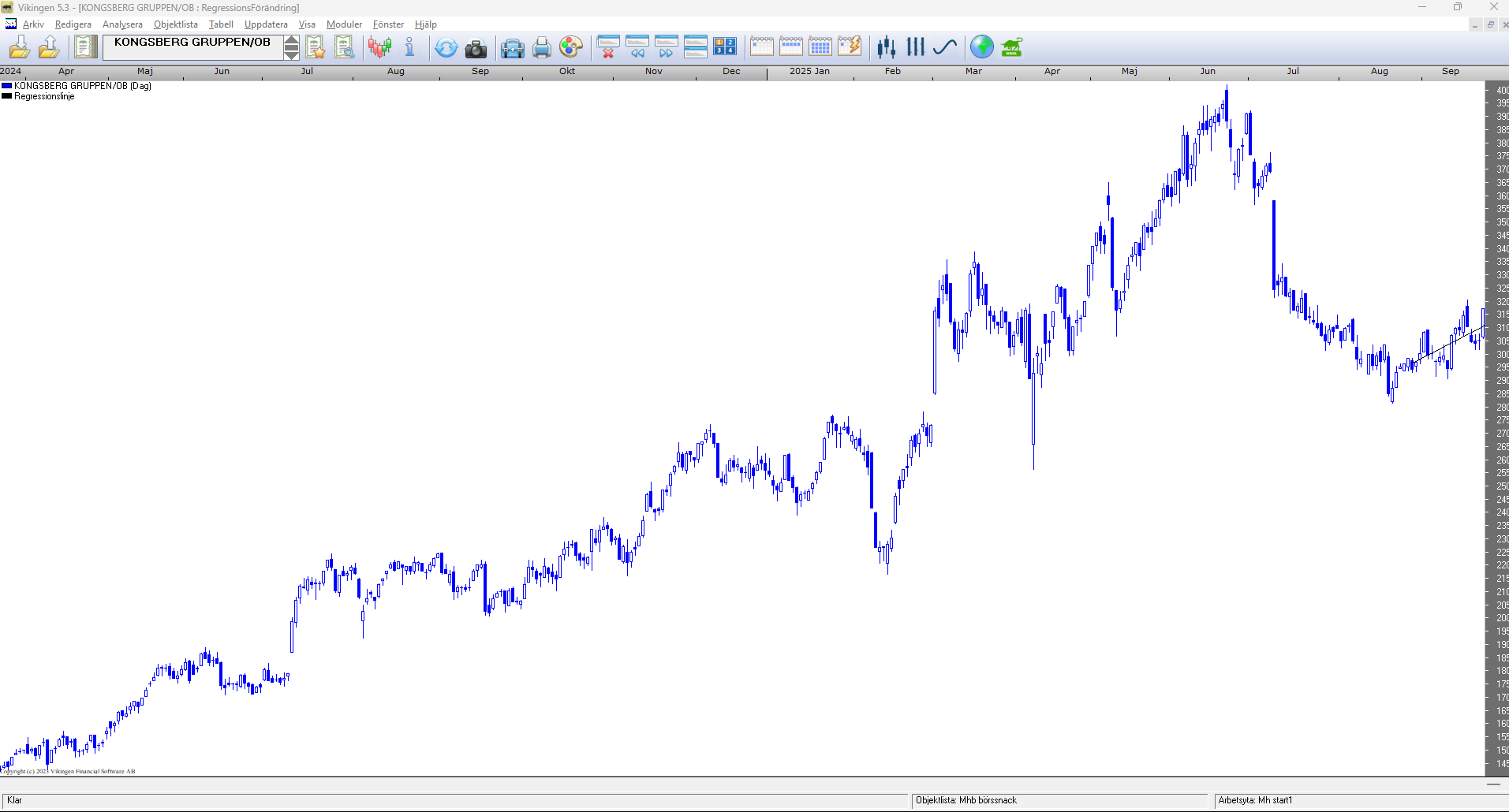

Technical analysis

- Sharp fall from about 400 NOK to 285, now the share is at about 312 NOK

- The stock trend is heavily oversold, and RSI is extremely oversold. Stock rebounds after big fall, see the chart below

- RSI, relative strength index, the stock is heavily oversold and has turned upwards after the big fall

- Relative trend to OMX index looks much the same, heavily oversold, now turning upwards

I.e. the company is doing better than the market after a sharp fall. Hopefully, big funds will now step in and buy.

Business concept

Business concept

Here is an analysis of Kongsberg Gruppen ASA, a Norwegian technology and defense company.

Strengths

Technological leadership: Kongsberg has a strong position in advanced technologies, particularly in marine systems, missiles and defense electronics. The company is a world leader in certain niches.

Stable contracts: The company has a large share of revenue from long-term contracts with both the Norwegian government and international customers. This provides a stable and predictable revenue stream.

Breadth: In addition to the defense segment, they have a large civilian arm with technologies for the oil and gas industry, as well as for maritime navigation and automation, reducing dependence on the defense market alone.

Weaknesses

Dependency on government procurement: A large part of its revenue comes from government contracts. Cuts in national defense budgets can therefore directly affect the company’s revenues.

Long sales cycles: The sales process in the defense industry is very long and complex, which can make it difficult to adapt quickly to changing market conditions.

Sensitivity to oil prices: The maritime part of the company is affected by oil and gas prices, which can lead to volatility.

Opportunities

Opportunities

Increased defense budgets: The current geopolitical situation is driving increased defense spending globally, which is a great opportunity for Kongsberg to get new orders.

AI and digitalization: The possibility of integrating AI and digital solutions into both defence systems and maritime products opens up new revenue streams.

Expanding markets: The company can expand its international presence and secure more contracts in new countries.

Threats

Intense competition: The global defense industry is dominated by several very large players such as Airbus, Lockheed Martin and BAE Systems, making competition fierce.

Political risk: Changes in national policies or international relations may affect export controls and the company’s access to new markets.

Technological transition: Rapid technological developments can lead to new, smaller players with innovative solutions challenging the established players.

Vikingen Top 10 buy signals and the offer is still on!

Vikingen’s top 10 buy signals for week 39 are here! We use the Nordic Complete supplement in the BEST model.

Don’t miss Vikingen’s offer: until September 28, get 30% off the Vikingen Mini and Certificate’s Sweden programs ! Use the code SEP30

Here is a direct link to the Vikingen webshop, where you can choose from all the Vikingen programs and add-ons and find what suits you best.

Don’t miss Börssnack!

Every week you have the opportunity to participate in Börssnack that Aktieutbildning.nu gives on Wednesdays, via an open webinar at 19-20! Here you can find more info about Börssnack.

In Börssnack, you’ll learn how to invest in interesting companies and get answers to questions like:

How do we do better in the stock market? Which global stock markets look best? How should you act in the stock market? Is now the time to buy/sell? Which stocks and funds are interesting? What does Börssnack’s portfolio look like? It is reviewed and analyzed every Wednesday. A warm welcome!

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Yours sincerely